Volvo 2010 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2010 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

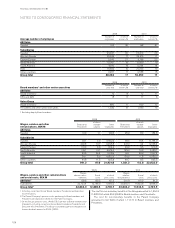

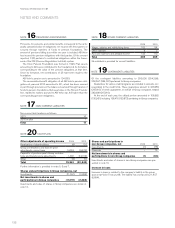

Below is a presentation of derivative instruments and options.

Outstanding derivative instruments for dealing with currency

and interest-rate risks related to financial assets and liabilities

Dec 31, 2009 Dec 31, 2010

Notional

amount

Carrying

value

Notional

amount

Carrying

value

Interest-rate swaps

– receivable

position 64,162 3,560 70,067 3,539

– payable

position 100,460 (2,948) 65,576 (3,924)

Forwards and futures

– receivable

position 0 0 900 0

– payable

position 30,274 (3) 400 0

Foreign exchange derivative contracts

– receivable

position 16,165 172 13,336 143

– payable

position 15,424 (214) 25,192 (381)

Options purchased

– receivable

position 1,985 116 1,126 181

– payable

position 353 (3) 0 0

Options written

– receivable

position 13 0 0 0

– payable

position 2,572 (117) 976 (182)

Total 563 (624)

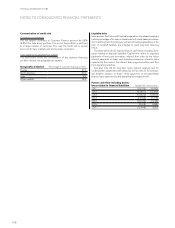

Outstanding forward contracts and options contracts for

hedging of currency risk and interest risk of commercial

receivables and liabilities

Dec 31, 2009 Dec 31, 2010

Notional

amount

Carrying

value

Notional

amount

Carrying

value

Foreign exchange derivative contracts

– receivable

position 9,307 416 6,418 188

– payable

position 5,448 (281) 3,381 (75)

Options purchased

– receivable

position 1,222 51 558 9

– payable

position – – – –

Options written

– receivable

position – – – –

– payable

position 1,193 – 558 (4)

Subtotal 186 118

Raw materials derivative contracts

– receivable

position 367 42 579 168

– payable

position 106 (58) 39 (41)

Total 170 245

FINANCIAL INFORMATION 2010

112