ICICI Bank 2005 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

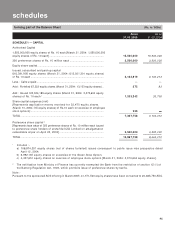

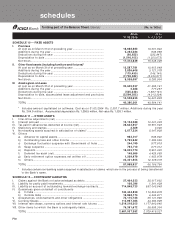

F11

forming part of the Profit and Loss Account

schedules

Year ended Year ended

31.03.2005 31.03.2004

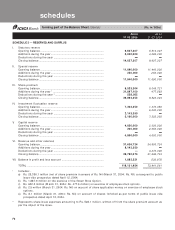

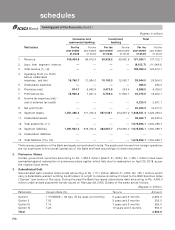

SCHEDULE 13 — INTEREST EARNED

I. Interest/discount on advances/bills ....................................................... 67,528,301 60,738,528

II. Income on investments .......................................................................... 22,294,366 25,400,941

III. Interest on balances with Reserve Bank of India and other inter-bank funds 2,320,089 2,106,345

IV. Others* ...................................................................................................... 1,956,188 1,778,132

TOTAL ........................................................................................................ 94,098,944 90,023,946

* Includes interest on income tax refunds Rs. 247.3 million (March 31, 2004 Rs. 406.1 million).

SCHEDULE 14 — OTHER INCOME

I. Commission, exchange and brokerage ................................................. 19,210,001 10,717,982

II. Profit/(Loss) on sale of investments (net).............................................. 5,461,352 12,246,330

III. Profit/(Loss) on revaluation of investments (net).................................. (907) ——

——

—

IV. Profit/(Loss) on sale of land, buildings and other assets (net)* .......... (20,822) (19,136)

V. Profit/(Loss) on foreign exchange transactions (net)............................ 3,146,394 1,926,267

VI. Income earned by way of dividends, etc. from subsidiary

companies and/or joint ventures abroad/ in India ................................ 1,880,786 1,261,730

VII. Miscellaneous Income (including lease income).................................. 4,484,635 4,516,055

TOTAL ........................................................................................................ 34,161,439 30,649,228

* Includes profit/(loss) on sale of assets given on lease.

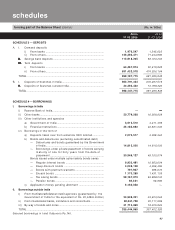

SCHEDULE 15 — INTEREST EXPENDED

I. Interest on deposits................................................................................. 32,520,688 30,230,202

II. Interest on Reserve Bank of India/inter-bank borrowings ................... 2,527,689 2,293,656

III. Others (including interest on borrowings of erstwhile ICICI Limited)* 30,660,499 37,628,634

TOTAL ........................................................................................................ 65,708,876 70,152,492

* Includes expenses incurred to raise funds amounting to Rs. 252.6 million (March 31, 2004: Rs. 297.4 million).

SCHEDULE 16 — OPERATING EXPENSES

I. Payments to and provisions for employees .......................................... 7,374,121 5,460,573

II. Rent, taxes and lighting .......................................................................... 1,853,347 1,492,502

III. Printing and Stationery ............................................................................ 876,632 861,008

IV. Advertisement and publicity................................................................... 1,162,555 686,788

V. Depreciation on Bank’s property (including non banking assets)....... 2,933,725 2,609,344

VI. Depreciation (including lease equalisation) on Leased assets ........... 2,969,907 2,785,069

VII. Directors’ fees, allowances and expenses ........................................... 3,872 3,650

VIII. Auditors’ fees and expenses .................................................................. 17,632 16,750

IX. Law Charges ............................................................................................. 97,141 86,895

X. Postages, Telegrams, Telephones, etc. ................................................. 1,736,270 1,415,019

XI. Repairs and maintenance........................................................................ 2,159,454 1,895,723

XII. Insurance .................................................................................................. 597,230 334,991

XIII. Direct marketing agency expenses ........................................................ 4,854,521 2,937,004

XIV. Other expenditure.................................................................................... 6,355,068 5,127,009

TOTAL ........................................................................................................ 32,991,475 25,712,325

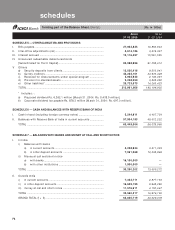

SCHEDULE 17 — PROVISIONS AND CONTINGENCIES

I. Income Tax

- Current period tax ............................................................................ 1,764,935 2,695,947

- Deferred tax adjustment ................................................................. 3,425,081 (68,800)

II. Wealth Tax ................................................................................................ 30,000 24,000

III. Provision for investments (including credit subsitutes) (net) ............. 5,415,587 987,056

IV. Provision for advances (net)* .................................................................. (1,213,571) 4,591,155

V. Others ....................................................................................................... 85,984 207,936

TOTAL ........................................................................................................ 9,508,016 8,437,294

* Includes provision on non performing advances, non performing leased assets, other receivables and standard

assets.

(Rs. in ‘000s)