Volvo 2010 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2010 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

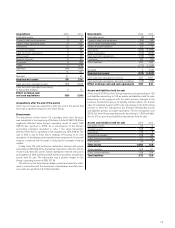

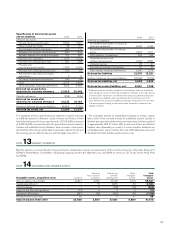

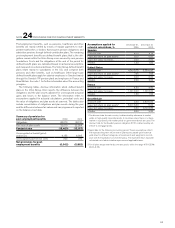

Changes in the Volvo Group’s holdings of shares and participations: 2009 2010

Balance sheet, December 31, preceding year 1,953 2,044

Change in Group structure (15) –

Acquisitions and divestments, net 45 104

Write-downs (48) (119)

Capital contribution 2 31

Share of income in associated companies 12 (75)

Revaluation of shares to fair value 92 148

Translation differences (74) 22

Dividends (21) (1)

Revaluation of holdings of Volvo Technology Transfer 80 –

Reclassifications – (42)

Other 18 (14)

Balance sheet, December 31 2,044 2,098

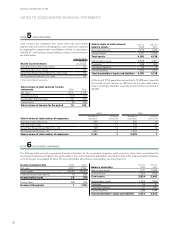

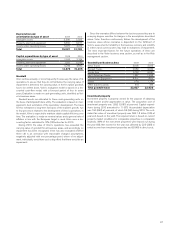

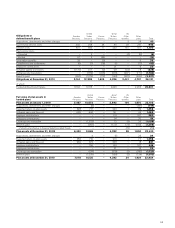

NOTE 16 NON-CURRENT CUSTOMER-FINANCING RECEIVABLES

2009 2010

Installment credits 18,517 15,673

Financial leasing 20,478 19,620

Other receivables 718 732

Total 39,713 36,025

Non-current customer-financing receivables maturities

2012 16,814

2013 11,668

2014 4,929

2015 2,120

2016 or later 494

Total 36,025

See notes 36 and 37 for financial instruments and goals and policies

in financial risk management.

NOTE 17 NON-CURRENT RECEIVABLES

2009 2010

Other interest-bearingloans to external parties 287 204

Other interest-bearing financial receivables 298 562

Other financial receivables 1,425 1,741

Other receivables 1,613 1,676

Total 3,623 4,184

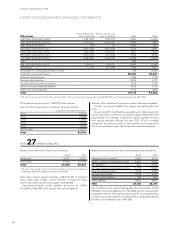

Effective interest rate for non-current customer-financing receivables

was 6.54% as per December 31, 2010.

During 2010 SEK 4.1 billion, of which SEK 2.6 billion of the non-

current customer-financing receivables, in Brazil were sold as a risk

mitigation measure and to release capital for reinvestment in the

country.

See notes 36 and 37 for financial instruments and goals and policies in financial risk management.

89