Volvo 2010 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2010 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

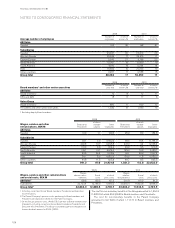

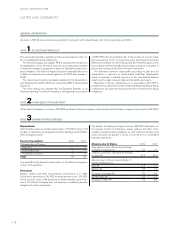

NOTE 37FINANCIAL INSTRUMENTS

The financial assets treated within the framework of IAS 39 are clas-

sified either as financial assets at fair value through profit and loss, as

loans and receivables, as investments held to maturity or as available-

for-sale financial assets. Financial liabilities are classified as financial

liabilities at fair value through profit and loss or as financial liabilities

valued at amortized cost. For more information about the categories

within Financial assets and liabilities see note 1.

Information regarding reported and fair values

In the table below, carrying values are compared with fair values of financial instruments.

December 31, 2009 December 31, 2010

Carrying value Fair value Carrying value Fair value

Assets

Financial assets at fair value through profit and loss

The Volvo Group’s outstanding currency risk contracts – commercial exposure 467 467 197 197

The Volvo Group’s outstanding raw materials contracts 42 42 168 168

The Volvo Group’s outstanding interest risk contracts – financial exposure 3,848 3,848 3,863 3,863

Marketable securities 16,676 16,676 9,767 9,767

21,033 21,033 13,995 13,995

Loans receivable and other receivables

Accounts receivable 21,337 – 24,433 –

Customer financing receivables381,977 – 72,688 –

Loans to external parties and other interest-bearing receivables 349 – 253 –

Conduit loans and other interest-bearing loans 131 – 104 –

103,794 – 97,478 –

Financial assets available for sale

Shares and participations for which:

a market value can be calculated1707 707 836 836

a market value can not be calculated21,337 – 1,262 –

2,044 707 2,098 836

Cash and cash equivalents 21,234 21,234 22,966 22,966

Liabilities

Financial liabilities at fair value through profit and loss

The Volvo Group's outstanding currency risk contracts – commercial exposure 281 281 79 79

The Volvo Group’s outstanding raw materials contract 58 58 41 41

The Volvo Group's outstanding interest risk contracts – financial exposure 3,285 3,285 4,487 4,487

3,624 3,624 4,607 4,607

Financial liabilities valued at amortized cost

Long term bond loans and other loans 105,427 112,733 82,679 88,304

Short term bank loans and other loans 51,448 51,943 39,142 39,379

156,875 164,676 121,821 127,683

Trade Payables 35,955 – 47,250 –

1 Refers to Volvo’s ownership in Deutz AG valued at market value and Trucks

Asia’s holdings in listed shares. The carrying value is equal to the market

value for holdings in listed companies

2 Possession in unlisted shares, for which a reliable fair value cannot be deter-

mined, are reported at the acquisition value reduced in appropriate cases by

write-downs. No single block of shares represent a significant amount.

3 Volvo does not estimate the risk premium for the customer financing receiv-

ables and chooses therefore not to disclose fair value for this category.re

not to disclose fair value for this category.

109