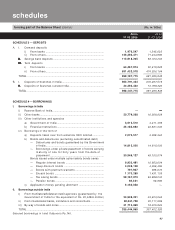

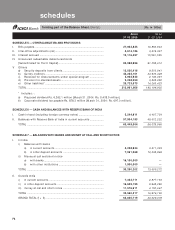

ICICI Bank 2005 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F9

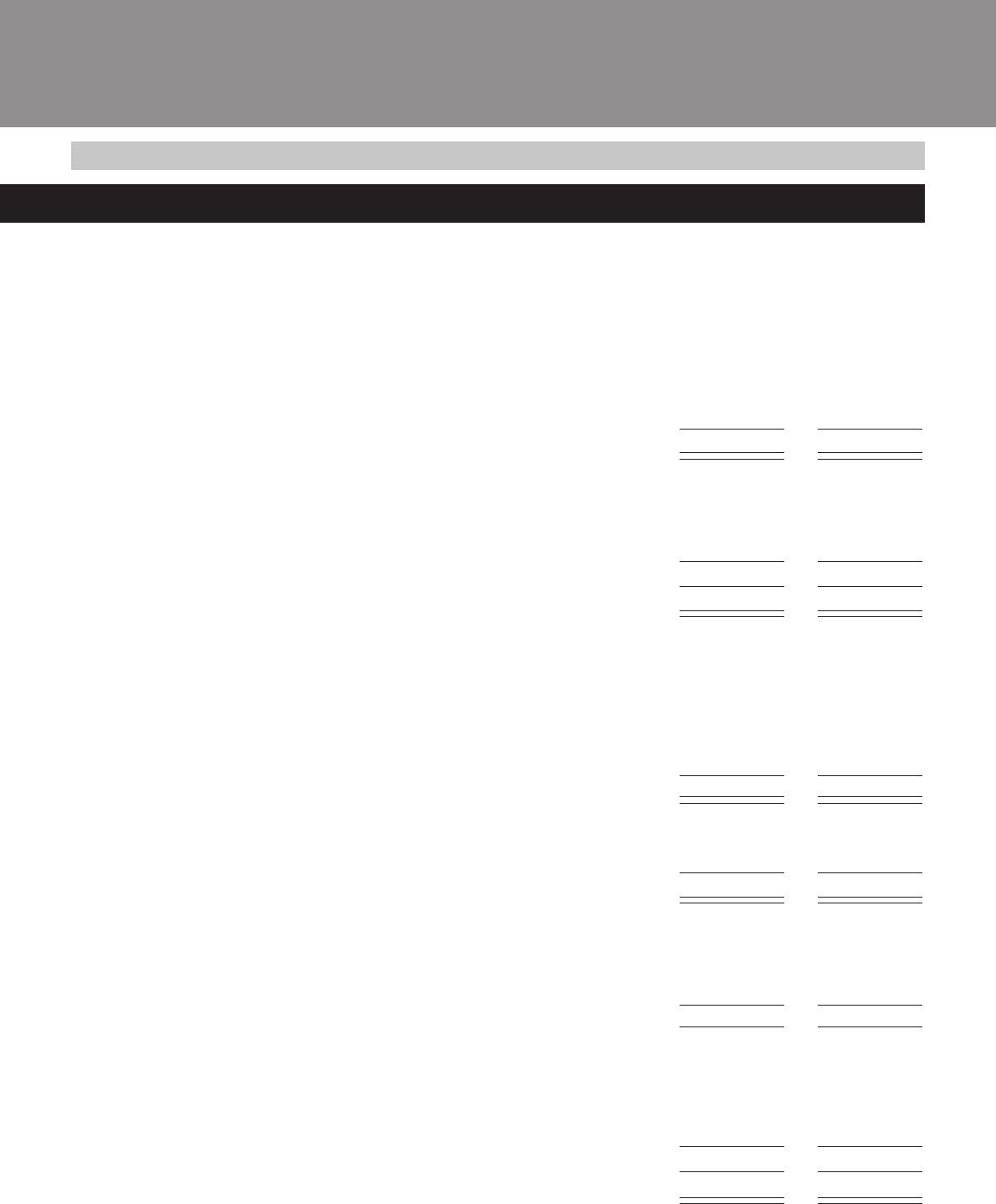

schedules

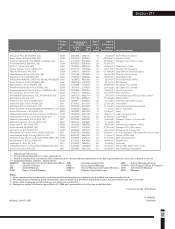

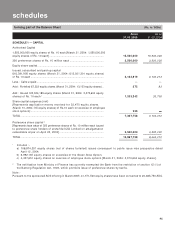

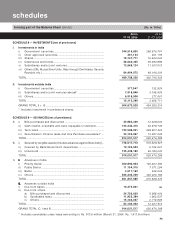

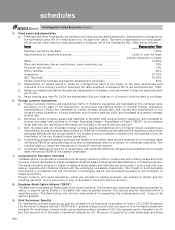

SCHEDULE 8 — INVESTMENTS [net of provisions]

I. Investments in India

i) Government securities.................................................................... 344,516,800 298,876,781

ii) Other approved securities............................................................... 301,154 301,155

iii) Shares................................................................................................ 19,147,771 16,842,660

iv) Debentures and bonds .................................................................... 28,540,305 55,490,989

v) Subsidiaries and/or joint ventures.................................................. 12,848,124 11,037,612

vi) Others (CPs, Mutual Fund Units, Pass through Certificates, Security

Receipts etc.).................................................................................... 84,404,072 48,196,306

TOTAL ........................................................................................................ 489,758,226 430,745,503

II. Investments outside India

i) Government securities.................................................................... 377,947 132,924

ii) Subsidiaries and/or joint ventures abroad* ................................... 7,818,846 3,198,926

iii) Others................................................................................................ 6,918,506 277,861

TOTAL ........................................................................................................ 15,115,299 3,609,711

GRAND TOTAL (I + II)............................................................................... 504,873,525 434,355,214

* Includes investment in preference shares.

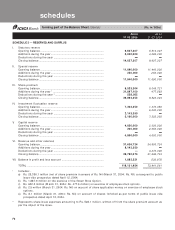

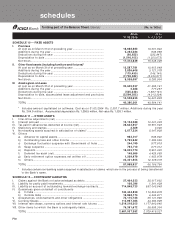

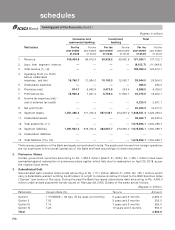

SCHEDULE 9 — ADVANCES [net of provisions]

A. i) Bills purchased and discounted ..................................................... 43,984,209 12,308,603

ii) Cash credits, overdrafts and loans repayable on demand ........... 123,344,410 60,978,735

iii) Term loans ........................................................................................ 722,588,931 539,807,424

iv) Securitisation, Finance lease and Hire Purchase receivables* ... 24,133,967 13,381,526

TOTAL ........................................................................................................ 914,051,517 626,476,288

B. i) Secured by tangible assets [includes advances against Book Debt]... 778,517,712 573,528,527

ii) Covered by Bank/Government Guarantees................................... 10,104,623 6,154,561

iii) Unsecured ........................................................................................ 125,429,182 46,793,200

TOTAL ........................................................................................................ 914,051,517 626,476,288

C. I.I.

I.I.

I. Advances in India

i) Priority Sector ................................................................................... 200,892,904 145,307,396

ii) Public Sector ..................................................................................... 11,154,310 7,071,294

iii) Banks ................................................................................................. 4,517,162 433,504

iv) Others................................................................................................ 635,303,209 463,026,182

TOTAL ........................................................................................................ 851,867,585 615,838,376

II.II.

II.II.

II. Advances outside India

i) Due from banks ................................................................................ 10,375,851 ——

——

—

ii) Due from others

a) Bills purchased and discounted ............................................. 24,736,630 5,958,406

b) Syndicated loans ...................................................................... 11,925,394 1,962,537

c) Others........................................................................................ 15,146,057 2,716,969

TOTAL ........................................................................................................ 62,183,932 10,637,912

GRAND TOTAL (C. I and II) ....................................................................... 914,051,517 626,476,288

* Includes receivables under lease amounting to Rs. 913.6 million (March 31, 2004: Rs. 1,417.8 million)

forming part of the Balance Sheet (Contd.) (Rs. in ‘000s)

As on As on

31.03.2005 31.03.2004