Volvo 2010 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2010 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

world

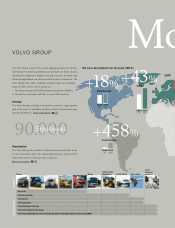

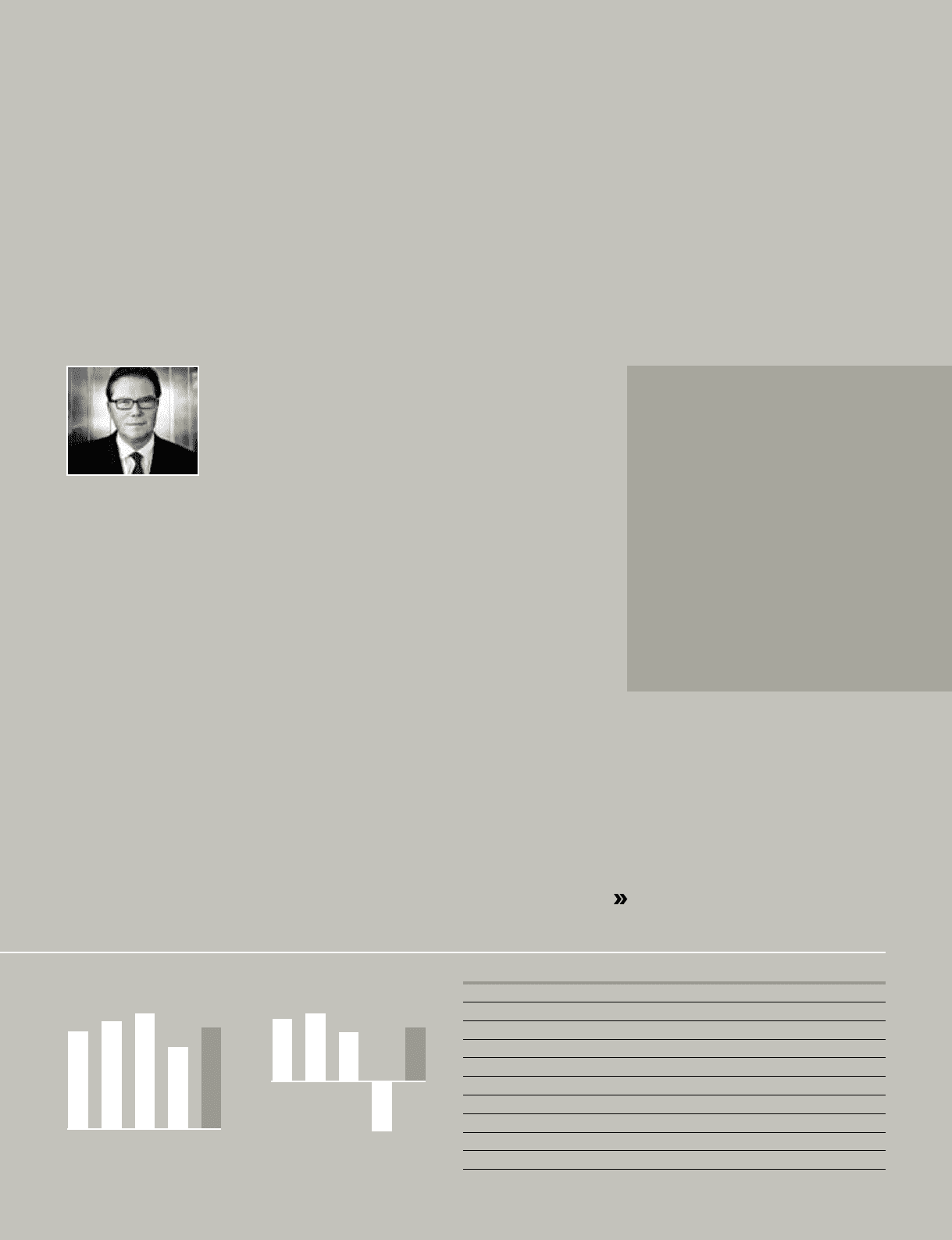

Net sales, SEK bn Operating income, SEK bn

1009080706

265218305285259

080706

09

(17.0)

15.922.220.4

10

18.0

Key ratios 2009 2010

Net sales Volvo Group, SEK M 218,361 264,749

Operating income (loss) Volvo Group, SEK M (17,013) 18,000

Operating income (loss)Industrial Operations, SEK M (16,333) 17,834

Operating income (loss)Customer Finance, SEK M (680) 167

Operating margin Volvo Group, % (7.8) 6.8

Income (Loss)after financial items, SEK M (20,573) 15,514

Income(Loss)for the period, SEK M (14,685) 11,212

Diluted earnings per share, SEK (7.26) 5.36

Dividend per share, SEK 0 2.501

Return on shareholders' equity, % (19.7) 16.0

1 According to the Board’s proposal.

The Volvo Group’s vision is to be valued as

the world’s leading provider of commercial

transport solutions.

Recovery, growth

and strengthened

profitability

During 2010, the

Volvo Group grew at

a good pace with

increased sales in all regions, improved profitabil-

ity and good cash flow. After having reported a

substantial loss in 2009 when the global finan-

cial crisis hit hard and we were forced into con-

siderable rationalizations, it is pleasing to note

that recovery in growth and profitability has been

swift.

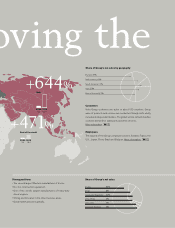

The Group’s sales of SEK 265 billion during

2010 represented an increase of 21% compared

with the preceding year. Demand for the Group’s

products recovered strongly in essentially all

markets. Demand continued to rise from already

high levels in emerging markets, while in our

mature markets, with the exception of Japan,

there was a significant gain in momentum during

the second half of the year.

Significantly improved earnings

Operating income improved to SEK 18 billion,

compared with the loss of SEK 17 billion the pre-

ceding year. The operating margin was 6.8%. The

improvement in earnings is of course an effect of

us selling more products and services, but it is

also the result of focused work on rationalizing

and streamlining all parts of the Group, as well as

our tight grip on costs. The combination of

increased profitability with our achievement of

growth without tying up any additional operating

capital resulted in our Industrial Operations gen-

erating an operational cash flow of SEK 19 billion.

In spite of our debt increasing when we were

going through the global financial crisis in 2009,

we made the assessment that we could take it

upon ourselves to reduce our debt by lowering

cost levels and turning around the negative cash

flow. Through hard work, we succeeded in what

we set out to accomplish. Thanks to the improved

profitability and strong cash flow, we once again

stand financially strong, with a net debt in Indus-

trial Operations that at the close of the year was

down to 37% of shareholders’ equity – in line with

our objective.

We have been fortunate to be able to welcome

the return of increasing numbers of our former

colleagues to the Volvo Group – colleagues who

sadly had to leave us in conjunction with the

financial crisis but who have now been offered

work again in increasing numbers. It is also pleas-

Net sales increased by 21% to SEK 264.7

billion

Operating income amounted to SEK 18.0

billion

Operating cash flow of SEK 19.0 billion in

Industrial Operations

Net debt in Industrial Operations reduced

to 37.4% of shareholders’ equity

Proposed dividend of SEK 2.50 per share

THE VOLVO

GROUP 2010

CEO comment

1