Volvo 2010 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2010 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

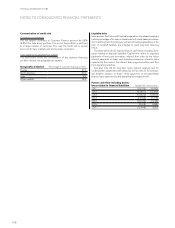

Derecognition of financial assets

Financial assets that have been transferred in such a way that part or

all of the financial assets do not qualify for derecognition, are included

in reported assets of the Volvo Group. In accordance with IAS 39

Financial Instruments, Recognition and Measurement, an evaluation

is made whether substantially all the risks and rewards have been

transferred to an external party. When Volvo has concluded that it is

not the case, the part of the financial assets that reflect Volvo’s con-

tinuous involvement are being recognized. On December 31, 2010,

Volvo recognizes SEK 1.2 billion (2.2) corresponding to Volvo’s con-

tinuous involvement, mostly within the customer financing operations.

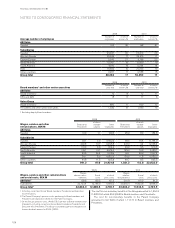

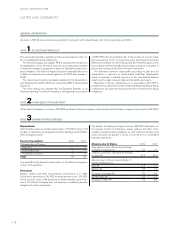

Financial assets and liabilities measured at fair value

December 31, 2009 December 31, 2010

Assets Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total

Financial assets

at fair value through profit and loss

Currency risk contracts

– commercial exposure – 467 – 467 – 197 – 197

Raw materials contracts – 42 – 42 – 168 – 168

Interest risk contracts

– financial exposure – 3,848 – 3,848 – 3,863 – 3,863

Marketable securities – 16,676 – 16,676 – 9,767 – 9,767

Available for sale financial assets

Shares and participations for which:

a market value can be calculated 707 – – 707 836 – – 836

Total 707 21,033 – 21,740 836 13,995 14,831

Liabilities

Financial liabilities

at fair value through profit and loss

Currency risk contracts

– commercial exposure – 281 – 281 – 79 – 79

Raw materials contracts – 58 – 58 – 41 – 41

Interest risk contracts

– financial exposure – 3,285 – 3,285 – 4,487 – 4,487

Total – 3,624 – 3,624 – 4,607 – 4,607

The levels in the table above reflect to what extent market values have

been used when valuating financial assets and liabilities. Financial

instruments in level 1 are valued based on unadjusted quoted market

prices for identical assets or liabilities. Level 2 instruments are valued

based on inputs, other than quoted prices within level 1, that are

observable either directly (as prices) or indirectly (derived from prices).

Level 3 instruments would be valued based on unobservable inputs,

i.e. using a valuation technique based on assumptions. Volvo has no

financial instruments classified as level 3 instruments.

FINANCIAL INFORMATION 2010

110