Volvo 2010 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2010 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

industrial system, as an effect of increased pro-

duction levels, and continued cost control.

During 2010, operating profit was negatively

impacted by higher costs for raw material and

components amounting to approximately SEK

300 M compared to the preceding year.

In 2010, research and development expenses

amounted to SEK 12,970 M (13,193). Even

though costs decreased compared with 2009,

they remained at a relatively high level primarily a

consequence of projects relating to new emis-

sion regulations in Europe, USA and Japan.

Selling expenses decreased by 5% and admin-

istration expenses by 3% compared to 2009,

depsite net sales increasing by 23%.

Since return on equity was 16%, SEK 350 M

was provisioned for profit-sharing to employees

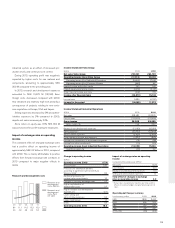

Impact of exchange rates on operating

income

The combined effect of changed exchange rates

had a positive effect on operating income of

approximately SEK 3.2 billion in 2010, compared

with 2009. This is mainly attributable to positive

effects from forward exchange rate contracts in

2010 compared to major negative effects in

2009.

Income Statement Volvo Group

SEK M 2009 2010

Net sales Volvo Group 218,361 264,749

Operating Income (loss) Volvo Group (17,013) 18,000

Operating income (loss) Industrial Operations (16,333) 17,834

Operating income (loss) Customer Finance (680) 167

Interest income and similar credits 390 442

Interest expense and similar credits (3,559) (3,142)

Other financial income and costs (392) 213

Income after financial items (20,573) 15,514

Income taxes 5,889 (4,302)

Income for the period (14,685) 11,212

Income Statement Industrial Operations

SEK M 2009 2010

Net sales 208,487 257,375

Cost of sales (179,578) (197,480)

Gross income 28,909 59,895

Gross margin, % 13.9 23.3

Research and development expenses (13,193) (12,970)

Selling expenses (23,752) (22,649)

Administrative expenses (5,838) (5,640)

Other operating income and expenses (2,432) (659)

Income from investments in associated companies (15) (86)

Income from other investments (13) (57)

Operating income (loss) Industrial Operations (16,333) 17,834

Operating margin, % (7.8) 6.9

Impact of exchange rates on operating

income

Compared with preceding year, SEK bn

Net sales1(10.5)

Cost of sales 12.3

Research and development expenses 0.3

Selling and administrative expenses 1.1

Total effect of changes in exchange

rates on operating income 3.2

1 Group sales are reported at monthly spot rates and the

effects of currency hedges are reported among Cost of

sales.

Change in operating income

SEK bn

Operating income 2009 (17.0)

Gross income 27.2

Provisions for healthcare benefits

according to agreement with United Auto

Workers, UAW 0.9

Additional provisions for

residual value commitments 1.0

Changes in currency exchange rates 3.2

Higher capitalization of

development costs 0.7

Higher research and development

expenditures (0.7)

Lower selling and

administrative expenses 0.4

Lower credit losses 1.7

Other 0.6

Operating income 2010 18.0

Operating net flow per currency

Local currency, million 2009 2010

USD 1,803 2,410

EUR 595 373

GBP 315 405

CAD 192 241

JPY(x100) (83) (103)

Research and development costs

1009080706

13.013.214.311.18.4

5.06.34.93.93.4

Research and

development

costs, SEK bn

Research and

development

costs, % of

net sales

59