ICICI Bank 2005 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

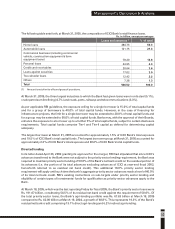

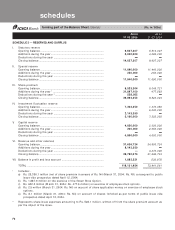

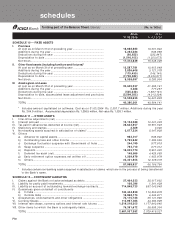

F3

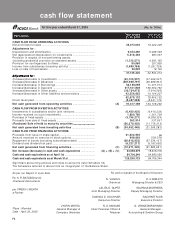

I. INCOME

Interest earned .................................................................. 13 94,098,944 90,023,946

Other income .................................................................... 14 34,161,439 30,649,228

TOTAL ................................................................................. 128,260,383 120,673,174

II. EXPENDITURE

Interest expended ............................................................. 15 65,708,876 70,152,492

Operating expenses ......................................................... 16 32,991,475 25,712,325

Provisions and contingencies .......................................... 17 9,508,016 8,437,294

TOTAL ................................................................................. 108,208,367 104,302,111

III. PROFIT/LOSS

Net profit for the year ....................................................... 20,052,016 16,371,063

Profit brought forward ...................................................... 530,876 50,520

TOTAL ................................................................................. 20,582,892 16,421,583

IV. APPROPRIATIONS/TRANSFERS

Statutory Reserve.............................................................. 5,020,000 4,093,000

Capital Reserve ................................................................. 200,000 2,650,000

Investment Fluctuation Reserve ..................................... —2,760,000

Special Reserve................................................................. 250,000 250,000

Revenue and other Reserves .......................................... 6,000,000 —

Proposed equity share dividend...................................... 6,329,609 5,440,592

Proposed preference share dividend ............................. 35 35

Corporate dividend tax ..................................................... 901,027 697,080

Balance carried over to balance sheet ............................ 1,882,221 530,876

TOTAL ................................................................................. 20,582,892 16,421,583

Significant Accounting Policies and Notes to Accounts ....... 18

Earning per share (Refer note B. 8)

Basic (Rs.)........................................................................... 27.55 26.66

Diluted (Rs.) ....................................................................... 27.33 26.44

Face value per share (Rs.)......................................................... 10.00 10.00

profit and loss account

for the year ended March 31, 2005

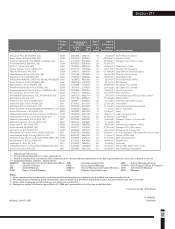

JYOTIN MEHTA

General Manager &

Company Secretary

For S. R. BATLIBOI & CO.

Chartered Accountants

per VIREN H. MEHTA

a Partner

Place : Mumbai

Date : April 30, 2005

As per our Report of even date For and on behalf of the Board of Directors

The Schedules referred to above form an integral part of the Profit and Loss Account.

Year ended Year ended

Schedule 31.03.2005 31.03.2004

N. VAGHUL

Chairman

LALITA D. GUPTE

Joint Managing Director

CHANDA D. KOCHHAR

Executive Director

N. S. KANNAN

Chief Financial Officer &

Treasurer

K. V. KAMATH

Managing Director & CEO

KALPANA MORPARIA

Deputy Managing Director

NACHIKET MOR

Executive Director

G. VENKATAKRISHNAN

General Manager -

Accounting & Taxation Group

(Rs. in ‘000s)