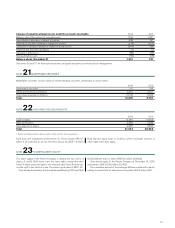

Volvo 2010 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2010 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

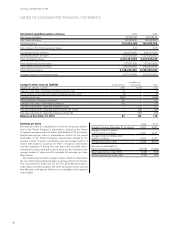

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 12 INCOME TAXES

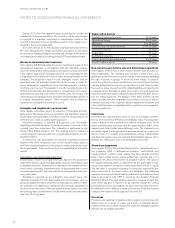

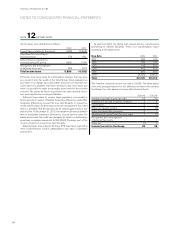

Income taxes were distributed as follows:

2009 2010

Current taxes relating to the period (989) (3,668)

Adjustment of current taxes

for prior periods (73) 180

Deferred taxes originated or

reversed during the period 6,981 (747)

Recognitionand derecognition

of deferred tax assets (30) (67)

Total income taxes 5,889 (4,302)

Provisions have been made for estimated tax charges that may arise

as a result of prior tax audits in the Volvo Group. Volvo evaluates tax

processes on a regular basis and makes provisions for possible out-

come when it is probable that Volvo will have to pay more taxes and

when it is possible to make a reasonably assessment of the possible

outcome. Tax claims for which no provision has been deemed neces-

sary were reported as contingent liabilities.

Deferred taxes relate to income taxes payable or recoverable in

future periods in respect of taxable temporary differences, deductible

temporary differences, unused tax-loss carryforwards or unused tax

credit carryforwards. Deferred tax assets are recognized to the extent

that it is probable that the amount can be utilized against future tax-

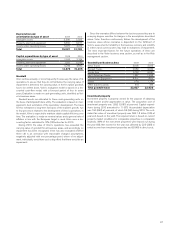

able income. At December 31, 2010, the valuation allowance attribut-

able to deductible temporary differences, unused tax-loss carry for-

wards and unused tax credit carryforwards for which no deferred tax

asset was recognized amounted to 339 (296). The major part of the

reserve consists of unused loss carryforwards.

Deferred taxes amounting to 93 (neg: 816) have been reported in

other comprehensive income, attributable to fair value of derivative

instruments.

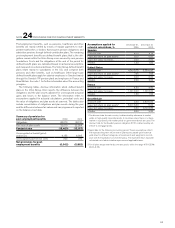

At year-end 2010, the Group had unused tax-loss carryforwards

amounting to 25,000 (30,200). These loss carryforwards expire

according to the table below:

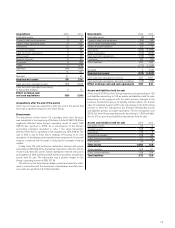

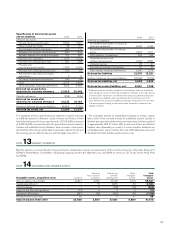

Due date 2009 2010

2011 300 100

2012 100 100

2013 100 200

2014 400 400

2015 800 800

2016– 28,500 23,400

Total 30,200 25,000

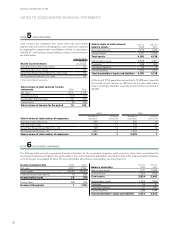

The Swedish corporate income tax rate is 26.3%. The table below

shows the principal reasons for the difference between this rate and

the Group's tax rate, based on income after financial items.

2009, % 2010, %

Swedish corporate income tax rates 26 26

Difference in tax rate in various countries 2 4

Capital gains 0 0

Other non-taxable income 0 (3)

Other non-deductible expenses 0 1

Adjustment of current taxes for prior years 1 (1)

Recognitionand derecognition

of deferred tax assets 1 1

Other, net (1) 0

Income tax rate for the Group 29 28

FINANCIAL INFORMATION 2010

84