Volvo 2010 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2010 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ing that we have been able to provision SEK 350

M for profit sharing to our employees, since

return on shareholders’ equity for 2010 amounted

to 16%. The past two years have required quick

adaptations that we would never have managed

without the extraordinary efforts undertaken by

employees throughout the Group.

Based on the much improved profitability and

the significantly reduced debt level, the Board

proposes to resume dividends with a pay-out of

SEK 2.50 per share for the financial year of 2010.

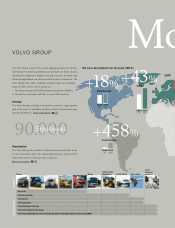

Improvements within all business areas

The improved demand was clearly visible in our

truck operations, with order intake rising by 75%

while deliveries increased by 41%. Order intake

gradually increased from low levels in Europe and

North America. In many emerging markets such

as Brazil and India, demand remained strong. On

the other hand, the Japanese market weakened

during the second half of the year. Net sales in

the truck operations increased 20% to SEK 167

billion and the operating margin improved to

6.0%. The positive trend in order intake led to a

gradual increase in the pace of manufacturing

and delivery in most of our truck plants.

The growth and profitability development of

Construction Equipment was strong throughout

the year with a gradual improvement in Europe and

North America, and with a very good contribution

from emerging markets, particularly China. Sales

rose 51% to SEK 54 billion and the business area

recorded an operating income of slightly more

than SEK 6 billion. The full year operating margin

was 11.5% with a strong finish to the year. We have

increased our market share in the important Chi-

nese market and now rank as its third largest

manufacturer. We are moving our position forward

further with the launch of SDLG branded excava-

tors from Lingong and a large number of Volvo

products.

Buses’ sales increased by 11% and the operat-

ing margin rose to 3.8%. The business area had

a positive trend in profitability throughout the

year despite relatively low volumes in the impor-

tant markets of Europe and North America. The

improved profitability is partly a result of increased

sales, but primarily the fruit of considerable

efforts to raise internal efficiency and lower

costs.

Volvo Penta turned around with a profit of SEK

578 M and a margin of 6.6% despite continued

weak demand for marine engines. With one of the

industry’s broadest product ranges and a global

network of service and distributors, Volvo Penta

is strategically well-positioned to be an innovative

partner to important boat builders. The industrial

engine business had a good development and

the aim is to further increase sales of industrial

engines by breaking into new segments of the

market.

Volvo Aero’s operating income rose to SEK

286 M despite a loss of SEK 538 M related to the

divestment of the U.S.-based service business.

Core operations developed strongly due to

increased volumes, resulting in improved capacity

utilization, improved productivity and lower costs.

Volvo Aero remains well-established with partici-

pation in many interesting engine programs that

will be entering production in coming years.

In our Customer Finance Operations profitabil-

ity gradually improved as our customers’ business

activity increased, which in turn led to a more sta-

ble financial situation for them. As a consequence

of the Volvo Group’s increased sales of new prod-

ucts, we also see that our credit portfolio is grow-

ing again.

Intensive year of news

We take a long-term view of our business and

what needs to be done to create value for our

customers and to create sustainable profitability.

Accordingly, we maintained our relatively high

investments in product development during both

2009 and 2010. We also continued to invest in

our plants and sales channels. Combined, this

means that we now stand well-prepared in terms

of both products and capacity.

As one of the world’s largest manufacturers of

commercial vehicles, we have a responsibility to

reduce the impact on the environment caused by

our production as well as the usage of our prod-

ucts – it is a responsibility that we take most

se riously. Engines that use less fuel lower our

customers’ operating costs and strengthen their

competitiveness while reducing environmental

impact. At the beginning of the year, we intro-

duced on a broad front in the USA, the new

engines that meet the latest, extremely stringent

requirements on emission levels that are in fact

practically zero for nitrogen oxides and particu-

lates. Trucks fitted with the new engines have

been well received by both old and new custom-

ers and we are capturing market share in North

America as a consequence. But the truck news

doesn’t end there. In Europe, Volvo Trucks

launched the new construction truck Volvo FMX

that strengthens the offering within this impor-

tant segment of the market. In Japan, UD Trucks,

in conjunction with the introduction of new emis-

sion regulations, launched a new heavy Quon

truck equipped with Group engines.

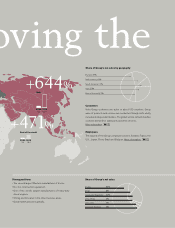

Through Eicher, we have a very strong position

in medium-duty trucks in India and a well-per-

forming sales network. We are now further devel-

oping Eicher to keep pace with the strong growth

in the country and for export to other countries.

We are developing a new generation of heavy-

duty trucks and investing in new assembly cap-

acity. We are also building a new engine plant that

will be the global base for the medium-duty

engine platform to be launched in increasing

numbers of the Group’s products in the coming

years.

Volvo CE launched a number of new Volvo

products during the year. Manufacturing was also

begun in China of the new series of excavators

under the SDLG brand. In addition, Volvo CE’s

engines received certification in accordance with

the new environmental rules that are beginning to

be introduced in Europe and North America in

2011. During the year, Volvo Buses began mass

production of hybrid buses at its plant in Poland.

This is but a small selection of news for a year

when the pace of renewal remained high for all

business areas.

CONTINUED CEO COMMENT

2

A GLOBAL GROUP 2010