ICICI Bank 2005 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F61

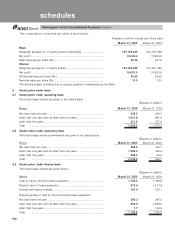

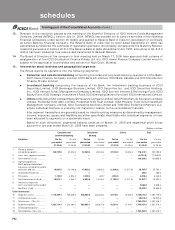

Maturity profile of present value of lease payments (Rupees in million)

March 31, 2005 March 31, 2004

- Not later than one year .......................................................................... 222.8 276.5

- Later than one year and not later than five years .............................. 683.3 1,008.7

- Later than five years ............................................................................... 7.5 132.6

Total .................................................................................................. 913.6 1,417.8

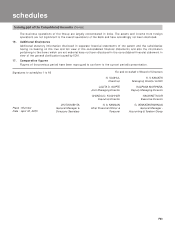

9. Others

a. Exchange fluctuation

Exchange fluctuation aggregating Rs. 244.7 million (March 31, 2004 : Rs. 577.8 million,), which arises on

account of rupee-tying agreements with the Government of India, is held in "Exchange Fluctuation Suspense

with Government Account" pending adjustment at maturity on receipt of payments from the Government

for repayments to foreign lenders.

b. Swap suspense (net)

Swap suspense (net) aggregating Rs. 794.7 million (debit) (March 31, 2004: Rs. 677.0 million (debit)),

which arises out of conversion of foreign currency swaps, is held in "Swap suspense account" and will be

reversed at conclusion of swap transactions with swap counter parties.

10. Provision for non-performing assets

In its circular dated DBOD.BP.BC 99/21.04.048/2003-2004 dated June 21, 2004 RBI has introduced graded higher

provisioning norms which would require a bank to make 100% provision on the secured portion of the doubtful assets

outstanding for more than three years in doubtful category instead of the earlier requirement of 50% provision. However,

RBI has allowed banks to make 100% provision on the existing assets which are in doubtful category for more than three

years as on March 31, 2004 till March 31, 2007 in a graded manner (i.e. 60% as on March 31, 2005, 75% as on March 31,

2006 and 100% as on March 31, 2007). Accordingly the Bank has adopted the revised RBI guidelines.

The impact of the adoption of the revised guidelines on the profit and loss account is not significant.

11. Changes in accounting policies

ICICI Bank Limited

Effective April 1, 2004 the commissions paid to direct marketing agents (DMAs) of auto loans, net of subvention income

received from them, is recorded upfront in the profit and loss account. For disbursements made till March 31, 2004, the gross

commissions paid to direct marketing agents (DMAs) of auto loans were recorded upfront in the profit and loss account and

subvention income received from them is being amortised over the life of the loan. The impact of the change is not significant.

Effective April 1, 2004, the Bank has accounted for the unrealised gain on rupee interest rate derivatives (net of provisions,

if any) as compared to its earlier policy of ignoring such unrealised gains. As a result the profit after tax for the current year

is higher by Rs. 296.3 million.

Other entities

a) In case of ICICI Lombard General Insurance Company Limited, effective April 1, 2004 software costing less

than Rs. 500,000 are depreciated @ 20%. Had the company continued to follow the accounting policy followed

in previous year, the amount transferred to shareholder's account, operating profit, profit before tax and net

block of fixed assets would have been lower by Rs. 20.0 million and accumulated depreciation would have

been higher by Rs. 20.0 million.

b) ICICI Securities Limited has changed its method of accounting for interest rate swaps. Hitherto, mark-to-

market gains on open interest rate swaps positions were not recognised. The company has started recognising

gains on all open IRS positions. However, there is no impact on the profits for the period ended March 31, 2005

since the Company does not have mark-to-market gains on open IRS positions as at March 31, 2005.

c) ICICI Strategic Investments Fund has changed the method of valuation of investments from cost less permanent

impairments, to fair value. This constitutes change in accounting policy, and as a result investments are higher

by Rs. 2,083.7 million.

12. Transfer of investments from AFS to HTM Category

During the year ended March 31, 2005, the Bank has transferred investments amounting to Rs. 213,489.4 million

from Available for Sale category to Held to Maturity category in accordance with RBI circular: DBOD.No.BP.BC.37/

21.04.141/2004-05 dated September 2, 2004. The difference between the book value of each investment and the

lower of its acquisition cost and market value on the date of transfer,amounting to Rs. 1,828.2 million has been

provided for in the profit and loss account.

schedules

forming part of the Consolidated Accounts (Contd.)