ICICI Bank 2005 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F56

under contractual obligations. It is calculated on a daily pro-rata basis subject to a minimum of 50% of the

premium, written during the twelve months preceding the balance sheet date for fire, marine, cargo and

miscellaneous business and 100% for marine hull business, in accordance with section 64 V, (1) (ii) (b) of

the Insurance Act, 1938.

d. Acquisition costs

Acquisition costs are those costs that vary with, and are primarily costs related to the acquisition of new and

renewal insurance contracts viz. commission, policy issue expenses, etc. These costs are expensed in the year

in which they are incurred.

e. Liability for life policies in force

In respect of life insurance business, liability for life policies in force and also policies in respect of which

premium has been discontinued but a liability exists, is determined by the Appointed Actuary on the basis of an

annual review of the life insurance business, as per the gross premium method in accordance with accepted

actuarial practice, requirements of the IRDA and the Actuarial Society of India. The linked policies sold by the

Company carry two types of liabilities - unit liability representing the fund value of policies and non-unit liability

for future expenses, meeting death claims, income taxes and cost of any guarantees.

f. Actuarial method and valuation

In case of life insurance business, the actuarial valuation liability on both participating and non-participating

policies is calculated using the gross premium method. The gross premium reserves are calculated using

assumptions for interest, mortality, expense, and inflation and in the case of participating policies, the future

bonuses together with allowance for taxation and allocation of profits to shareholders. These assumptions are

determined as prudent estimates at the date of valuation with allowances for adverse deviations.

For the participating policies and non-participating term insurance policies, the interest rates used for valuation

are in the range of 4% to 7% per annum (Previous year - 4% to 6% per annum). For non participating single

premium investment policies which are maintained as a hedged portfolio, the interest rates used for valuation

range from 4.7% to 10% per annum (Previous year - 4.7% to 10% per annum).

The valuation has been carried out without assuming lapses or policies becoming paid up. Mortality rates used

are based on the published L.I.C. (1994 - 96) Ultimate Mortality Table, adjusted to reflect expected experience

and allowances for adverse deviation. The method of unearned premium for the unexpired portion of the risk

has been adopted for the general fund liabilities of linked business and riders there under, and one year

renewable group term insurance.

The unit liability in respect of linked business has been valued on the basis of the units, to the credit of

policyholders, as on the valuation date. The adequacy of charges under unit-linked policies to meet future

expenses has been tested and provision has been made as appropriate. Provision has also been made for the

cost of guarantee under unit-linked products that carry a guarantee.

g. Premium deficiency

Premium deficiency is recognised when the sum of expected claim costs and related expenses exceed the

reserve for unexpired risks and is computed at a business segment level.

h. Brokerage and incentives

In case of Prudential ICICI Asset Management Company Limited, brokerage and incentives paid on the

subscriptions raised during the initial offer period of the first three open ended schemes of the Fund offering

benefits under Section 54EB of the Income tax Act, 1961 are charged to profit and loss account over the period

of eighty four months.

Brokerage on Asset Shield products under PMS are amortised over the term. The unamortised portion of the

brokerage is carried forward as prepaid expense. In the previous year such expenses for six month and one year

Asset Shield products was charged as expense upfront.

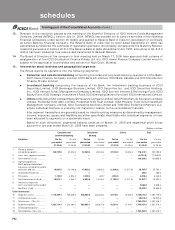

B. NOTES FORMING PART OF THE ACCOUNTS

1. Preference shares

Certain Government Securities amounting to Rs. 1,952.3 million (March 31, 2004: Rs. 1,455.1 million) have been

earmarked against redemption of preference share capital, which falls due for redemption on April 20, 2018 as per

the original issue terms.

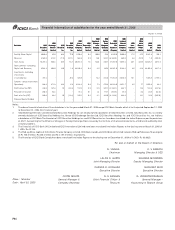

schedules

forming part of the Consolidated Accounts (Contd.)