ICICI Bank 2005 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F30

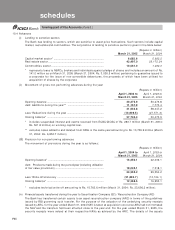

Effective April 1, 2004, the Bank has accounted for the unrealised gain on rupee interest rate derivatives (net of

provisions, if any) as compared to its earlier policy of ignoring such unrealised gains. As a result the profit after tax

for the current year is higher by Rs. 296.3 million.

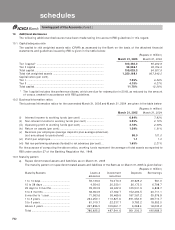

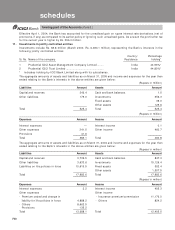

11. Investments in jointly controlled entities

Investments include Rs. 83.8 million (March 2004: Rs. 6,690.1 million) representing the Bank’s interests in the

following jointly controlled entities:

Country/ Percentage

Sr. No. Name of the company Residence holding*

1 Prudential ICICI Asset Management Company Limited ......... India 44.99%*

2 Prudential ICICI Trust Limited ................................................... India 44.80%*

* indicates holding by ICICI Bank Limited along with its subsidiaries.

The aggregate amounts of assets and liabilities as on March 31, 2005 and income and expenses for the year then

ended relating to the Bank’s interests in the above entities are given below: (Rupees in million)

Liabilities Amount Assets Amount

Capital and reserves 346.4 Cash and bank balances 1.5

Other liabilities 179.0 Investments 356.3

Fixed assets 38.0

Other assets 129.6

Total 525.4 Total 525.4

(Rupees in million)

Expenses Amount Income Amount

Interest expenses — Interest income 0.1

Other expenses 341.5 Other income 460.7

Provisions 41.6

Total 383.1 Total 460.8

The aggregate amounts of assets and liabilities as on March 31, 2004 and income and expenses for the year then

ended relating to the Bank’s interests in the above entities are given below: (Rupees in million)

Liabilities Amount Assets Amount

Capital and reserves 3,739.5 Cash and bank balances 847.3

Other liabilities 3,633.6 Investments 15,126.4

Liabilities on life policies in force 10,610.5 Fixed assets 502.4

Other assets 1,507.5

Total 17,983.6 Total 17,983.6

(Rupees in million)

Expenses Amount Income Amount

Interest expenses 2.2 Interest income 405.3

Other expenses Other income

- Premium ceded and change in - Insurance premium/commission 11,176.0

liability for life policies in force 4,888.2 - Others 824.2

- Others 8,662.5

Provisions 135.2

Total 13,688.1 Total 12,405.5

forming part of the Accounts (Contd.)

schedules