Volvo 2010 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2010 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

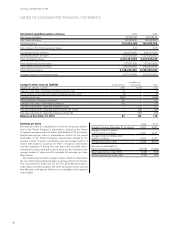

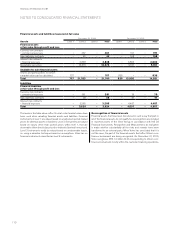

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

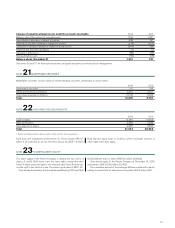

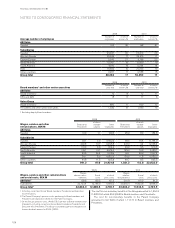

NOTE 31 LEASING

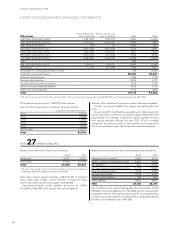

NOTE 30 CASH-FLOW

Volvo as a lessor

At December 31, 2010, future rental income from non-cancellable

financial and operating leases (minimum leasing fees) amounted to

45,530 (50,522). Future rental income is distributed as follows:

Finance

leases

Operating

leases

2011 12,338 4,083

2012–2015 21,009 6,385

2016 or later 482 1,233

Total 33,829 11,701

Allowance for uncollectible

future rental income (445)

Unearned rental income (2,904)

Present value of future rental income

related to non-cancellable leases 30,480

Other items not affecting

cash amounted to: 2009 2010

Risk provisions and losses related to doubtful

accounts receivable/customer-financing

receivables 2,779 1,401

Capital gains/losses on the sale of subsidiaries

and other business units (108) 34

Unrealized exchange rate gains/losses

onaccounts receivable and payable (26) (44)

Provision for global profit sharing program – 350

Expenses for healthcare benefitsas a result of

the Master Agreement between Mack Trucks

and UAW (see note 24) 877 –

Provision for restructuring reserves 334 –

Write-down of assets held for sale 368 65

Othernon-cash items 173 (245)

4,397 1,561

Investments in shares and participations: 2009 2010

New issue of shares (2) (13)

Capitalcontribution (6) (31)

Acquisitions (61) (154)

Divestments 16 91

Other 15 1

(38) (106)

Acquired and divested subsidiaries

and other business units: 2009 2010

Acquired subsidiaries and

other business units (56) (214)

Divested subsidiaries and

other business units 205 831

149 617

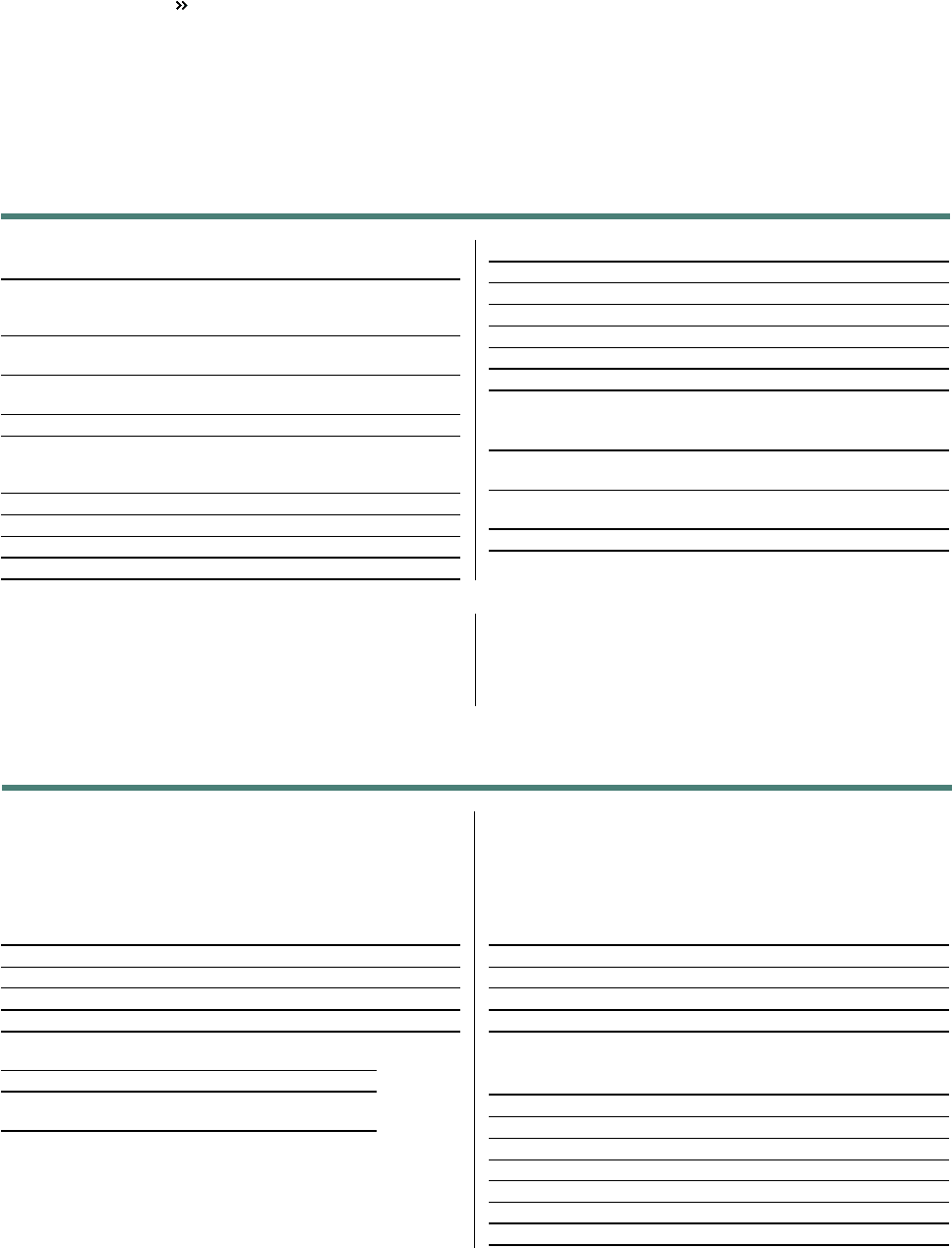

Volvo as a lessee

At December 31, 2010, future rental payments (minimum leasing

fees) related to non-cancellable leases amounted to 3,916 (4,135).

Future rental payments are distributed as follows:

Finance

leases

Operating

leases

2011 496 815

2012-2015 486 1,605

2016 or later 66 448

Total 1,048 2,868

Rental expenses amounted to:

2009 2010

Finance leases:

Contingent rents (6) (8)

Operating leases:

Contingent rents (24) (20)

Rental payments (950) (923)

Sublease payments 8 6

Total (972) (945)

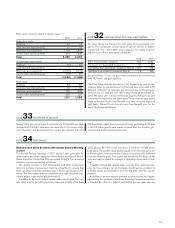

Important increase/decrease in bond loans and other loans

During 2010 the Volvo Group has reduced its borrowings as a conse-

quence of a strong cash flow and lower demands of funding from the

Customer Finance Operations.

During 2009, the Volvo Group completed a number of important

funding transactions. A five year EUR 700 M bond was issued, followed

by a three year SEK 4.2 billion bond. The Group also received a seven

year loan from the European Investment Bank equivalent to EUR 400 M.

Volvo Treasury AB, a subsidiary of AB Volvo, issued a USD 750 M

guaranteed bond offering at an interest rate of 5.95% due 2015.

FINANCIAL INFORMATION 2010

100