Volvo 2010 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2010 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

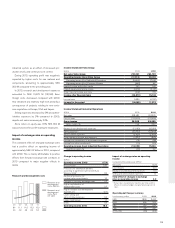

BOARD OF DIRECTORS’ REPORT 2010

Currencies Interest rates in Sweden, Europe and the U.S.

09

7.2

10.4

04

7.3

9.1

05

7.5

9.2

06

7.4

9.3

07

6.8

9.3

08

7.8

10.9

03

8.0

9.1

02

9.7

9.1

01

10.3

9.2 7.76.5 6.7 5.8 5.8 8.66.77.37.9

Source: Reuters

10

6.7

9.0

8.3

00

9.2

8.4

8.2

SEK/USD

SEK/EUR

SEK/100 JPY

Sweden

Europe

The U.S.

07

4.3

4.3

4.0

08

2.4

2.9

2.2

09

3.4

3.4

3.8

02

5.3

4.8

4.5

03

4.6

4.1

4.0

04

4.4

4.0

4.2

05

3.4

3.4

4.3

06

3.7

3.8

4.8

01

5.1

4.8

5.0

Source: Reuters

Government bonds, 10 year benchmarks

10

3.3

3.0

3.3

%

%

%

00

5.4

5.3

6.0

Currency-related risk

More than 90% of the net sales of the Volvo

Group are generated in countries other than

Sweden. Changes in exchange rates have a

direct impact on the Volvo Group’s operating

income, balance sheet and cash flow, as well as

an indirect impact on Volvo’s competitiveness,

which over time affects the Group’s earnings.

Interest-related risk

Interest-related risk includes risks that changes

in interest rates will impact the Group’s income

and cash flow (cash-flow risks) or the fair value of

financial assets and liabilities (price risks).

Market risk from investments in shares or

similar instruments

The Volvo Group is indirectly exposed to market

risks from shares and other similar instruments,

as a result of managed capital transferred to

independent pension plans being partly invested

in instruments of these types.

Credit-related risk

An important part of the Group’s credit risk is

related to how the financial assets of the Group

have been placed. The majority are placed in

Swedish Government bonds and interest-bearing

bonds issued by Swedish real estate financing

institutions.

Liquidity risk

Volvo ensures its financial preparedness by

always maintaining a certain portion of revenues

in liquid assets.

Operational risk

The profitability depends on successful

new products

The Volvo Group’s long-term profitability depends

on the Company’s ability to successfully launch

and market its new products. Product life cycles

continue to shorten, putting increased focus on

the success of the Group’s product development.

Reliance on suppliers

Volvo purchases raw materials, parts and compo-

nents from numerous external suppliers. A sig-

nificant part of the Group’s requirements for raw

materials and supplies is filled by single-source

suppliers. The effects of delivery interruptions

vary depending on the item or component. Cer-

tain items and components are standard through-

out the industry, whereas others are internally

developed and require unique tools that are time-

consuming to replace.

The Volvo Group’s costs for raw materials and

components can vary significantly over a busi-

ness cycle. Cost variations may be caused by

changes in world market prices for raw materials

or by an inability of our suppliers to deliver.

Intangible assets

AB Volvo owns or otherwise has rights to patents

and brands that refer to the products the Com-

pany manufactures and markets. These have

been acquired over a number of years and are

valuable to the operations of the Volvo Group.

Volvo does not consider that any of the Group’s

operations are heavily dependent on any single

patent or group of patents.

Through Volvo Trademark Holding AB, AB

Volvo and Volvo Car Corporation jointly own the

Volvo brand. AB Volvo has the exclusive right to

use the Volvo name and trademark for its prod-

ucts and services. Similarly, Volvo Car Corpora-

tion has the exclusive right to use the Volvo name

and trademark for its products and services.

54