ICICI Bank 2005 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

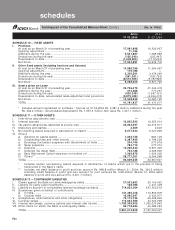

F48

b) Commissions paid to direct marketing agents (DMAs) for auto loans, is recorded upfront in the profit and

loss account net of subvention income received from them.

c) Income from hire purchase operations is accrued by applying the interest rate implicit on outstanding

balances.

d) Income from leases is calculated by applying the interest rate implicit in the lease to the net investment

outstanding on the lease over the primary lease period. Leases effected from April 1, 2001 have been

accounted as per Accounting Standard 19 "Accounting for Leases" issued by ICAI. Accordingly, leases

effected from April 1, 2001 are accounted as advances at an amount equal to the net investment in the

lease. The lease rentals are apportioned between principal and finance income based on a pattern reflecting

a constant periodic return on the net investment of outstanding in respect of finance lease. The principal

amount is recognised as repayment of advances and the finance income is reported as interest income.

e) Income on discounted instruments is recognised over the tenure of the instrument on a constant yield basis.

f) Dividend is accounted on an accrual basis when the right to receive the dividend is established.

g) Fees received as a compensation of future interest sacrifice is amortised over the remaining period of the

facility.

h) Arranger's fee is accrued proportionately where more than 75% of the total amount of finance has been

arranged.

i) All other fees are recognised upfront on their becoming due.

j) Income arising from sell down/securitisation of loan assets is recognised upfront, net of future servicing

cost for assets sold, expected prepayment and projected delinquencies and included in interest income.

k) Guarantee commission is recognised over the period of the guarantee.

Other entities

a) Revenue from issue management, loan syndication, financial advisory services etc., is recognised based on the

stage of completion of assignments and terms of agreement with the client.

b) Income from brokerage activities is recognised as income on the trade date of the transaction.Brokerage income in

relation to public issues/ other securities is recognised based on mobilization and terms of agreement with the client.

c) In case of life insurance business, insurance premium is recognised as income when due. Premium on lapsed

policies is recognised as income when such policies are reinstated. For linked business, premium is recognised

when the associated units are allotted. Income from Linked Funds which includes, fund management charges,

administrative charges, mortality charges, etc are recovered from the linked fund in accordance with terms and

conditions of policy and are accounted on accrual basis.

In case of general insurance business, insurance premium is recognised as income over the contract period

based on 1/365 method or over the period of risk whichever is appropriate on a gross basis net of service tax.

Any subsequent revision to premium is recognised over the remaining period of risk or contract period.

Adjustments to premium income arising on cancellation of policies is recognised in the year in which it is

cancelled. Commission on reinsurance business is recognised as income in the year of ceding the risk. Profit

commission under re-insurance treaties is recognised as income in the year of determination of profits.

In case of insurance business, interest income on investments is recognised on an accrual basis. Accretion of

discount and amortisation of premium relating to debt securities is recognised over the holding/maturity period on

a straight-line basis. In case of listed equity shares / mutual fund units, the profit or loss on actual sale of investment

includes the accumulated changes in the fair value previously recognised under "Fair Value Change Account".

d) In case of the venture funds, the annual management fee, performance fee and the advisory fee are recognised

as revenue when they contractually accrue except where the management believes that the collectability is in

doubt. Dividend income from investment in units of mutual fund is recognised on cash basis.

Income on securities classified as stock-in-trade is recognised on trade date.

e) In case of ICICI Equity Fund, ICICI Eco-net Internet and Technology Fund, ICICI Emerging Sectors Fund and ICICI

Strategic Investments Fund (schemes of ICICI Venture Capital Fund) dividend from equity shares is recognised

on ex-dividend dates in respect of quoted companies and on the respective dates of the shareholders' resolution

in the case of unquoted companies. Realised gains and losses on investments and units in Mutual Fund and

unrealized gains or losses on restatement of units in Mutual Fund are dealt with in the Revenue Account. The

cost of investments sold is determined on weighted average basis and the cost of units in Mutual Fund sold is

determined on first-in, first-out basis for the purpose of calculating gains or losses on sale.

schedules

forming part of the Consolidated Accounts (Contd.)