Volvo 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

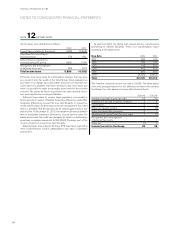

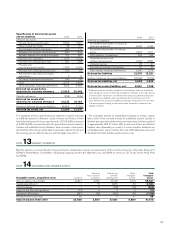

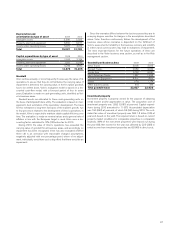

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

IAS 27 amendment Consolidated and separate financial statements

The standard became effective on July 1, 2009, as a consequence of

the revised IFRS 3, and applies to fiscal years beginning on or after

that date. The amendment brings about changes in IAS 27 regarding,

for example, how to report changes in ownership in cases where the

Parent Company retains or loses the control of the owned entity. The

Group applies the amendment as of January 1, 2010. The application

prospectively affects the accounting for changes in share ownership

made from the application date.

In addition to the above-mentioned, the below amendments to

standards and new interpretations from IFRIC have been applicable

for the Volvo Group from January 1, 2010, but have not had a signifi-

cant impact on the Group’s financial statements during the year.

– IAS 39 amendment Financial instruments: Recognition and Meas-

urement: Eligible hedge items

– IFRS 1 amendments Additional exemptions for first-time adopters

– IFRIC 16 Hedges of a net investment in a foreign operation

– IFRIC 17 Distribution of non-cash assets to owners

– IFRIC 18 Transfers of assets from customers

– Revised IFRS 1 First time adoption of IFRS

– IFRIC 9 and IAS 39 amendment Embedded derivatives

– IFRS 2 amendment Group Cash-settled Share-based Payment

Transactions

– IFRS 1 amendments Limited exemption from comparative IFRS 7

Disclosures for First-time Adopters

– Annual improvements

*These standards/interpretations have not been adopted by the EU at the publi-

cation of the annual report. Accordingly, stated dates for adoption may change

as a consequence of decisions within the EU endorsement process.

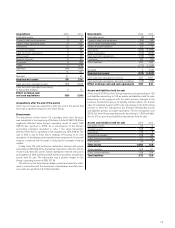

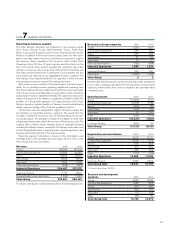

NOTE 4 ACQUISITIONS AND DIVESTMENTS OF SHARES IN SUBSIDIARIES

AB Volvo’s holding of shares in subsidiaries as of December 31, 2010

is shown in the disclosures of AB Volvo’s holding of shares. Significant

acquisitions, formations and divestments within the Group are listed

below.

Acquisitions

The Volvo Group has not made any acquisitions during 2009 and

2010 which solely or jointly have had a significant impact on the Volvo

Group’s financial statements.

New accounting principles 2011 and later

When preparing the consolidated accounts as of December 31, 2010,

a number of standards and interpretations have been published, but

have not yet become effective. The following is a preliminary assess-

ment of the effect that the implementation of these standards and

statements could have on the Volvo Group’s financial statements.

IFRS 9 Financial instruments*

IFRS 9 Financial instruments has been published in three parts:

Classification and Measurement, Impairment and Hedge accounting,

which will replace IAS 39 with effective date January 1, 2013 or later.

Earlier adoption is permitted given endorsement. Volvo is currently

reviewing the effects implementation of IFRS 9 will have on the Group.

When all three parts of the project are completed a common stand-

point will be given.

In addition to the above-mentioned, the below amendments to

standards and interpretations from IFRIC are applicable for the Volvo

Group from January 1, 2011 or later, but are not expected to have a

significant impact on the Group’s financial statements.

– IFRS 7 Amendments Financial Instruments: Disclosures

– IFRIC 14 The limit on a defined benefit asset, minimum funding

requirements and their interaction

– IFRIC 19 Extinguishing Financial Liabilities with Equity Instru-

ments

– IFRIC 12 Service Concession Arrangements

– Revised IAS 24 Related Party Disclosures

– IAS 32 amendment Classification of rights issues

– Annual improvements

Valuation of acquisitions

For acquisitions in 2009 and 2010, the fair-value adjustments to the

purchase price allocations have not been significant for the Volvo

Group. The effects on the Volvo Group’s balance sheet and cash-flow

statement in connection with the acquisition of subsidiaries and other

business units are specified in the following table based on valuations

on the respective acquisition dates:

FINANCIAL INFORMATION 2010

78