Volvo 2010 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2010 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

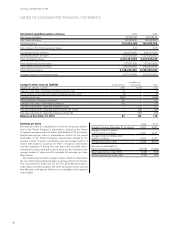

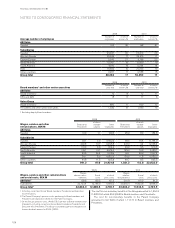

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

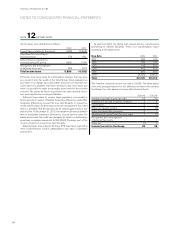

Pension costs 2009 2010

Current year service costs 969 896

Interest costs 1,684 1,510

Expected return on plan assets (1,362) (1,402)

Actuarial gains and losses1504 420

Past service costs

– Unvested 18 19

– Vested (314) 28

of which effect of agreement with UAW in Mack Trucks (317) –

Curtailments and settlements 36 (38)

Termination benefits 40 34

Pension costs for the period, defined-benefit plans 1,575 1,467

Pension costs for defined-contribution plans 3,116 3,273

Total pension costs for the period 4,691 4,740

1 For each plan, actuarial gains and losses are reported as income or expenses, when the accumulated amount exceeds the so called corridor. The income or

expenses are then recognized over the expected average remaining service period of the employees.

Costs for the period, post-employment benefits other than pensions 2009 2010

Current year service costs 270 49

Interest costs 334 170

Expected return on plan assets (1) –

Actuarial gains and losses14 (1)

Past service costs

– Unvested 7 –

– Vested 0 26

Curtailments and settlements 1,124 2

of which effect of agreement with UAW in Mack Trucks 1,194 –

Termination benefits 20 7

Total costs for the period, post-employment benefits other than pensions 1,758 253

1 For each plan, actuarial gains and losses are reported as income or expenses, when the accumulated amount exceed the so called corridor. The income or

expenses are then recognized over the expected average remaining service period of the employees.

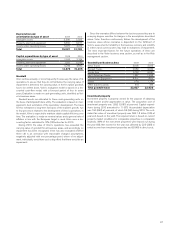

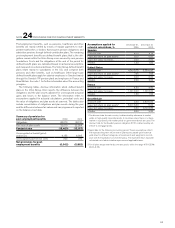

An increase of one percentage point per year in healthcare costs

would change the accumulated post-employment benefit obligation

as of December 31, 2010 by approximately 155, and the post-employ-

ment benefit expense for the period by approximately 10. A decrease

of one percentage point would decrease the accumulated value of

obligations by about 132 and reduce costs for the period by approxi-

mately 8. Calculations made as of December 31, 2010 show an annual

increase of 8% in the weighted average per capita costs of covered

health care benefits. It is assumed that the percentage will decline

gradually to 4.5% and then remain at that level.

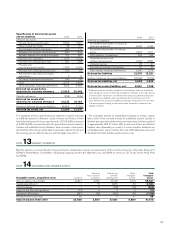

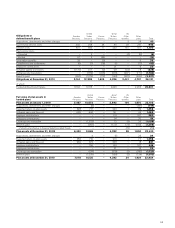

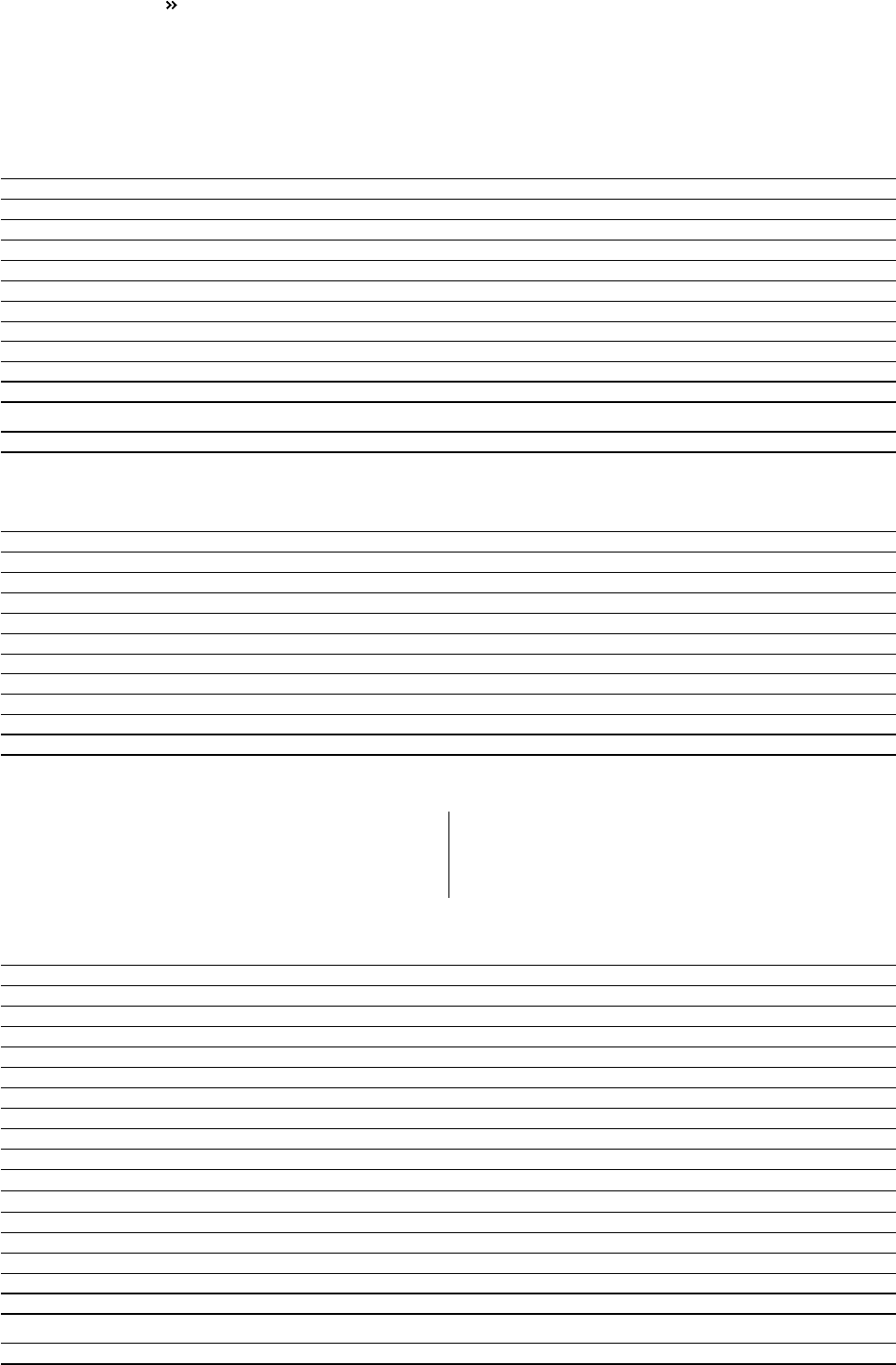

Obligations in

defined-benefit plans Sweden

Pensions

United

States

Pensions

France

Pensions

Great

Britain

Pensions

US

Other

benefits

Other

plans Total

Obligations at January 1, 2009 9,097 13,648 2,087 4,035 6,971 5,333 41,171

Acquisitions, divestments and other changes – – (53) – – (3) (56)

Current year service costs 323 264 65 52 252 283 1,239

Interest costs 414 774 104 242 328 168 2,030

Past service costs

– Unvested 1 (90) – – – – (89)

– Vested – (316) 3 – 5 – (308)

of which effect of agreement with UAW in Mack Trucks – (317) – – – – (317)

Termination benefits 32 – (1) – – 25 56

Curtailments and settlements (8) (18) – – (3,163) (140) (3,329)

of which effect of agreement with UAW in Mack Trucks – – – – 1,194 – 1,194

of which reclassification to financial liability in Mack Trucks – – – – (4,282) – (4,282)

Employee contributions – – – 24 – (1) 23

Actuarial (gains) and losses 321 1,096 18 187 231 (47) 1,806

Exchange rate translation – (1,008) (110) 73 (320) (148) (1,513)

Benefits paid (299) (992) (216) (175) (607) (671) (2,960)

Obligations at December 31, 2009 9,881 13,358 1,897 4,438 3,697 4,799 38,070

of which

Funded defined-benefit plans 9,465 12,923 – 4,438 – 2,277 29,103

FINANCIAL INFORMATION 2010

94