Volvo 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 ACCOUNTING PRINCIPLES

The consolidated financial statements for AB Volvo and its subsidiaries

have been prepared in accordance with International Financial Re porting

Standards (IFRS) issued by the International Accounting Standards

Board (IASB), as adopted by the EU. The portions of IFRS not adopted

by the EU have no material effect on this report. This Annual report is

prepared in accordance with IAS 1 Presentation of Financial State-

ments and in accordance with the Swedish Companies Act. In addition,

RFR 1 Supplementary Rules for Groups, has been applied, issued by

the Swedish Financial Reporting Board. Effective in 2005 Volvo has

applied International Financial Reporting Standards (IFRS) in its finan-

cial reporting. In accordance with the IFRS transitions rules in IFRS 1,

Volvo applies retrospective application from the IFRS transition date at

January 1, 2004. The details of the transition from Swedish GAAP to

IFRS are set out in Note 3 in the annual reports of 2005 and 2006.

Refer to the 2004 Annual Report for a description of the previous

Swedish accounting principles applied by Volvo.

In the preparation of these financial statements, the company man-

agement has made certain estimates and assumptions that affect the

value of assets and liabilities as well as contingent liabilities at the

balance sheet date. Reported amounts for income and expenses in

the reporting period are also affected. The actual future outcome of

certain transactions may differ from the estimated outcome when

these financial statements were issued. Any such differences will

affect the financial statements for future accounting periods. The key

sources of estimation uncertainty are set out in Note 2.

Consolidated financial statements

Principles for consolidation

The consolidated financial statements have been prepared in accord-

ance with the principles set forth in IAS 27, Consolidated and Separ-

ate Financial Statements. Accordingly, intra-Group transactions and

gains on transactions with associated companies are eliminated. The

consolidated financial statements comprise the Parent Company,

subsidiaries, joint ventures and associated companies.

– Subsidiaries are defined as companies in which Volvo holds more

than 50% of the voting rights or in which Volvo otherwise has a con-

trolling interest.

– Joint ventures are companies over which Volvo has joint control

together with one or more external parties. Joint ventures are reported

by use of the proportionate method of consolidation.

- Associated companies are companies in which Volvo has a sig-

nificant influence, which is normally when Volvo’s holdings equals to at

least 20% but less than 50% of the voting rights. Holdings in associ-

ated companies are reported in accordance with the equity method.

The Group’s share of reported income in such companies is included

in the consolidated income statement in Income from investments in

associated companies, reduced in appropriate cases by depreciation

of surplus values and the effect of applying different accounting prin-

ciples. Income from associated companies is included in operating

income as the Volvo investments are of operating nature. For practical

reasons, some of the associated companies are included in the con-

solidated accounts with a certain time lag, normally one quarter. Divi-

dends from associated companies are not included in consolidated

income. In the consolidated balance sheet, the book value of share-

holdings in associated companies is affected by Volvo’s share of the

company’s net income, reduced by depreciation of surplus values and

by the amount of dividends received.

Volvo applies IFRS 3 (revised), Business Combinations, for acquisi-

tions. Prior acquisitions are not restated. All business combinations

are accounted for in accordance with the purchase method. Volvo val-

ues acquired identifiable assets, tangible and intangible, and liabilities

at fair value. Surplus amount from purchase price, possible minority

Amounts in SEK M unless otherwise specified. The amounts within parentheses refer to the preceding year, 2009.

and fair value of previous possessions at the acquisition date com-

pared to the Group’s share of acquired net assets are reported as

goodwill. Any lesser amount, so-called negative goodwill, is reported

in the income statement.

At step acquisitions a business combination occurs only at the date

control is achieved, at the same time goodwill is calculated. Transac-

tions with the minority are reported as equity as long as control of the

subsidiary is retained. For each business combination Volvo chooses

if the minority should be valued either at fair value or at the minority’s

proportionate share of the acquiree’s net assets. All acquisition-

related costs are expensed. Companies acquired during the year are

consolidated as of the date of acquisition. Companies that have been

divested are included in the consolidated financial statements up to

and including the date of divestment.

Translation to Swedish kronor when consolidating

companies using foreign currencies

AB Volvo’s functional currency is the Swedish krona. All reporting in

group companies for group purposes is made in the currency, in which

the company has the majority of its revenues and expenses; normally

the currency of the country where the company is located. AB Volvo’s

and the Volvo Group’s presentation currency is Swedish kronor. In pre-

paring the consolidated financial statements, all items in the income

statements of foreign subsidiaries and joint ventures (except for sub-

sidiaries in highly inflationary economies) are translated to Swedish

kronor at monthly exchange rates. All balance sheet items are trans-

lated at exchange rates at the respective year-ends (closing rate). The

differences in consolidated shareholders’ equity, arising as a result of

variations between closing rates, for the current and previous year are

charged or credited directly to shareholders’ equity as a separate

component.

The accumulated translation difference related to a certain sub-

sidiary, joint venture or associated company is reversed to income as

a part of the gain/loss arising from the divestment or liquidation of

such a company.

IAS 29, Financial Reporting in Hyperinflationary Economies, is

applied to financial statements of subsidiaries operating in highly

inflationary economies. Volvo applies reporting based on historical

value. Translation differences due to inflation are charged against

earnings for the year. Currently, Volvo has no subsidiaries with a func-

tional currency that could be considered a hyperinflationary currency.

Receivables and liabilities in foreign currency

Receivables and liabilities in foreign currency are valued at closing

rates. Translation differences on operating assets and liabilities are rec-

ognized in operating income, while translation differences arising in

financial assets and liabilities are charged to other financial income and

expenses. Financial assets and liabilities are defined as items included

in the net financial position of the Volvo Group (see Definitions at the

end of this report). Derivative financial instruments used for hedging of

exchange and interest risks are reported at fair value. Gains on

exchange rates are reported as receivables and losses on exchange

rates are reported as liabilities. Depending on the lifetime of the finan-

cial instrument it is reported as current or non-current in the balance

sheet. Exchange rate differences on loans and other financial instru-

ments in foreign currency, which are used to hedge net assets in foreign

subsidiaries and associated companies, are offset against translation

differences in the shareholders’ equity of the respective companies.

Exchange rate gains and losses on payments during the year and on

the valuation of assets and liabilities in foreign currencies at year-end

are credited to, or charged against, income in the year they arise. The

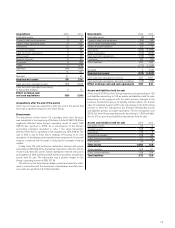

more important exchange rates applied are shown in the table.

71