ICICI Bank 2005 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F47

The financial statements of the subsidiaries used in the consolidation are drawn upto the same reporting date as that of

the Bank, i.e. year ended March 31, 2005.

As per the approval of the Reserve Bank of India (RBI) dated March 31, 2003 received by the Bank for the acquisition of

ICICI Distribution Finance Private Limited (IDFPL), the Bank is required to initiate proceedings for the voluntary winding

up of IDFPL after the business is transferred to the Bank's balance sheet. Hence, the financials of IDFPL are not prepared

on a going concern basis.

Adjustments relating to the recoverability and the classification of recorded asset amount or to amounts and classification of

liabilities that may be necessary on winding up of IDFPL have been made based on management's assessment of the same.

All assets and liabilities of IDFPL have been stated at net realisable value.

The investment in TCW/ICICI Investment Partners LLC. (holding of the Bank is 50%) is accounted under equity method

as per AS 23 “Accounting for Investments in Associates in Consolidated Financial Statements.” TCW/ICICI Investment

Partners LLC. is an asset and fund management company, which undertakes financial, trust, agency, investment and

other operations that may arise in connection therewith.

The Bank has adopted AS 27 “Financial Reporting of Interests in Joint Ventures” and the investments in the following

companies have been accounted in accordance with the provisions of AS 27 :-

Sr. Name of the company Nature of Country/ Percentage

No. Activity residence holding

1 Prudential ICICI Asset Management Company Limited Asset Management India **44.99%

2 Prudential ICICI Trust Limited Trusteeship Services India **44.80%

** Indicates holding by ICICI Bank Limited along with its subsidiaries.

The financial statements of the following companies which are in the nature of jointly controlled entities, have been

consolidated as per AS 21 "Consolidated Financial Statements" issued by the ICAI, consequent to the limited revision to

AS 27 "Financial Reporting of Interests in Joint Ventures" issued by the ICAI. The said companies, for the previous year

were consolidated as per AS 27 "Financial Reporting of Interests in Joint Ventures" issued by the ICAI. The figures for the

previous year have not been re-grouped in respect of these jointly controlled companies. Accordingly, the figures for the

previous year are not comparable to that extent.

Sr. Name of the company Nature of Country/ Percentage

No. Activity residence holding

1 ICICI Prudential Life Insurance Company Limited Life Insurance India 74.00%

2 ICICI Lombard General Insurance Company Limited General Insurance India 74.00%

The companies in which ICICI Bank's holding is temporary in nature are excluded from consolidation.

Equity issue of ICICI Bank Limited

During April 2004, the Bank made an issue of 115,920,758 equity shares (including 6,992,187 equity shares issued by

exercise of green shoe option) of Rs.10 each at a premium of Rs. 270 per share aggregating Rs. 32,457.8 million under

the Prospectus dated April 12, 2004. The expenses of the issue have been charged to the Share Premium Account, in

accordance with the objects of the Issue stated in the Prospectus.

ICICI Bank had sponsored American Depositary Shares (ADSs) Offering which opened for participation on March 7, 2005

and closed on March 11, 2005. In terms of the Offering, 20,685,750 ADSs representing 41,371,500 equity shares had

been sold at a price of US$ 21.1 per ADS. The gross proceeds from the ADS Offering were approximately US$ 436.7

million (Rs.19,099.6 million). The net consideration per share (after deduction of expenses in connection with the

offering) was Rs. 453.16.

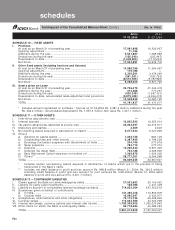

A. SIGNIFICANT ACCOUNTING POLICIES

1. Revenue recognition

ICICI Bank Limited

a) Interest income is recognised in the profit and loss account as it accrues except in the case of non-performing assets

where it is recognised, upon realisation, as per the prudential norms of RBI. Accrual of income is also suspended

considering economic conditions and other risk factors, on certain other loans, including certain projects under

implementation, where the implementation has been significantly delayed or in the opinion of the management

significant uncertainties exist as to the final financial closure and/or date of completion of the project.

forming part of the Consolidated Accounts (Contd.)

schedules