Volvo 2010 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2010 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

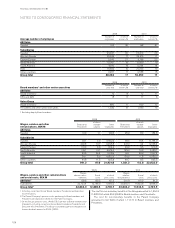

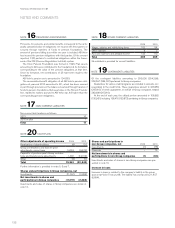

The Volvo Group’s outstanding forward contracts and options contracts for hedging of commercial currency risks

Currencies

Other

currencies

Fair

value

Million USD GBP EUR JPY Net SEK

Due date 2011 amount 687 68 93 (2,488) 570

Due date 2012 amount (4) – – – 313

Due date 2013 amount (3) – – – 20

Total 680 68 93 (2,488) 903

Average contract rate 7.04 11.03 9.37 0.08

Fair value of outstanding forward contracts 85 14 28 3 (12) 118

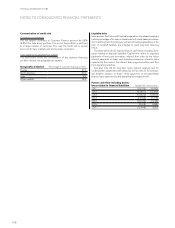

Hedge accounting

Cash-flow hedging

Volvo only hedges firm flows whereof the major part is realized within

six months. The hedged amount of firm flows for all periods are within

the framework of Volvo’s currency policy.

Derivative financial instruments used for hedging of future com-

mercial currency exposure that is firm and forecasted electricity con-

sumption have, in accordance with IAS 39, been reported at fair value

in the balance sheet. Since the fourth quarter 2009 hedge account-

ing is not applied on new financial instruments used for hedging of

commercial flows. However, for the major part of previously entered

financial instruments hedge accounting is continuously applied. The

majority of those financial instruments have expired during the year.

When hedge accounting is not applied, unrealized gains and losses

from fluctuations in the fair values of the financial instruments are

reported in the income statement in the segment Group headquarter

functions and other. This has positivley affected the Group’s operating

income by 124 (neg: 27) in 2010. When the derivative financial instru-

ment has been realized the income effect is reported within the

respective segments.

When cash-flow hedge accounting is applied for previously entered

financial instruments Volvo tests for effectiveness. Hedging is consid-

ered to be effective when the forecasted future cash flow’s currency

fluctuation and maturity date coincide with those of the financial

instrument. The hedging relationship is regularly tested up until its

maturity date. If the identified relationships are no longer deemed

effective, the currency fluctuations on the hedging instrument from

the last period the instrument was considered effective are reported

in the Group’s income statement. For 2010, Volvo reported 4 (loss 36)

as a gain related to the ineffectiveness of cash-flow hedging.

As of January 1, 2011 unrealized changes in fair value of financial

instruments related to a receivable or payable will be reported within

the respective segments. All other unrealized changes in fair value of

financial instruments will henceforth be reported in the income state-

ment in the segment Group headquarter functions and other.

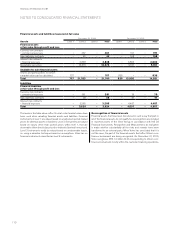

Hedge accounting is applied on the financial instruments hedging

forecasted electricity consumption. The fair value is debited or cred-

ited to a separate component in other comprehensive income to the

extent the requirements for cash-flow hedge accounting are fulfilled.

Accumulated changes in the value of the hedging instruments are

reported in the income statement of the same time as the underlying

hedged transaction affects the Groups results. The table in note 23,

Shareholders’ equity shows how the electricity consumption reserve

has changed during the year. To the extent that the requirements for

hedge accounting are not met, any changes in the value attributable

to derivatives are immediately charged to the income statement.

Hedging of forecasted electricity is considered to be effective

when predetermined factors that affect electricity prices are in agree-

ment with forecasts of future electricity consumption and designated

derivative instruments. The hedging relationship is regularly tested up

until its maturity date. If the identified relationships are no longer

deemed effective, the currency fluctuations on the hedging instru-

ment from the last period the instrument was considered effective are

reported in the Group’s income statement. For 2009, Volvo reported

4 (4) related to the ineffectiveness of the hedging of forecasted elec-

tricity consumption.

Hedging of currency and interest rate risks on loans

Volvo has chosen to apply hedge accounting for a loan of approxi-

mately EUR 1 billion borrowed in the second quarter of 2007. Fair

value of the outstanding hedge instrument amounts to 1,168 (1,159).

The carrying value of the loan related to hedge accounting amounts

to a negative 977 (neg: 970). The changes in the fair value of the

outstanding hedge instruments and the changes in the carrying value

of the loan are reported in the income statement.

Changes in market value on the instruments used for hedging of

risk in financial assets and liabilities for which hedge accounting has

not been applied are reported in net financial income and expense,

see note 11. In the future, in applicable cases when the requirements

for hedge accounting are considered to be fulfilled, Volvo will consider

to apply hedge accounting for this kind of instruments.

Hedging of net investments in foreign operations

Volvo applies hedge accounting for certain net investments in foreign

operations. Current earnings from such hedging shall be accounted

for in a separate item within shareholders’ equity. A total of negative

202 (neg 314) in shareholders’ equity relating to hedging of net

investments in foreign operations was reported in 2010.

The hedged amount offirm flows for all periods are within the framework of Volvo’s currency policy.

113