ICICI Bank 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11th Annual Report and Accounts 2004-2005

New

Horizons

2004-2005

ANNUAL REPORT

th

Spine should be

adjusted by

printer

design by dickenson www.notension.biz

Table of contents

-

Page 1

New Horizons th ANNUAL REPORT 2004-2005 -

Page 2

... micro finance solutions in rural India. Through focused strategies and by actively leveraging our technology platforms, we have established a meaningful international presence in a relatively short span of time. Our products and services are finding great appeal across all audiences, at home and... -

Page 3

... on Corporate Governance Business Overview Management's Discussion and Analysis Particulars of Employees under Section 217 (2A) of the Companies Act, 1956 2 4 6 6 6 7 30 31 44 56 Financials: Auditors' Report Balance Sheet Profit and Loss Account Cash Flow Statement Schedules Statement pursuant to... -

Page 4

... - insurance companies, mutual funds, venture capital companies, stock exchanges and credit rating agencies. This process gathered momentum in the post-reform era, with an explosion of new players and competitive products and services. While the entry of private sector players saw modern, technology... -

Page 5

... and retail customers and are rapidly expanding our scale of operations. Our strategy is to continue to grow our existing businesses and create a robust business model for rural India and the urban low-income segment, play a serious and proactive role in India's growth and development and establish... -

Page 6

... the point-of-sale of the product being financed or indeed, to the customer's home or office. We put in place robust credit approval and Dear Stakeholders, Fiscal 2005 was a momentous year for the Indian economy and for us at the ICICI group. The Indian economy displayed maturity and resilience in... -

Page 7

...leveraging our international presence, the global communications infrastructure and our India-based technology platforms to offer a unique value proposition to our customers. There is a growing focus in India today, among policy makers and industry, on realising the potential of the rural economy as... -

Page 8

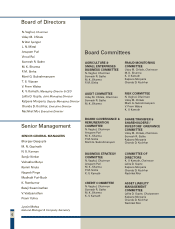

..., Deputy Managing Director Chanda D. Kochhar, Executive Director Nachiket Mor, Executive Director BOARD GOVERNANCE & REMUNERATION COMMITTEE AUDIT COMMITTEE N. Vaghul, Chairman Uday M. Chitale Marti G. Subrahmanyam V. Prem Watsa K. V. Kamath Board Committees AGRICULTURE & SMALL ENTERPRISES BUSINESS... -

Page 9

... public offering on the New York Stock Exchange. The issue price was fixed at US$ 21.11 per ADS with each ADS representing two underlying equity shares. This represented a premium of 18% to the closing domestic price on March 11, 2005, the last date for tender of shares in the offering. The offering... -

Page 10

... product and service propositions offered by ICICI Bank appeal not only to the Indian diaspora and Indian corporates with international aspirations, but also to a diverse customer profile overseas. ICICI Bank is thus seeking to emerge as a major global bank. ICICI Bank has subsidiaries in Canada, UK... -

Page 11

...Subsidiaries ICICI Securities Limited ICICI Venture Funds Management Company Limited ICICI Prudential Life Insurance Company Limited ICICI Lombard General Insurance Company Limited ICICI Home Finance Company Limited ICICI Investment Management Company Limited ICICI Trusteeship Services Limited ICICI... -

Page 12

.... Having recognised the potential of rural India, ICICI Bank is reaching out to rural households through multiple channels and a comprehensive product suite, enabling a new growth engine for the Indian economy and itself. To boost its rural finance business, ICICI Bank has been supporting over 45... -

Page 13

... the merger of ICICI Distribution Finance Private Limited with ICICI Home Finance Company Limited. DIRECTORS Satish C. Jha retired at the Annual General Meeting (AGM) held on September 20, 2004 and did not seek re-appointment. S. B. Mathur, Chairman of Life Insurance Corporation of India (LIC... -

Page 14

.... For the non-resident Indian, we offer a range of remittance solutions and liability and asset products including online home loans. Our private banking clients avail of banking solutions which include multi manager portfolio, real estate funds, mutual funds and structured notes. We have tapped... -

Page 15

...) Rules, 1975, as amended, the names and other particulars of the employees are set out in the Annexure to the Directors' Report. APPOINTMENT OF NOMINEE DIRECTORS ON THE BOARD OF ASSISTED COMPANIES Erstwhile ICICI Limited (ICICI) had a policy of appointing nominee directors on the boards of certain... -

Page 16

... are enabling higher income levels, de-risked livelihoods and improved productivity in rural India. ICICI Bank is providing financial services to the farmer community through crop loans, loans against jewellery, farm equipment loans and a range of insurance products offering protection to lives and... -

Page 17

... of value for all stakeholders. Whistle Blower Policy In line with the best international governance practices and the Sarbanes-Oxley Act, ICICI Bank has formulated a Whistle Blower Policy for the ICICI group. In terms of this policy, employees of ICICI Bank and its group companies are free to... -

Page 18

... & Small Enterprises Business Committee Terms of Reference The functions of the Committee include review of the business strategy of the Bank in the agri-business and small enterprises segments and review of the quality of the agricultural lending and small enterprises finance credit portfolio. 16 -

Page 19

... and branch statutory auditors and fixing of their remuneration, review of the annual financial statements before submission to the Board, review of the adequacy of internal control systems and the internal audit function, review of customer service initiatives and functioning of customer service... -

Page 20

...) Number of Meetings attended 2 1 2 N.A. N.A. Remuneration policy The Board Governance & Remuneration Committee has the power to determine and recommend to the Board the amount of remuneration (including performance bonus and perquisites) and grant of stock options to the wholetime Directors. The... -

Page 21

... to approve the annual income and expenditure and capital expenditure budgets for presentation to the Board for final approval and to review and recommend to the Board the business strategy of ICICI Bank. Composition The Business Strategy Committee comprises five Directors, namely, N. Vaghul, Anupam... -

Page 22

...the year which was attended by all the members of the Committee. IX. Risk Committee Terms of reference The Committee reviews ICICI Bank's risk management policies in relation to various risks (credit, portfolio, liquidity, interest rate, off-balance sheet and operational risks), investment policies... -

Page 23

...in fiscal 2005 were processed to the satisfaction of shareholders. At March 31, 2005, no complaints were pending. No applications were pending for transfer of shares at that date. XI. Committee of Directors Terms of reference The powers of the Committee include credit approvals as per authorisation... -

Page 24

... on the website of ICICI Bank. The Management's Discussion & Analysis forms part of the Annual Report. XVI. General Shareholder Information Eleventh Annual General Meeting Date Saturday, August 20, 2005 Time 1.30 p.m. Venue Professor Chandravadan Mehta Auditorium, General Education Centre, Opposite... -

Page 25

... equity shares. Code for ICICI Bank 532174 ICICIBANK IBN ICICI Bank has paid annual listing fees for fiscal 2006 on its capital to BSE and NSE and for calendar year 2005 to New York Stock Exchange (NYSE) where its securities are listed. Market Price Information The reported high and low closing... -

Page 26

... and network and facilities management services. 3i Infotech has received the ISO-9001 certification for its transaction processing activities. ICICI Bank's equity shares are traded only in dematerialised form. During the year, 8,723,737 equity shares of ICICI Bank were transferred into electronic... -

Page 27

... the total issued/paid up equity capital of ICICI Bank. Certificates issued in this regard are placed before the Share Transfer & Shareholders'/Investors' Grievance Committee and forwarded to stock exchanges where the equity shares of ICICI Bank are listed. Registrar and Transfer Agent The Registrar... -

Page 28

...Shareholder Deutsche Bank Trust Company Americas (Depositary for ADS holders) Life Insurance Corporation of India Allamanda Investments Pte Limited Government of Singapore HWIC Asia Fund Bajaj Auto Limited M & G Investment Management Limited A/c The Prudential Assurance Company Limited The New India... -

Page 29

... 27.34% of ICICI Bank's paid-up equity share capital at March 31, 2005. Currently, there are no convertible debentures outstanding. Plant Locations - Not applicable Address for Correspondence Jyotin Mehta General Manager & Company Secretary ICICI Bank Limited ICICI Bank Towers Bandra-Kurla Complex... -

Page 30

...to eligible employees and wholetime Directors. Each option confers on the employee a right to apply for one equity share of face value of Rs. 10 of ICICI Bank at Rs. 359.95, which was the last closing price on the stock exchange which recorded the highest trading volume in ICICI Bank shares on April... -

Page 31

..., the domestic and international banking community, investment bankers, rating agencies and stock exchanges for their support. ICICI Bank would like to take this opportunity to express sincere thanks to its valued clients and customers for their continued patronage. The Directors express their deep... -

Page 32

... by ICICI Bank Limited ('Bank'), for the year ended on March 31, 2005, as stipulated in clause 49 of the Listing Agreements entered into by the said Bank with stock exchanges. The compliance of conditions of corporate governance is the responsibility of the management. Our examination was limited to... -

Page 33

... witnessing a deficit for the first time in three years (US$ 6.4 billion during fiscal 2005). The current account however, was in a surplus of US$ 159.0 million for the fourth quarter of fiscal 2005 mainly on account of invisibles receipts. International crude oil prices increased from US$ 35.76 per... -

Page 34

... for retail credit exposure, rating based differential risk weights for other credit exposures and a capital charge for operational risk. A roadmap for the presence of foreign banks in India has also been outlined. Initially, foreign banks are allowed entry only in private sector banks identified by... -

Page 35

...our operations in various overseas markets as well as our products and services for non-resident Indians (NRIs) and our international trade finance and correspondent banking relationships. The Corporate Centre comprises all shared services and corporate functions, including finance and balance sheet... -

Page 36

..., Government of India relief bonds and insurance products as well as initial public offerings of equity. www.ICICIdirect.com (ICICIdirect) is a leading online share trading platform, and also enables investments in other forms such as mutual funds and government savings instruments. Customer service... -

Page 37

Business Overview turnaround times. We believe we are the market leader in cash management services in India. The corporate markets business focused on delivery of market solutions such as foreign exchange products, derivatives and market-making in corporate bonds to our corporate clients. There ... -

Page 38

... and branches launched several products during the financial year. ICICI Bank UK became the first Indian bank in the UK to launch credit cards. ICICI Bank Canada offered a unique product 'Hello Canada' which was primarily targeted at immigrants to Canada and helps customers to set up their banking... -

Page 39

Business Overview direct banking offering using the internet as the access channel. The Bank leveraged India based delivery skills by outsourcing several back office operations from the UK and Canada subsidiaries to central processing shops in India. ICICI Bank UK has achieved a profit and set off ... -

Page 40

... Poor's (S&P) Credit Analysis & Research Limited (CARE) Investment Information and Credit Rating Agency (ICRA) Rating Baa3 BB+ CARE AAA AAA RISK MANAGEMENT Risk is an integral part of the banking business and we aim at the delivery of superior shareholder value by achieving an appropriate trade-off... -

Page 41

Business Overview Market Risk Market risk is the risk of loss resulting from changes in interest rates, foreign currency exchange rates, equity prices and commodity prices. Our exposure to market risk is a function of our trading portfolio, mandated government securities portfolio, asset-liability ... -

Page 42

...types of customers and product lines to provide quicker access to our phone banking representatives. Taking forward our strategy to offer multi-channel access and enhanced functionality to our customers, we have added new services on mobile banking for various deposit, credit card and demat accounts... -

Page 43

...this area internationally. The leadership development process involves personal investment of time by the wholetime Directors and senior management in mentoring high potential managers. The Bank has involved potential leaders in policy making and has encouraged them to engage with other employees as... -

Page 44

Business Overview ORGANISATIONAL EXCELLENCE The Organisational Excellence Group, headed by a Senior General Manager who reports to the Managing Director & CEO, is engaged in institutionalising quality across the Bank by building skills and capabilities in various quality frameworks. The group has ... -

Page 45

... the process of designing a weather insurance product for the landless poor to cover loss of work due to adverse weather conditions. PUBLIC RECOGNITION During fiscal 2005, we received several prestigious awards in recognition of our business strategies, customer service levels and technology focus... -

Page 46

... 2004. In April 2004, ICICI Bank raised additional equity capital of Rs. 32.46 billion (which was equivalent to 40.5% of the net worth at March 31, 2004) at a price of Rs. 280 per share. As a result of the increase in capital during the year, return on average equity declined to 17.9% in fiscal... -

Page 47

...) and Cash Reserve Ratio (CRR) on these liabilities, which were not subject to these ratios prior to the merger. While ICICI Bank's cost of deposits (4.5% in fiscal 2005) is comparable to the cost of deposits of other banks in India, ICICI Bank's total cost of funding (5.8% in fiscal 2005) is higher... -

Page 48

... retail asset products like home loans and credit cards and retail liability-related income like account servicing charges, and an increase in transaction banking fee income from corporate clients. During fiscal 2005, retail banking operations contributed about 54.8% of total fee income, corporate... -

Page 49

... of business, particularly in retail banking and includes maintenance of ATMs, credit card expenses, call centre expenses and technology expenses. The volume of credit cards issued increased to about 3.3 million at March 31, 2005 from about 2.2 million at March 31, 2004. The number of branches and... -

Page 50

... the buoyant equity markets. These shares were acquired primarily at the time of the initial project finance assistance as well as on conversion of loans into shares as a part of restructuring of debt. During fiscal 2005, the Bank transferred Statutory Liquidity Ratio (SLR) investments amounting to... -

Page 51

... securities - Cash & balances with RBI & banks - Government securities Advances Debentures & bonds Other investments Fixed assets Other assets Total assets Liabilities : Equity capital and reserves - Equity capital - Reserves Preference capital Deposits - Savings deposits - Current deposits - Term... -

Page 52

..., Tier-I capital includes Rs. 1.55 billion out of the face value of Rs. 3.50 billion of 20 year non-cumulative preference shares issued to ITC Limited as a part of the scheme for merger of ITC Classic Finance Limited with ICICI. CONSOLIDATED ACCOUNTS The consolidated profit after tax for fiscal... -

Page 53

..., the profit/(loss) of the principal subsidiaries of ICICI Bank. Rs. in billion FY2004 ICICI Securities Limited ICICI Prudential Life Insurance Company Limited ICICI Lombard General Insurance Company Limited ICICI Venture Funds Management Company Limited ICICI Home Finance Company Limited 1.65... -

Page 54

...jewellery Non-banking finance companies Tea Construction Leather & leather products Other Industries Total (1) (2) (3) Amount is net of write-offs and gross of provisions. Includes home loans, automobile loans, commercial business loans, two-wheeler loans, personal loans, credit cards & others. All... -

Page 55

... of ICICI Bank's retail finance loans. Loans and advances (1) Home loans Automobile loans Commercial business (including commercial vehicle, construction equipment & farm equipment loans) Personal loans Credit card receivables Loans against securities Two-wheeler loans Others Total (1) Amount is net... -

Page 56

... with regulations governing the presentation of financial information by banks, the Bank reports non-performing assets net of cumulative write-offs in its financial statements. The following table sets forth classification of net customer assets (net of write-offs and provisions) of ICICI Bank at... -

Page 57

... Power Chemicals Textiles Other Infra- Telecom Engineering Electronics Services - Finance Food processing Automobile (including trucks) Iron & steel Services - Others Other metal & metal products Paper & paper products Rubber & rubber products Agriculture Ceramics, granites & related Non-banking... -

Page 58

... Co. Indian Overseas Bank Officer,Canara Bank Junior Executive, BHEL, Hyderabad Head Agency Business, DGP Windsor Adviser to Chairman, Bakrie Group, Indonesia Executive, SRF Limited India Telecomp Limited Zonal Manager, Standard Chartered Bank Director-Operations, Asian Finance & Investment Honda... -

Page 59

... Life Insurance State Bank of Bikaner & Jaipur Director, Anik Financial State Bank of India Research Director, MARG IRIS Limited GE Capital TFS Limited GE Capital TFS Limited Hewitt Associates Wipro Systems General Manager (HR), ICI India Limited Mulla & Mulla Chief Manager, Bank of India Times Bank... -

Page 60

financials 58 -

Page 61

... the accounting principles generally accepted in India; i. ii. iii. in case of the balance sheet, of the state of the affairs of the Bank as at M arch 31, 2005; in case of the profit and loss account, of the profit for the year ended on that date; and in case of cash flow statement, of the cash flow... -

Page 62

...umbai Date : April 30, 2005 K. V . KAM ATH M anaging Director & CEO KALPANA M ORPARIA Deputy M anaging Director NACHIKET M OR Executive Director G. VENKATAKRISHNAN General M anager Accounting & T axation Group JYOTIN M EHTA General M anager & Company Secretary N. S. KANNAN Chief Financial Officer... -

Page 63

.../ TRANSFERS Statutory Reserve ...Capital Reserve ...Investment Fluctuation Reserve ...Special Reserve ...Revenue and other Reserves ...Proposed equity share dividend ...Proposed preference share dividend ...Corporate dividend tax ...Balance carried over to balance sheet ...TOTAL ... 5,020... -

Page 64

... maturity securities ...Net cash generated from investing activities ...CASH FLOW FROM FINANCING ACTIVITIES Proceeds from issue of share capital ...Amount received on exercise of stock options ...Repayment of bonds (including subordinated debt) ...Dividend and dividend tax paid ...Net cash generated... -

Page 65

... (M arch 31, 2004: Nil equity shares) of Rs.10 each on exercise of employee stock options] ...TOTAL ...Preference share capital 2 [Represents face value of 350 preference shares of Rs. 10 million each issued to preference share holders of erstw hile ICICI Limited on amalgamation redeemable at par on... -

Page 66

...,000 31,636,724 530,876 73,941,561 VII. Balance in profit and loss account ...TOTAL ...1 Includes : a) Rs. 29,396.1 million (net of share premium in arrears of Rs. Nil (M arch 31, 2004: Rs. Nil) consequent to public issue vide prospectus dated April 12, 2004. b) Rs. 1,887.9 million on the exercise... -

Page 67

... of branches outside India ... TOTAL ... SCHEDULE 4 - BORROWINGS I. Borrow ings in India i) ii) iii) Reserve Bank of India ...Other banks ...Other institutions and agencies a) b) iv) a) b) Government of India ...Financial Institutions ...Deposits taken over from erstw hile ICICI Limited ...Bonds and... -

Page 68

... Bank of India in current accounts ...TOTAL ... 5,544,811 57,904,193 63,449,004 4,467,734 49,612,232 54,079,966 SCHEDULE 7 - BALANCES WITH BANKS AND M ONEY AT CALL AND SHORT NOTICE I. In India i) Balances w ith banks a) b) ii) a) b) in current accounts ...in other deposit accounts ...w ith banks... -

Page 69

... credits, overdrafts and loans repayable on demand ...Term loans ...Securitisation, Finance lease and Hire Purchase receivables* ...Secured by tangible assets [includes advances against Book Debt] ...Covered by Bank/Government Guarantees ...Unsecured ...Advances in India Priority Sector ...Public... -

Page 70

... . Non-banking assets acquired in satisfaction of claims* ...VI. Others a) Advance for capital assets ...b) Outstanding fees and other Income ...c) Exchange fluctuation suspense w ith Government of India ...d) Sw ap suspense ...e) Deposits ...f) Deferred tax asset (net) ...g) Early retirement option... -

Page 71

schedules forming part of the Profit and Loss Account Year ended 31.03.2005 SCHEDULE 13 - INTEREST EARNED I. Interest/discount on advances/bills ...II. Income on investments ...III. Interest on balances with Reserve Bank of India and other inter-bank funds IV . Others* ...TOTAL ... (Rs. in '000s) ... -

Page 72

schedules forming part of the Accounts (Contd.) SCHEDULE 18 SIGNIFICANT ACCOUNTING POLICIES AND NOTES TO ACCOUNTS Overview ICICI Bank Limited (" ICICI Bank" or " the Bank" ), incorporated in Vadodara, India is a publicly held bank engaged in providing a w ide range of banking and financial services ... -

Page 73

... quoted on the stock exchanges, w herever linked to the Yield-to-M aturity (" YTM " ) rates, is w ith a mark-up (reflecting associated credit risk) over the YTM rates for government securities published by FIM M DA. Unquoted equity shares are valued at the book value, if the latest balance sheet... -

Page 74

.... Staff Retirement Benefits For employees covered under group gratuity scheme of Life Insurance Corporation of India (" LIC" )/ICICI Prudential Life Insurance Company Limited (" ICICI Prulife" ), gratuity charge to profit and loss account is on the basis of premium charged. For employees covered... -

Page 75

... at year-end. Defined contributions for provident fund are charged to the profit and loss account based on contributions made in terms of the scheme. The Bank provides for pension, a deferred retirement plan, covering certain employees. The plan provides for a pension payment on a monthly basis... -

Page 76

... 31.03.05 For the year ended 31.03.04 1. 2. 3. 4. Revenue Less: Inter segment revenue Total revenue (1) -(2) Operating Profit (i.e. Profit before unallocated expenses, and tax) Unallocated expenses Provisions (net) Profit before tax Income tax expenses (net) / (net of deferred tax credit) 106,436... -

Page 77

schedules forming part of the Accounts (Contd.) 4. Employee Stock Option Scheme ("ESOS") In terms of the ESOS, as amended, the maximum number of options granted to any eligible employee in a financial year shall not exceed 0.05% of the issued equity shares of the Bank at the time of grant of the ... -

Page 78

schedules forming part of the Accounts (Contd.) Insurance services During the year ended M arch 31, 2005, the Bank paid insurance premium to insurance joint ventures amounting to Rs. 315.4 million (M arch 31, 2004: Rs. 157.2 million). During the year ended M arch 31, 2005 the Bank received claims ... -

Page 79

schedules forming part of the Accounts (Contd.) Remuneration to w hole-time directors Remuneration paid to the w hole-time directors of the Bank during the year ended M arch 31, 2005 w as Rs. 60.5 million (M arch 31, 2004: Rs. 58.5 million) Related party balances The follow ing balances payable to/ ... -

Page 80

...Limited, ICICI International Limited, ICICI Trusteeship Services Limited, ICICI Home Finance Company Limited, ICICI Investment M anagement Company Limited, ICICI Securities Holdings Inc., ICICI Securities Inc., ICICI Bank UK Limited, ICICI Bank Canada, ICICI Prudential Life Insurance Company Limited... -

Page 81

... average no. of equity shares outstanding ...733,720,485 Net profit ...20,052.0 Diluted earnings per share (Rs.) ...27.33 Nominal value per share (Rs.) ...10.00 The dilutive impact is mainly due to options granted to employees by the Bank. 9. 9.1 Assets under lease Assets under operating lease... -

Page 82

...per cent)...Business per employee (average deposits plus average advances) (not annualised for period end) ...(vi) Profit per employee ...(vii) Net non-performing advances (funded) to net advances (per cent) ...RBI under section 27 of the Banking Regulation Act, 1949. 10.3 M aturity pattern a) Rupee... -

Page 83

... pattern of forex denominated assets and liabilities as on M arch 31, 2005 is given below : (Rupees in million) Loans & advances M aturity Buckets 1 to 14 days ...15 to 28 days ...29 days to 3 months ...3 to 6 months ...6 months to 1 year ...1 to 3 years ...3 to 5 years ...Above 5 years ...Total... -

Page 84

schedules forming part of the Accounts (Contd.) 10.4 Advances (i) Lending to sensitive sectors The Bank has lending to sectors, w hich are sensitive to asset price fluctuations. Such sectors include capital market, real estate and commodities. The net position of lending to sensitive sectors is ... -

Page 85

...15,115.3 April 1, 2004 to M arch 31, 2005 Opening balance ...Add: Provision made during the year (including utilisation of fair value provision) ...Less: Transfer from investment fluctuation reserve ...Add: Write-off during the year ...Closing balance ... (Rupees in million) April 1, 2003 to M arch... -

Page 86

... and (d) above are not mutually exclusive * This excludes investments, amounting to Rs. 2,551.3 million, in preference shares of subsidiaries, namely ICICI Bank UK Limited and ICICI Bank Canada and Rs. 7,189.6 million invested by overseas branches/offshore banking unit. The issuer composition of... -

Page 87

schedules forming part of the Accounts (Contd.) ii) Non performing non-SLR investments The non performing non-SLR investments of the Bank as on M arch 31, 2005 is given below : (Rupees in million) Particulars Opening balance ...Additions during the period ...Reductions during the period ...Closing ... -

Page 88

.... 10.13 Rupee and foreign currency derivatives ICICI Bank is a leading participant in the financial derivatives market. The Bank deals in derivatives for balance sheet management and market making purposes w hereby the Bank offers derivative products to its customers, enabling them to hedge their... -

Page 89

schedules forming part of the Accounts (Contd.) The market making and the proprietary trading activities in derivatives are governed by the investment policy of the Bank, w hich lays dow n the position limits, stop loss limits as w ell as other risk limits. The Risk M anagement Group (RM G) lays dow... -

Page 90

... 2004, the Bank has accounted for the unrealised gain on rupee interest rate derivatives (net of provisions, if any) as compared to its earlier policy of ignoring such unrealised gains. As a result the profit after tax for the current year is higher by Rs. 296.3 million. 11. Investments in jointly... -

Page 91

... to direct marketing agents (DM As) of auto loans w ere recorded upfront in the profit and loss account and subvention income received from them is being amortised over the life of the loan. The impact of the change is not significant. Transfer of investments from AFS to HTM category During the year... -

Page 92

...ed ICICI Investment Management M arch 31, 2005 Company Limited 10 ICICI Prudent ial Life M arch 31, 2005 Insurance Company Limited 11 ICICI Lombard General M arch 31, 2005 Insurance Company Limited 12 ICICI Dist ribut ion Finance Privat e Limit ed 13 ICICI Bank UK Limit ed 14 ICICI Bank Canada (see... -

Page 93

Consolidated financial statements of ICICI Bank Limited and its subsidiaries F33 -

Page 94

... the attached Consolidated Balance Sheet of ICICI Bank Limited and its subsidiaries, associates and joint ventures (the 'Group') as at M arch 31, 2005, and also the Consolidated Profit and Loss Account and the Consolidated Cash Flow Statement for the year ended on that date annexed thereto. These... -

Page 95

...: a. in the case of the consolidated balance sheet, of the state of affairs of the Group as at M arch 31, 2005; b. in the case of the consolidated profit and loss account, of the profit for the year ended on that date ; and c. in the case of the consolidated cash flow statement, the cash flow s for... -

Page 96

...,062 ASSETS Cash and balance w ith Reserve Bank of India ...Balances w ith banks and money at call and short notice ...Investm ents ...Advances ...Fixed Assets ...Other Assets ...TOTAL Contingent liabilities ...Bills for collection ...Significant Accounting Policies and Notes to Accounts ...18 12... -

Page 97

... dividend tax ...Balance carried over to Balance Sheet ...TOTAL ...Significant Accounting Policies and Notes to Accounts Earning per share (Refer note B. 7) ...Basic (Rs.) ...Diluted (Rs.) ...Face value per Share (Rs.) ...18 25.45 25.25 10.00 25.73 25.52 10.00 The Schedules referred to above form... -

Page 98

... term investment ... Net cash generated from investing activities ...(B) CASH FLOW FROM FINANCING ACTIVITIES Proceeds from issue of share capital ...Amount received on exercise of stock option & calls in arrears ...Repayment of bonds (including subordinated debts)...Dividend and dividend tax paid... -

Page 99

...Net) (Represents application money received for 22,470 eq uit y shares of Rs.10 each on exercise of em p loyee st ock options) ...TO TAL ...Preference Share Capital 2 [Represents face value of 350 preference shares of Rs. 10 million each issued to preference share holders of erstw hile ICICI Limited... -

Page 100

... application money on exercise of employee stock options. e) Rs. 8.1 million (M arch 31, 2004: Rs.Nil) on account of shares forfeited as per terms of equity issue vide prospectus dated April 12, 2004. Represents share issue expenses amounting to Rs. 528.1 million, w ritten-off from the share premium... -

Page 101

... ings in the form of a) Deposits (including deposits taken over from erstw hile ICICI Limited) ...b) Commercial paper ...c) Bonds and debentures (excluding subordinated debt) ...Debentures and bonds guaranteed by the Government of India ...Tax free bonds ...Borrow ings under privat e placem ent of... -

Page 102

...]. Corporate dividend tax payable Rs. 930.9 million [M arch 31, 2004: Rs. 697.0 million] SCHEDULE 6 - CASH AND BALANCES WITH RESERVE BANK OF INDIA I. II. Cash in hand (including foreign currency notes) ...Balances w ith Reserve Bank of India in current and other deposit accounts TOTAL ... 5,735... -

Page 103

... discounted ...A. i) ii) Cash credits, overdrafts and loans repayable on demand ...iii) Term loans ...iv) Securitisation, finance lease and hire purchase receivables* ...TOTAL ...B. i) ii) iii) Secured by tangible assets [includes advances against book debt] ...Covered by Bank/Government guarantees... -

Page 104

...certain non-banking assets acquired in satisfaction of claim s w hich are in the process of being transferred in the Bank's name. Includes net debit balance in profit and loss account Rs. 908.8 million (M arch 31, 2004: Rs. 336.0 million) including credit balance in profit and loss account for joint... -

Page 105

... EXPENDED I. Interest on deposits ...II. Interest on Reserve Bank of India/inter-bank borrow ings ...III. Others (including interest on borrow ings of erstw hile ICICI Limited)* TOTAL ...SCHEDULE 16-OPERATING EXPENSES I. Payments to and provisions for employees ...II. Rent, taxes and lighting ...III... -

Page 106

... Limited ICICI International Limited ICICI Bank UK Limited ICICI Distribution Finance Private Limited ICICI Bank Canada ICICI Property Trust ICICI Eco-net Internet & Technology Fund ICICI Equity Fund ICICI Emerging Sectors Fund ICICI Strategic Investments Fund Country/ residence India India USA USA... -

Page 107

...). The net consideration per share (after deduction of expenses in connection w ith the offering) w as Rs. 453.16. A. 1. SIGNIFICANT ACCOUNTING POLICIES Revenue recognition ICICI Bank Limited a) Interest income is recognised in the profit and loss account as it accrues except in the case of non... -

Page 108

...trade is recognised on trade date. e) In case of ICICI Equity Fund, ICICI Eco-net Internet and Technology Fund, ICICI Emerging Sectors Fund and ICICI Strategic Investments Fund (schemes of ICICI Venture Capital Fund) dividend from equity shares is recognised on ex-dividend dates in respect of quoted... -

Page 109

... those quoted on the stock exchanges, w herever linked to the Yield-to-M aturity ("YTM ") rates, is w ith a mark-up (reflecting associated credit risk) over the YTM rates for government securities published by FIM M DA. Unquoted equity shares are valued at the book value, if the latest balance sheet... -

Page 110

... forming part of the Consolidated Accounts (Contd.) In case of ICICI Equity Fund, ICICI Eco-net Internet and Technology Fund, ICICI Emerging Sectors Fund and ICICI Strategic Investments Fund (schemes of ICICI Venture Capital Fund) quoted investments are valued on the valuation date at the closing... -

Page 111

... basis. Listed equity shares as at the balance sheet date are stated at fair value being the last quoted closing price on the National Stock Exchange or The Stock Exchange, M umbai. M utual fund units as at the balance sheet date are valued at the previous day's net asset values. Equity shares aw... -

Page 112

schedules forming part of the Consolidated Accounts (Contd.) Other entities In case of ICICI Securities Limited, the policy of provisioning against non performing loans and advances has been decided by the management considering prudential norms prescribed by the RBI for Non Banking Financial ... -

Page 113

... Inc., ICICI Securities Inc., ICICI Bank UK Limited, ICICI Bank Canada, ICICI International Limited and TCW/ICICI Investment Partners LLC have been converted in accordance w ith Accounting Standard 11 on "The effects of changes in foreign exchange rates". In translating the financial statements of... -

Page 114

... Interest Rate derivatives w here even mark-to-market gains are recognised. 3. Debit/ credit balance on open position are disclosed as current assets / current liabilities, as the case may be. In case of ICICI Bank UK Limited, trading book derivatives are carried at fair value in the balance sheet... -

Page 115

... Cash and cash equivalents include cash in hand, balances w ith RBI, balances w ith other banks and money at call and short notice. 15. Ot hers a. Reinsurance premium of insurance business In case of general insurance business, insurance premium on ceding of the risk is recognised in the year... -

Page 116

... the general fund liabilities of linked business and riders there under, and one year renew able group term insurance. The unit liability in respect of linked business has been valued on the basis of the units, to the credit of policyholders, as on the valuation date. The adequacy of charges under... -

Page 117

... of the issued equity shares of the Bank at the time of grant of the options and aggregate of all such options granted to the eligible employees shall not exceed 5% of the aggregate number of the issued equity shares of the Bank on the date (s) of the grant of options. In terms of the Scheme, 18,215... -

Page 118

... in the balance sheet as on M arch 31, 2005: (Rupees in million) Items/Related Party Joint ventures and Associates Key M anagement @ Personnel 37.1 19.1 - 2.3 - - Total Deposits w ith ICICI Bank ...Advances ...Investments of ICICI Bank ...Investments of related parties in ICICI Bank ...Receivables... -

Page 119

... Statement" , in the current financial year. 7. Earnings per share ("EPS") The group reports basic and diluted earnings per equity share in accordance w ith AS 20, "Earnings per Share". Basic earnings per share is computed by dividing net profit after tax by the w eighted average number of equity... -

Page 120

...Weighted average no. of equity shares ...Net profit ...Diluted earnings per share (Rs.) ...Nominal value per share (Rs.) ...The dilutive impact is mainly due to options granted to employees by the Bank. 8. 8.1 Assets given under lease Assets given under operating lease The future lease rentals are... -

Page 121

... is not signif icant . Changes in account ing policies ICICI Bank Limited Effective April 1, 2004 the commissions paid to direct marketing agents (DMAs) of auto loans, net of subvention income received from them, is recorded upfront in the profit and loss account. For disbursements made till March... -

Page 122

... Company Limited, ICICI Trusteeship Services Limited and TCW/ICICI Investment Partners LLC. w hose individual business is presently not material in relation to the consolidated financials. Inter segment transactions are generally based on transfer pricing measures as determined by management. Income... -

Page 123

... & CEO KALPANA M ORPARIA Deputy M anaging Director NACHIKET M OR Executive Director G. VENKATAKRISHNAN General M anager Accounting & T axation Group Place : M umbai Date : April 30, 2005 JYOTIN M EHTA General M anager & Company Secretary N. S. KANNAN Chief Financial Officer & Treasurer F63 -

Page 124

... The financials of ICICI Bank UK Limited and ICICI International Limited have been translated into Indian Rupees at the closing rate on M arch 31,2005 of 1 USD= Rs 43.745. 4. The Paid-up Share capital of ICICI Home Finance Company Limited, ICICI Bank Canada and ICICI Bank UK Limited includes Paid-up... -

Page 125

... OF ICICI BANK LIM ITED AND ITS SUBSIDIARIES FOR THE FINANCIAL YEAR ENDED M ARCH 31, 2005 Contents Consolidated balance sheets ...F66 Consolidated statements of operations ...F67 Consolidated statements of stockholders' equity & other comprehensive income ...F68 Consolidated statements of cash flow... -

Page 126

...Trading assets ...Securities: Available for sale ...Non-readily marketable equity securities ...Venture capital investments ...Investments in affiliates ...Loans, net of allow ance for loan losses, security deposits and unearned income ...Customers' liability on acceptances ...Property and equipment... -

Page 127

......Net gain on trading activities ...Net gain/(loss) on venture capital investments ...Net gain on other securities ...Net gain on sale of loans and credit substitutes ...Foreign exchange income ...Softw are development and services ...Gain on sale of property and equipment ...Transaction processing... -

Page 128

...com pensation . Com prehensive incom e ...Net incom e/(loss) ...Net unrealized gain/(loss) on securities, net of realization (net of tax) ...Translation adjustm ents (net of nil tax) ...Com prehensive incom e/ (loss) Cash dividends declared (Rs.7.5 per com m on share) . Balance as of M arch 31, 2005... -

Page 129

... equity securities ...Origination of loans, net ...Proceeds from sale of loans ...Purchase of property and equipment ...Proceeds from sale of property and equipment ...Investments in affiliates ...Payment for business acquisition, net of cash acquired . Net cash (used in)/ provided by investing... -

Page 130

...) 8,859 1,299 2,269 3,568 Cash and cash equivalents at the end of the year ...Supplementary information: Cash paid for: Taxes ...Non-cash items: Foreclosed assets ...Conversion of loan to equity shares ...Change in unrealized gain/(loss) on securities available for sale, net ... 1,027 3,313 8,401... -

Page 131

...RETAIL BANKING Home Loans Car & Two-Wheeler Loans Commercial Vehicle Financing Personal Loans Loans Against Securities Savings & Term Deposits Salary Accounts Investment Products Private Banking Demat Services Credit, Debit & Smart Cards Bill Payment Services Roaming Current Accounts SME Financing... -

Page 132

design by dickenson www.notension.biz