ICICI Bank 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

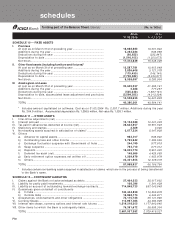

F4

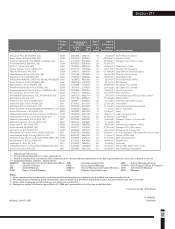

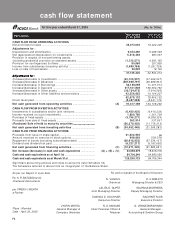

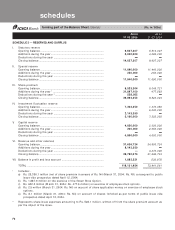

Particulars Year ended Year ended

31.03.2005 31.03.2004

CASH FLOW FROM OPERATING ACTIVITIES

Net profit before taxes ........................................................................ 25,272,032 19,022,209

Adjustments for :

Depreciation and amortisation ........................................................... 9,424,450 9,268,549

Net (appreciation)/depreciation on investments .............................. 5,416,494 987,057

Provision in respect of non-performing assets

(including prudential provision on standard assets) ........................ (1,213,571) 4,591,155

Provision for contingencies & others ................................................. 85,984 207,936

Income from subsidiaries (investing activity) ................................... (1,880,786) (1,261,729)

Loss on sale of fixed assets ............................................................... 20,822 19,136

37,125,425 32,834,313

Adjustments for :Adjustments for :

Adjustments for :Adjustments for :

Adjustments for :

(Increase)/decrease in Investments ................................................... (43,133,937) (47,269,037)

(Increase)/decrease in Advances ........................................................ (287,949,797) (90,899,851)

Increase/(decrease) in Borrowings..................................................... 54,169,059 11,401,514

Increase/(decrease) in Deposits ......................................................... 317,101,929 199,392,782

(Increase)/decrease in Other assets ................................................... (20,734,975) (7,914,593)

Increase/(decrease) in Other liabilities and provisions .................... 43,226,853 14,154,337

62,679,132 78,865,152

Direct taxes paid .................................................................................. (8,487,388) (8,531,173)

Net cash generated from operating activities .............................. (A) 91,317,169 103,168,292

CASH FLOW FROM INVESTING ACTIVITIES

Investments in subsidiaries and/or joint ventures ........................... (6,430,433) (6,415,226)

Income received on such investments ............................................. 1,880,786 1,261,729

Purchase of fixed assets ..................................................................... (3,795,277) (4,838,324)

Proceeds from sale of fixed assets .................................................... 262,914 337,851

(Purchase)/Sale of held to maturity securities ......................................................

......................................................

........................... (26,370,435) (11,715,313)

Net cash generated from investing activities ............................... (B) (34,452,445) (21,369,283)

CASH FLOW FROM FINANCING ACTIVITIES

Proceeds from issue of share capital ................................................ 31,922,933 — —

— —

—

Amount received on exercise of stock options ................................ 649,862 539,078

Repayment of bonds (including subordinated debt) ....................... (38,616,923) (57,334,107)

Dividend and dividend tax paid .......................................................... (6,227,217) (5,187,662)

Net cash generated from financing activities................................ (C) (12,271,345) (61,982,691)

Net increase/(decrease) in cash and cash equivalents ................... (A) + (B) + (C) 44,593,379 19,816,318

Cash and cash equivalents as at April 1st ......................................... 84,706,344 64,890,026

Cash and cash equivalents as at March 31st .................................... 129,299,723 84,706,344

For and on behalf of the Board of Directors

N. VAGHUL

Chairman

LALITA D. GUPTE

Joint Managing Director

CHANDA D. KOCHHAR

Executive Director

N. S. KANNAN

Chief Financial Officer &

Treasurer

K. V. KAMATH

Managing Director & CEO

KALPANA MORPARIA

Deputy Managing Director

NACHIKET MOR

Executive Director

G. VENKATAKRISHNAN

General Manager -

Accounting & Taxation Group

JYOTIN MEHTA

General Manager &

Company Secretary

cash flow statement

for the year ended March 31, 2005

Significant accounting policies and notes to accounts (refer Schedule 18)

The Schedules referred to above form an integral part of the Balance Sheet.

For S. R. BATLIBOI & CO.

Chartered Accountants

per VIREN H. MEHTA

a Partner

Place : Mumbai

Date : April 30, 2005

As per our Report of even date

(Rs. in ‘000s)