ICICI Bank 2005 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F53

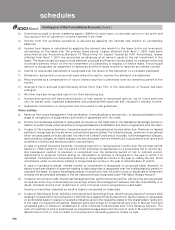

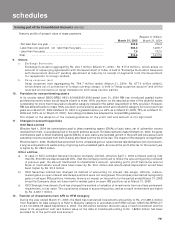

c) In case of Prudential ICICI Asset Management Company Limited, fixed assets other than leasehold improvements

and software development and licensing costs are depreciated at written down value method based on economic

lives of the assets as estimated by the management.

d) In case of ICICI Bank Canada and ICICI Bank UK Limited, fixed assets other than leasehold improvements are

depreciated using straight-line method over the estimated useful lives of the assets as estimated by the

management.

e) In case of ICICI Prudential Life Insurance Company Limited, assets costing upto Rs. 20,000 (Rupees twenty

thousand) are fully depreciated in the year of acquisition. Intangible assets comprising of software are stated at

cost less amortization. Significant improvements to software are capitalized with the insignificant improvements

being charged off as software expenses. Software expenses are amortized on Straight Line Method over a period

of 3 years from the date of put to use, being the Management's estimate of the useful life of such intangibles.

f) In case of ICICI Lombard General Insurance Company Limited, software costing less than Rs. 500,000 was fully

written off in the year of acquisition. However software acquired on or after April 1,2004 and costing less than

Rs. 500,000 are depreciated @ 20 percent.

6. Foreign currency transactions

ICICI Bank Limited

a) Foreign currency income and expenditure items of domestic operations are translated at the exchange rates

prevailing on the date of the transaction, income and expenditure items of integral foreign operations

(representative offices) are translated at weekly average closing rate, and income and expenditure of non integral

foreign operations (foreign branches and off-shore banking units) are translated at quarterly average closing rate.

b) Monetary foreign currency assets and liabilities of domestic and integral foreign operations are translated at

closing exchange rates notified by Foreign Exchange Dealers' Association of India ("FEDAI") at the balance sheet

date and the resulting profits/losses are included in the profit and loss account.

c) Both monetary and non-monetary foreign currency assets and liabilities of non integral foreign operations are

translated at closing exchange rates notified by FEDAI at the balance sheet date and the resulting profits/losses

exchange differences are accumulated in the foreign currency translation reserve until the disposal of the net

investment in the non integral foreign operations.

d) Outstanding forward exchange contracts are stated at contracted rates and are revalued at the exchange rates

notified by FEDAI for specified maturities and at interpolated rates for contracts of in-between maturities. The

resultant gains or losses are recognised in the profit and loss account.

e) Contingent liabilities on account of guarantees, endorsements and other obligations are stated at the exchange

rates notified by FEDAI at the balance sheet date.

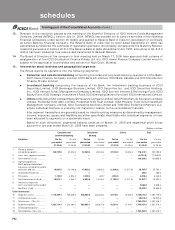

Other entities

The financial statements of foreign subsidiaries/associates - ICICI Securities Holdings Inc., ICICI Securities Inc., ICICI

Bank UK Limited, ICICI Bank Canada, ICICI International Limited and TCW/ICICI Investment Partners LLC have been

converted in accordance with Accounting Standard 11 on "The effects of changes in foreign exchange rates".

In translating the financial statements of the above-mentioned non-integral foreign operations, all monetary items

have been translated at the rate prevailing at the balance sheet date. All Profit and Loss items have been translated

at the average rate prevailing during the financial year.

Share Capital has been translated at the original rate when the capital was infused and the difference on account of

exchange rate has been transferred to Translation Reserve. The opening block of fixed assets have been translated

at the opening rate prevailing at the beginning of the year. Additions / Deductions made to fixed assets have been

translated at the average rate prevailing during the year. Similar treatment has been given to accumulated depreciation

on fixed assets.

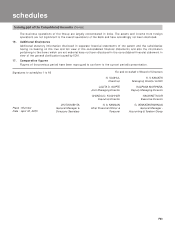

7. Accounting for derivative contracts

ICICI Bank Limited

The Bank enters into derivative contracts such as foreign currency options, interest rate and currency swaps and cross

currency interest rate swaps to hedge on-balance sheet/off-balance sheet assets and liabilities or for trading purposes.

The swap contracts entered to hedge on-balance sheet assets and liabilities are structured in such a way that they bear

an opposite and offsetting impact with the underlying on-balance sheet items. The impact of such derivative instruments

are correlated with the movement of underlying assets and accounted pursuant to the principles of hedge accounting.

Foreign currency and rupee derivatives, which are entered for trading purposes, are marked to market and the

resulting gain/loss, (net of provisions, if any) is recorded in the profit and loss account.

schedules

forming part of the Consolidated Accounts (Contd.)