ICICI Bank 2005 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F20

schedules

forming part of the Accounts (Contd.)

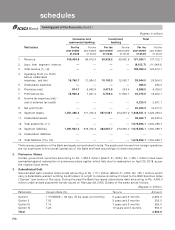

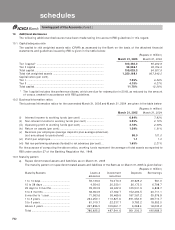

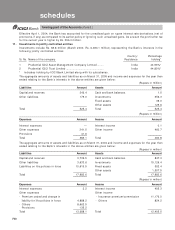

The following balances payable to/ receivable from subsidiaries/ joint ventures/ associates/ key management personnel

are included in the balance sheet as on March 31, 2004: (Rupees in million)

Items/Related Subsidiaries/ Associates Key Total

Party Joint ventures Management

Personnel@

Deposits with ICICI Bank........................... 2,021.2 37.3 23.1 2,081.6

Deposits of ICICI Bank* ............................. 131.2 — — 131.2

Call money borrowed ................................. — — — —

Advances..................................................... 2,426.0 — 10.2 2,436.2

Investments of ICICI Bank ......................... 14,303.6 15,942.5 — 30,246.1

Investments of related parties in ICICI Bank . 15.0 — 2.0 17.0

Receivables ................................................ 315.1 808.0 — 1,123.1

Payables ..................................................... 739.4 0.5 — 739.9

Guarantees ................................................. 100.0 — — 100.0

Letter of Comfort ....................................... 10,291.7 — — 10,291.7

Swaps/Forward Contracts.......................... 155,481.0 — — 155,481.0

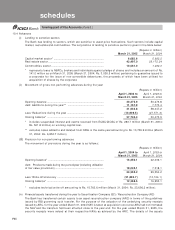

The following balances represent the maximum balance payable to/receivable from subsidiaries/ joint ventures/

associates/ key management personnel during the year ended March 31, 2004: (Rupees in million)

Items/Related Subsidiaries/ Associates Key Total

Party Joint ventures Management

Personnel@

Deposits with ICICI Bank........................... 11,897.6 450.1 94.0 12,441.7

Deposits of ICICI Bank............................... 2,500.0 — — 2,500.0

Call money borrowed ................................ 5,974.9 — — 5,974.9

Advances..................................................... 3,614.7 — 14.8 3,629.5

Investments of ICICI Bank ......................... 20,712.5 30,342.1 — 51,054.6

Investments of related parties in ICICI Bank 50.0 — 2.0 52.0

Receivables ................................................ 2,062.6 808.0 — 2870.6

Payables ..................................................... 1,061.3 0.5 — 1,061.8

Guarantees ................................................. 100.0 — — 100.0

Letter of Comfort ....................................... 11,341.7 — — 11,341.7

Swaps/Forward Contracts.......................... 165,731.5 — — 165,731.5

@ whole-time directors and relatives

* includes call money lent

Subsidiaries and joint ventures

ICICI Venture Funds Management Company Limited, ICICI Securities Limited, ICICI Brokerage Services Limited, ICICI

International Limited, ICICI Trusteeship Services Limited, ICICI Home Finance Company Limited, ICICI Investment

Management Company Limited, ICICI Securities Holdings Inc., ICICI Securities Inc., ICICI Bank UK Limited, ICICI Bank

Canada, ICICI Prudential Life Insurance Company Limited, ICICI Distribution Finance Private Limited, ICICI Lombard General

Insurance Company Limited, Prudential ICICI Asset Management Company Limited and Prudential ICICI Trust Limited.

Associates

ICICI Equity Fund, ICICI Eco-net Internet and Technology Fund, ICICI Emerging Sectors Fund, ICICI Strategic

Investments Fund, ICICI Property Trust and TCW/ICICI Investment Partners L.L.C.

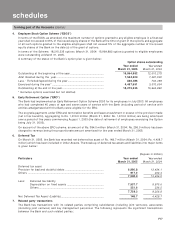

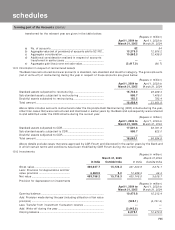

8. Earnings Per Share (“EPS”)

The Bank reports basic and diluted earnings per equity share in accordance with Accounting Standard 20, “Earnings

per Share”. Basic earnings per share is computed by dividing net profit after tax by the weighted average number of