Volvo 2010 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2010 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

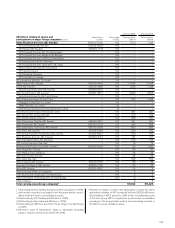

NOTE 13 INVESTMENTS IN SHARES AND PARTICIPATIONS

Holdings of shares and participations are specified in AB Volvo’s holding of shares. Changes in holdings of shares and participations are shown

below.

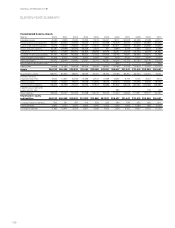

Group companies Non-Group companies

2009 2010 2009 2010

Balance December 31, previous year 46,122 57,062 2,280 2,363

Acquisitions/New issue of shares 85 – 2 87

Divestments – (3,493) – 0

Shareholder contributions 10,855 5,879 1 –

Write-downs/participations in partnerships – (19) 6 (124)

Revaluation of shares in listed companies – – 74 172

Balance, December 31 57,062 59,429 2,363 2,498

Shares and participations in Group companies

In December, 2010, AB Volvo transferred the company’s holding of

preference shares in UD Trucks Corporation, with the book value of

3,493, as shareholders’ contribution to Volvo Group Japan Corporation.

Shareholders’ contribution was also made to Kommersiella Fordon

Europa AB, 1,801, Volvo Financial Services AB, 225, Volvo China

Investment Co Ltd, 217, and Volvo Holding Mexico, 143.

Write-down was made at year-end of the holding of shares in Alviva

AB with 19.

During 2009, AB Volvo acquired total number of shares in Volvo

Logistics AB from Fortos Ventures AB in an amount of 85.

During 2009, shareholders’ contributions were made to Volvo

Treasury AB, 10,000, Volvo Information Technology AB, 500, and

Volvo China Investment Co Ltd, 355.

Shares and participations in non-Group companies

AB Volvo acquired Volvo Personvagnar AB’s participation (5%) in

Blue Chip Jet I HB in 2010 and in 2009 half of Skandia’s participation

in Blue Chip Jet I HB (5%) was acquired. AB Volvo’s participation in

Blue Chip Jet I HB is 50% after the acquisitions. During 2010 a capi-

tal contribution of 76 was made to Blue Chip Jet II HB. The book value

of the participations in the partnerships Blue Chip Jet I HB and Blue

Chip Jet II HB decreased during the year by a net of 113 (8).

The revaluation of AB Volvo’s ownership in the listed company Deutz

AG has increased the value by 172 (74), recognized in other compre-

hensive income.

Other shares and participations include the direct and indirect hold-

ings of VE Commercial Vehicles (VECV) for total amount of 1,845. In

the consolidated accounts of the Volvo group, VECV is reported as a

joint venture and consolidated according to the proportionate method.

The indirect ownership is an effect of the acquisition of 8.1% of Eicher

Motors Limited, which is the other venturer of VECV. These shares are

not separately valued as they form a part of the indirect ownership

VECV.

NOTE 14 OTHER SHORT-TERM RECEIVABLES

2009 2010

Accounts receivable 35 3

Prepaid expenses and accrued income 199 226

Other receivables 13 32

Total 247 261

The valuation allowance for doubtful receivables amounted to 4 (15)

at the end of the year.

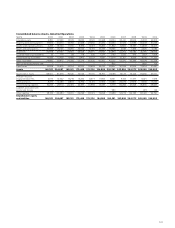

NOTE 15 UNTAXED RESERVES

The composition of, and changes in, untaxed reserves Value in balance

sheet 2009 Allocations 2010

Value in balance

sheet 2010

Accumulatedadditional depreciation

Land 3 – 3

Machinery and equipment 1 0 1

Total 4 0 4

121