Volvo 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

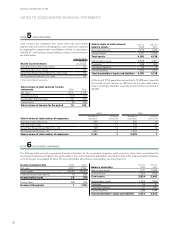

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

During 2010 Volvo has applied hedge accounting for certain net

investments in foreign operations. The current result for such hedges

is reported in a separate component in shareholders’ equity. In the

event of a divestment, the accumulated result from the hedge is rec-

ognized in the income statement.

See notes 36 and 37 for the valuation of all financial instruments in

the Volvo Group and for details and further description on principles

for economic hedging, hedge accounting and changes to the policies

for hedging and hedge accounting during 2010 and going forward.

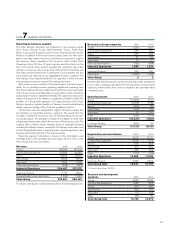

Research and development expenses

Volvo applies IAS 38, Intangible Assets, for reporting of research and

development expenses. In accordance with this standard, expend-

itures for development of new products, production systems and soft-

ware shall be reported as intangible assets if such expenditures with

a high degree of certainty will result in future financial benefits for the

company. The acquisition value for such intangible assets shall be

amortized over the estimated useful life of the assets. In order for

these development expenditures to be reported as assets, a number

of criteria must be met. For example, it must be possible to prove the

technical functionality of a new product or software prior to its devel-

opment being reported as an asset. In normal cases, this means that

expenditures are capitalized only during the industrialization phase of

a product development project. Other research and development

expenses are charged to income as incurred.

Intangible and tangible non-current assets

Volvo applies acquisition values for valuation of intangible and tan-

gible assets. Borrowing costs are included in the acquisition value of

assets that necessarily takes more than 12 months to get ready for its

intended use or sale, so called qualifying assets.

Investment property is reported at acquisition cost. Information

regarding estimated fair value of investment property is based on dis-

counted cash flow projections. The estimation is performed by the

Group’s Real Estate business unit. The required return is based on

current property market conditions for comparable properties in com-

parable locations.

In connection with participation in industrial cooperation projects

together with other companies, such as the aircraft engine projects

that Volvo Aero participates in, Volvo pays in certain cases an entrance

fee to participate. These entrance fees are capitalized as intangible

assets.

Depreciation, amortization and impairment

Depreciation is made on a straight-line basis based on the acquisition

value of the assets, adjusted in appropriate cases by write-downs, and

estimated useful lives. Depreciation is reported in the respective func-

tion to which it belongs. Impairment tests for depreciable non-current

assets are performed if there are indications of impairment at the bal-

ance sheet date.

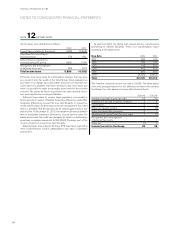

Goodwill is reported as an intangible non-current asset with

indefin ite useful life. For non-depreciable non-current assets such as

goodwill, impairment tests are performed annually, as well as if there

are indications of impairments during the year, through calculation of

the asset’s recovery value. If the calculated recovery value is less than

the carrying value, a write-down is made to the asset’s recovery value.

See note 14 for goodwill.

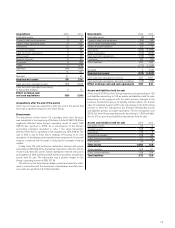

Depreciation periods

Capitalized type-specific tools 2 to 8 years

Operational leases 3 to 5 years

Machinery 5 to 20 years

Buildings and Investment property 25 to 50 years

Land improvements 20 years

Trademarks 20 years

Distribution networks 10 years

Product and software development 3 to 8 years

Aircraft engine projects 20years

Non-current assets held for sale and discontinued operations

Volvo applies IFRS 5, Non-current Assets Held for Sale and Discon-

tinued Operations. The standard also includes current assets. In a

global group like Volvo, processes are continuously ongoing regarding

the sale of assets or groups of assets at minor values. In cases in

which the criteria for being classified as a non-current asset held for

sale are fulfilled and the asset or group of assets is not of minor value,

the asset or group of assets and the related liabilities are reported on

a separate line in the balance sheet. The asset or group of assets are

tested for impairment and, if impaired valued at fair value after deduc-

tion for selling expenses. The balance sheet items and the income

effect resulting from the revaluation to fair value less costs to sell are

normally reported in the segment Group headquarter functions and

other, until the sale is completed and the result from it is assigned to

the other segments.

Inventories

Inventories are reported at the lower of cost, in accordance with the

first-in, first-out method (FIFO), or net realizable value. The acquisition

value is based on the standard cost method, including costs for all

direct manufacturing expenses and the apportionable share of the

capacity and other related manufacturing costs. The standard costs

are tested regularly and adjustments are made based on current con-

ditions. Costs for research and development, selling, administration

and financial expenses are not included. Net realizable value is calcu-

lated as the selling price less costs attributable to the sale.

Share-based payments

Volvo applies IFRS 2, Share-based Payments for share-based incen-

tive programs. IFRS 2 distinguishes between “cash-settled” and

“equity-settled”, in Volvo’s case, shares. The Volvo program includes

both a cash-settled and an equity-settled part, however this is not

applicable for 2010 as there were no program in 2010. The value of

the equity-settled payments is determined at the grant-date, recog-

nized as an expense during the vesting period and off-set in equity.

The fair value is calculated according to share price reduced by divi-

dend connected to the share before the allotment. The additional

social costs are reported as a liability, revalued at each balance sheet

date in accordance with UFR 7, issued by the Swedish Financial

Reporting Board. The cash-settled payment is revalued at each bal-

ance sheet day and is reported as an expense during the vesting

period and as a short term liability. An assessment whether the terms

for allotment will be fulfilled is made continuously. If the assessment

changes, the expense will be adjusted. See note 34.

Provisions

Provisions are reported on balance when a legal or constructive obli-

gation exists as a result of a past event and it is probable that an

outflow of resources will be required to settle the obligation and the

amount can be reliably estimated.

FINANCIAL INFORMATION 2010

74