Volvo 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

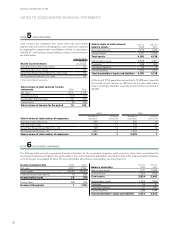

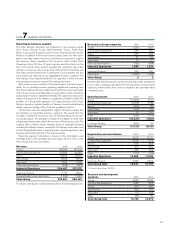

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Net sales and revenue recognition

The Group’s reported net sales pertain mainly to revenues from sales

of goods and services. Net sales are reduced by the value of dis-

counts granted and by returns.

Income from the sale of goods is recognized when significant risks

and rewards of ownership have been transferred to external parties,

normally when the goods are delivered to the customer. If, however,

the sale of goods is combined with a buy-back agreement or a re sidual

value guarantee, the sale is accounted for as an operating lease

transaction if significant risks of the goods are retained in Volvo.

Revenues are then recognized over the period of the residual value

commitment. If the residual value risk commitment is not significant,

independent from the sale transaction or in combination with a com-

mitment from the customer to buy a new Volvo product in connection

to a buy-back option, the revenue is recognized at the time of sale and

a provision is reported to reflect the estimated residual value risk (see

Provisions below)

Revenue from the sale of workshop services is recognized when

the service is provided. Interest income in conjunction with finance

leasing or installment contracts are recognized during the underlying

contract period. Revenue for maintenance contracts are recognized

according to how costs associated with the contracts are distributed

during the contract period.

Interest income is recognized on a continuous basis and dividend

income when the right to receive dividend is obtained.

Leasing

Volvo as the lessor

Leasing contracts are defined in two categories, operating and

finance leases, depending on the contract’s financial implications.

Operating leasing contracts are reported as non-current assets in

Assets under operating leases. Income from operating leasing is

reported equally distributed over the leasing period. Straight-line

depreciation is applied to these assets in accordance with the terms

of the undertaking and the deprecation amount is adjusted to corres-

pond to the estimated realizable value when the undertaking expires.

Assessed impairments are charged to the income statement. The

product’s assessed realizable value at expiration of the undertaking is

reviewed continuously on an individual basis.

Finance leasing agreements are reported as either Non-current or

current receivables in the customer finance operations. Payments from

finance leasing contracts are distributed between interest income and

amortization of the receivable in the customer finance operations.

Volvo as the lessee

Volvo evaluates leasing contracts in accordance with IAS 17, Leases.

In those cases in which risks and rewards that are related to owner-

ship are substantially held by Volvo, so called finance leases, Volvo

reports the asset and related obligation in the balance sheet at the

lower of the leased asset’s fair value or the present value of minimum

lease payments. Future leasing fee commitments are reported as

loans. The lease asset is depreciated in accordance with Volvo’s policy

for the respective non-current asset. The lease payments when made

are allocated between amortization and interest expenses. If the leas-

ing contract is considered to be a so called operating lease, lease

payments are charged to the income statement over the lease con-

tract period.

Reporting of financial assets and liabilities

Financial assets treated within the framework of IAS 39 are classified

either as

– Financial assets at fair value through profit and loss,

– Investments held to maturity,

– Loans and receivables, or as

– Available-for-sale financial assets

Financial liabilities are reported either at amortized cost or at fair value

through profit and loss.

Purchases and sales of financial assets and liabilities are recog-

nized on the transaction date. A financial asset is derecognized (extin-

guished) in the balance sheet when all significant risks and benefits

linked to the asset have been transferred to a third party. The same

principles are applied for financial assets in the segment reporting of

Volvo Group.

The fair value of assets is determined based on the market prices in

such cases they exist. If market prices are unavailable, the fair value is

determined for each asset using various valuation techniques. Trans-

action expenses are included in the asset’s fair value except in cases

in which the change in value is recognized in the income statement.

The transaction costs arising in conjunction with assuming financial

liabilities are amortized over the term of the loan as a financial cost.

Embedded derivatives are detached from the related main contract, if

applicable. Contracts containing embedded derivatives are valued at fair

value in the income statement if the contracts’ inherent risk and other

characteristics indicate a close relation to the embedded derivative.

Financial assets at fair value through profit and loss

All of Volvo’s financial assets that are recognized at fair value in the

income statement are classified as held for trading. Included are

derivatives that Volvo has decided not to apply hedge accounting on,

and derivates that are not part of an evidently effective hedge

accounting. Gains and losses on these assets are recognized in the

income statement. Short-term investments that are reported at fair

value through profit and loss mainly consist of interest-bearing finan-

cial instruments and are reported in note 21. Derivatives used for

hedging interest-rate exposure in the customer financing portfolio are

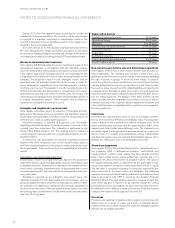

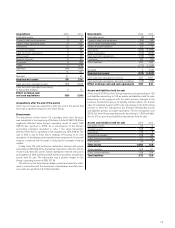

Exchange rates Average rate Closing rate

Country Currency 2009 2010 2009 2010

Brazil BRL 3.8444 4.0925 4.1375 4.0560

Canada CAD 6.7006 6.9973 6.8885 6.8085

China CNY 1.1192 1.0643 1.0600 1.0300

Denmark DKK 1.4275 1.2823 1.3926 1.2086

Euro EUR 10.6305 9.5502 10.3623 9.0113

Great Britain GBP 11.9322 11.1319 11.4913 10.5538

Japan JPY 0.0819 0.0823 0.0785 0.0835

Norway NOK 1.2172 1.1926 1.2440 1.1530

South Korea KRW 0.0060 0.0062 0.0062 0.0060

United States USD 7.6470 7.2060 7.2138 6.8038

FINANCIAL INFORMATION 2010

72