ICICI Bank 2005 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F62

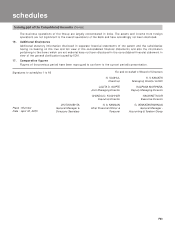

13. Pursuant to the resolution passed at the meeting of the Board of Directors of ICICI Venture Funds Management

Company Limited (IVFMCL), held on July 21, 2004, IVFMCL has decided not to carry on activities of Non Banking

Financial Companies, under section 45-1A(6)(i) and applied to Reserve Bank of India for cancellation of certificate

as a Non Banking Financial Company. The Reserve Bank of India vide its order dated September 27, 2004 has

cancelled as surrendered, the certificate of registration granted to the company. Consequently the Statutory Reserve,

created in pursuance of section 45-IC of the Reserve Bank of India (Amendment) Act, 1997, amounting to Rs. 210.0

million has been treated as free reserve and transferred to General Reserve.

14. The Board of Directors of the company in their meeting held on March 17, 2005 have approved draft scheme of

amalgamation of the ICICI Distribution Finance Private Ltd into ICICI Home Finance Company Limited which is

subject to the approval of shareholders and sanction of High Court, Mumbai.

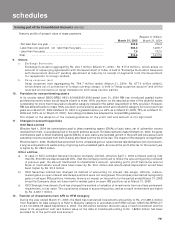

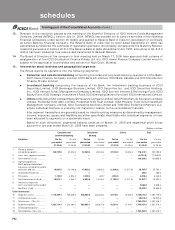

15. Information about business and geographical segments

The Group reports its operations into the following segments:

●Consumer and commercial banking comprising the retail and corporate banking operations of the Bank,

ICICI Home Finance Company Limited, ICICI Bank UK Limited, ICICI Bank Canada and ICICI Distribution

Finance Private Limited.

●Investment banking comprising the treasury of the Bank, the investment banking business of ICICI

Securities Limited, ICICI Brokerage Services Limited, ICICI Securities Inc., and ICICI Securities Holdings

Inc., ICICI Venture Funds Management Company Limited, ICICI Eco-net Internet & Technology Fund, ICICI

Equity Fund, ICICI Strategic Investments Fund, ICICI Emerging Sectors Fund and ICICI International Limited.

●Others comprising ICICI Lombard General Insurance Company Limited, ICICI Prudential Life Insurance company

Limited, Prudential ICICI AMC Limited, Prudential ICICI Trust Limited, ICICI Property Trust, ICICI Investment

Management Company Limited, ICICI Trusteeship Services Limited and TCW/ICICI Investment Partners LLC.

whose individual business is presently not material in relation to the consolidated financials.

Inter segment transactions are generally based on transfer pricing measures as determined by management.

Income, expenses, assets and liabilities are either specifically identifiable with individual segments or have

been allocated to segments on a systematic basis.

Based on such allocations, segmental balance sheet as on March 31, 2005 and segmental profit & loss

account for the year ended March 31, 2005 have been prepared. (Rupees in million)

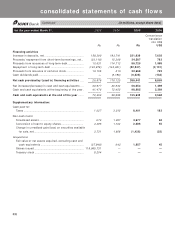

Consumer and Investment Others Total

commercial banking banking

Particulars For the For the For the For the For the For the For the For the

year ended year ended year ended year ended year ended year ended year ended year ended

31.03.05 31.03.04 31.03.05 31.03.04 31.03.05 31.03.04 31.03.05 31.03.04

1 Revenue (before

extraordinary profit) .............. 108,779.9 97,052.3 32,599.2 39,140.3 37,033.0 13,913.3 178,412.1 150,105.9

2 Less: Inter segment revenue ——————(9,102.8) (11,049.0)

3 Total revenue (1) -(2) ............. ——————169,309.3 139,056.9

4 Operating profit (i.e.

Profit before unallocated

expenses, extraordinary profit,

provision, and tax)................. 19,965.0 13,148.9 10,439.3 13,625.0 (1,606.8) (1,071.8) 28,797.5 25,702.1

5 Unallocated expenses ......... ——————384.0 256.0

6 Provisions ............................. 1,150.9 5,803.2 3,478.4 440.7 (422.9) —4,206.4 6,243.9

7 Profit before tax (4)-(5)-(6) ..... 18,814.1 7,345.7 6,960.9 13,184.3 (1,183.9) (1,071.8) 24,207.1 19,202.2

8 Income tax expenses

(net) / (net deferred tax credit) ——————5,683.8 3,398.4

9 Net Profit (7)-(8).................... ——————18,523.3 15,803.8

Other Information

10 Segment assets ................... 1,118,447.3 799,639.3 588,286.8 463,233.4 47,778.1 18,300.8 1,754,512.2 1,281,173.5

11 Unallocated assets .............. ——————28,915.3 26,302.6

12 Total assets (10)+ (11)........ ——————1,783,427.5 1,307,476.1

13 Segment liabilities ................ 1,353,714.3 1,003,090.2 389,689.1 292,912.8 40,024.1 11,473.1 1,783,427.5 1,307,476.1

14 Unallocated liabilities .......... ————————

15 Total liabilities (13)+ (14) ...... ——————1,783,427.5 1,307,476.1

schedules

forming part of the Consolidated Accounts (Contd.)