ICICI Bank 2005 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F28

forming part of the Accounts (Contd.)

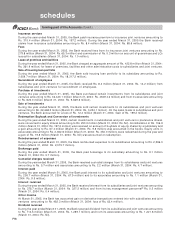

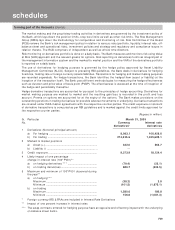

10.10 Credit exposure

As at March 31, 2005 the Bank has taken single borrower exposure above 15% with the approval of the Board of

Directors in the following cases:

Name of Borrower March 31, 2005

% to capital funds

Borrower A .................................................................................. 19.50%

Borrower B .................................................................................. 17.46%

Borrower C .................................................................................. 16.73%

Borrower D .................................................................................. 16.20%

10.11 Risk category-wise country-wise exposure

As per the extant RBI guidelines, the country exposure of the Bank is categorised into various risk categories

listed in the following table. Since the country exposure (net) of the Bank in respect of each country does not

exceed 1% of the total funded assets, no provision is required to be maintained on country exposures.

(Rupees in million)

Risk category Exposure (net) as on Exposure (net) as on

March 31, 2005 March 31, 2004

Insignificant................................................................................. 54,349.8 62,651.1

Low .............................................................................................. 11,408.4 2,217.7

Moderate ..................................................................................... 4,592.1 1,735.4

High............................................................................................ .. —8.6

Very High ................................................................................... .. ——

Off-Credit ..................................................................................... 656.2 —

Total.............................................................................................. 71,006.5 66,612.8

- of which funded........................................................................ 38,885.7 46,950.6

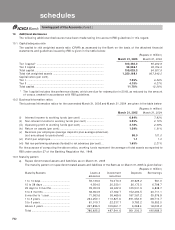

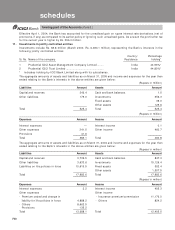

10.12 Interest rate swaps (“IRS”)

The notional principal amount of Rupee IRS contracts as at March 31, 2005 is Rs. 51.10 billion for hedging

contracts (March 31, 2004: Rs. 34.15 billion) and Rs. 1,114.30 billion for trading contracts (March 31, 2004:

Rs. 947.83 billion).

The fair value represents the estimated replacement cost of swap contracts as at balance sheet date. At

March 31, 2005 the fair value of trading rupee interest rate swap contracts is Rs. 0.33 billion (March 31, 2004 : Rs.

0.67 billion).

Associated credit risk is the loss that the Bank would incur in case all the counter-parties to these swaps fail to

fulfil their contractual obligations. As at March 31, 2005, the associated credit risk on trading rupee interest rate

swap contracts is Rs. 9.87 billion (March 31, 2004: Rs. 8.96 billion).

Market risk is monitored as the loss that would be incurred by the Bank for a 100 basis points rise in the interest

rates. As at March 31, 2005 the market risk on trading rupee interest rate swap contracts amounts to Rs. 0.14

billion (March 31, 2004: Rs. 0.06 billion).

Credit risk concentration is measured as the highest net receivable under swap contracts from a particular

counter party. As at March 31, 2005 there is a credit risk concentration of Rs. 0.27 billion (March 31, 2004: Rs. 0.68

billion) under rupee interest rate swap contracts, with ICICI Securities Ltd. As per the prevailing market practice,

the Bank does not insist on collateral from the counter parties of these contracts.

10.13 Rupee and foreign currency derivatives

ICICI Bank is a leading participant in the financial derivatives market. The Bank deals in derivatives for balance

sheet management and market making purposes whereby the Bank offers derivative products to its customers,

enabling them to hedge their risks.

Dealing in derivatives is centralised in the treasury of the Bank. Derivative transactions are entered into by the

treasury front office. Treasury middle office conducts an independent check of the transactions entered into by

the front office and also undertakes activities such as confirmation, settlement, accounting, risk monitoring and

reporting and ensures compliance with various internal and regulatory guidelines.

schedules