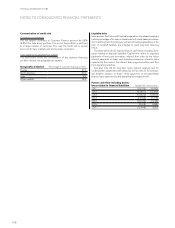

Volvo 2010 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2010 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

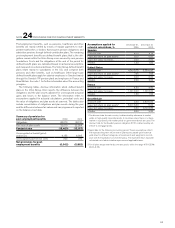

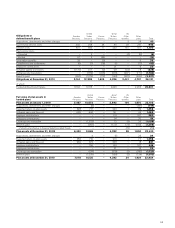

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

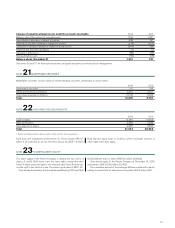

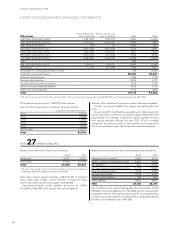

Other loans Actual interest rate,

Dec 31, 2010, %

Effective interest rate,

Dec 31, 2010, % 2009 2010

USD 2007–2010/2012–2018 0.52–7.50 0.52–7.76 17,281 13,433

EUR 2004–2009/2012–2027 3.25–6.50 3.28–6.50 5,995 1,485

GBP 2008/2012–2013 1.19 1.2 1,664 337

SEK 2007–2010/2012–2017 2.00–3.00 2.02–3.00 1,915 2,942

CAD 2006–2010/2012–2013 1.53–2.84 1.54–2.87 2,067 2,928

MXN 2007–2009/2012–2014 5.00–9.04 5.11–9.42 2,145 2,186

JPY 2005–2010/2012–2016 0.65–3.52 0.65–3.52 16,374 12,405

CHF 696 –

BRL 2003–2009/2012–2017 6.58–7.0 6.86–7.0 5,940 5,348

Other loans 1.7–7.5 1.71–7.64 1,189 1,871

Revaluation of outstanding derivaties to SEK 769 2,392

Total other non-current loans2 56,035 45,327

Deferred leasing income 1,965 1,778

Residual value liabilities 3,109 3,170

Accrued expenses service contracts 1,422 1,273

Other non-current financial liabilities 1,672 1,114

Other non-current liabilities 1,720 1,896

Total 115,114 93,325

2 Of which loans raised to finance the credit portfolio of the customer financing operations 21,064 (26,551) and financial derivatives 2.392 (769).

Of the above long-term loans, 1,288 (270) was secured.

See note 28 for a description of changes of assets pledged.

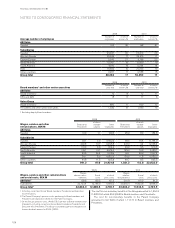

Long-term loans mature as follows:

2012 23,530

2013 13,836

2014 17,591

2015 10,190

2016 6,476

2017 or later 12,471

Total 84,094

See note 16 for maturities of long-term customer financing receivables.

Of other non-current liabilities the majority will mature within five

years.

At year-end 2010, credit facilities granted but not utilized and which

can be used without restrictions amounted to approximately SEK 35.3

billion (33.2). These facilities consisted of stand-by facilities for loans

with varying maturities through the year 2013. A fee is normally

charged for the unused portion of credit facilities and is reported in

the income statement under other financial income and expenses.

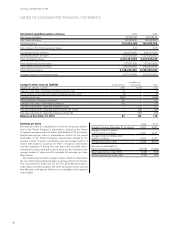

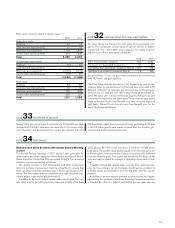

NOTE 27CURRENT LIABILITIES

Balance sheet amounts for loans were as follows:

2009 2010

Bank loans 14,083 12,261

Other loans 37,543 27,340

Total151,626 39,601

1 Of which loans raised to finance the credit portfolio of the customer financing

operations 29,690 (40,766) and derivatives 458 (178).

Bank loans include current maturities, 3,246 (4,713), of long-term

loans. Other loans include current maturities of long-term loans,

22,007 (25,108), and commercial paper, 1,416 (8,640).

Non-interest-bearing current liabilities accounted for 84,457

(70,955), or 68% (58) of the Group’s total current liabilities.

Balance sheet amounts for other current liabilities were as follows:

2009 2010

Advances from customers 3,556 3,416

Wages, salaries and withholding taxes 8,504 8,824

VAT liabilities 1,511 2,023

Accrued expenses and prepaid income 11,756 12,626

Deferred leasing income 1,725 1,640

Residual value liability 2,730 2,154

Other financial liabilities 783 242

Other liabilities 3,540 4,416

Total 34,105 35,341

Current liabilities also include trade payables that amounted to 47,250

(35,955), current tax liabilities of 1,732 (623) and non interest-bear-

ing liabilities held for sale reported within Note 4. Secured bank loans

at year-end 2010 amounted to 216 (329). The corresponding amount

for other current liabilities was 1,442 (58).

FINANCIAL INFORMATION 2010

98