Volvo 2010 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2010 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

of changed market interest rates on the interest-rates of both assets

and liabilities. Consequently, the effect of actual interest-rate changes

may deviate from the above analysis.

Currency risks

The content of the reported balance sheet may be affected by

changes in different exchange rates. Currency risks in Volvo’s opera-

tions are related to changes in the value of contracted and expected

future payment flows (commercial currency exposure), changes in the

value of loans and investments (financial currency exposure) and

changes in the value of assets and liabilities in foreign subsidiaries

(currency exposure of shareholders’ equity). The aim of Volvo’s cur-

rency-risk management is to minimize, over the short term, negative

effects on Volvo’s earnings and financial position stemming from

exchange-rate changes.

Commercial currency exposure

In order to hedge the value of future payment flows in foreign currencies,

Volvo uses forward contracts and currency options. In the fourth quarter

of 2009, Volvo revised its hedging policy in order to only hedge firm flows,

whereof the major part are realised within six months. Also, from the

fourth quarter of 2009, hedge accounting was not applied for new con-

tracts. For details regarding Hedge accounting, see note 37.

The nominal amount of all outstanding forward and option con-

tracts amounted to SEK 10.9 billion (17.2) at December 31, 2010. On

the same date, the fair value of these contracts was positive in an

amount of SEK 118 million (186).

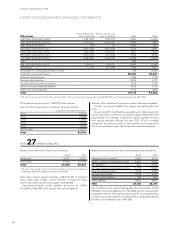

The table below presents the effect a change of the value of the

Swedish krona in relation to other currencies would have on the fair

value in the respective currencies of outstanding contracts. In reality,

currencies usually do not change in the same direction at any given

time, so the actual effect of exchange-rate changes may differ from

the below sensitivity analysis.

Change in value of SEK in relation to

all foreign currencies, %

Fair value of

outstanding contracts

(10) (218)

0 118

10 454

Financial currency exposure

Loans and investments in the Group’s subsidiaries are done mainly

through Volvo Treasury in local currencies, which minimizes individual

companies’ financial currency exposure. Volvo Treasury uses various

derivatives, in order to facilitate lending and borrowing in different cur-

rencies without increase the company’s own risk. The financial net

position of the Volvo Group is affected by exchange rate fluctuations,

since financial assets and liabilities are distributed among Group

companies that conduct their operations in different currencies.

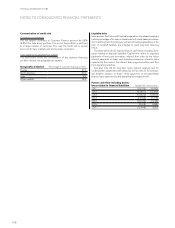

Currency exposure of shareholders’ equity

The consolidated value of assets and liabilities in foreign subsidiaries

is affected by current exchange rates in conjunction with translation of

assets and liabilities to Swedish kronor. To minimize currency expo-

sure of shareholders’ capital, the size of shareholders’ equity in foreign

subsidiaries is continuously optimized with respect to commercial and

legal conditions. Currency hedging of shareholders’ equity may occur

in cases where a foreign subsidiary is considered overcapitalized. Net

assets in foreign subsidiaries and associated companies amounted at

year-end 2010 to SEK 60.3 billion (59.4). Of this amount, SEK 0.8

billion (4.1) was currency-hedged through loans in foreign currencies.

The remaining loans used as hedging instruments are due in 2011

and SEK 3.1 billion expired in 2010. The need to undertake currency

hedging relating to investments in associated companies and other

companies is assessed on a case-by-case basis.

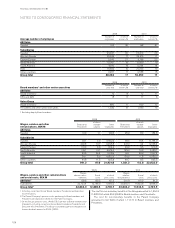

Credit risks

Volvo’s credit granting is steered by Group-wide policies and cus-

tomer-classification rules. The credit portfolio should contain a sound

distribution among different customer categories and industries. The

credit risks are managed through active credit monitoring, follow-up

routines and, where applicable, product reclamation. Moreover, regular

monitoring ensures that the necessary provisions are made for

incurred losses on doubtful receivables. In the tables below, ageing

analyses are presented of accounts receivables overdue and cus-

tomer finance receivables overdue in relation to the reserves made. It

is not unusual that a receivable is settled a couple of days after due

date, which affects the extent of the age interval 1–30 days.

The credit portfolio of Volvo’s customer-financing operations

amounted at December 31, 2010, to approximately net SEK 73 billion

(82). The credit risk of this portfolio is distributed over a large number

of retail customers and dealers. Collaterals are provided in the form of

the financed products. Credit granting aims for a balance between

risk exposure and expected yield. The Volvo Group’s financial assets

are largely managed by Volvo Treasury and invested in the money and

capital markets. All investments must meet the requirements of low

credit risk and high liquidity. According to Volvo’s credit policy, coun-

terparties for investments and derivative transactions should have a

rating of A or better from one of the well-established credit rating

institutions.

The use of derivatives involves a counterparty risk, in that a poten-

tial gain will not be realized if the counterparty fails to fulfill its part of

the contract. To reduce the exposure, master netting agreements are

signed, wherever possible, with the counterparty in question. Counter-

party risk exposure for futures contracts is limited through daily or

monthly cash transfers corresponding to the value change of open

contracts. The estimated gross exposure to counterparty risk relating

to futures, interest-rate swaps and interest-rate forward contracts,

options and commodities contracts amounted at December 31, 2010,

to 331 (588), 3,539 (3,560 ), 190 (167) and 168 (42).

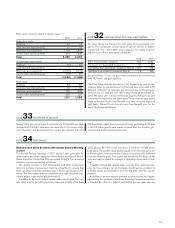

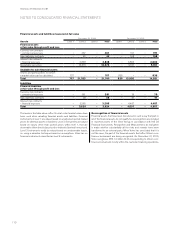

Credit portfolio – Accounts receivable and Customer financing

receivables

Accounts receivable 2009 2010

Accounts receivable gross 22,638 25,154

Valuation allowance for doubtful

accounts receivable (1,301) (721)

Accounts receivable net 21,337 24,433

For details regarding the accounts receivable and the valuation for

doubtful accounts receivable, refer to note 20.

Customer financing receivables 2009 2010

Customer financing receivables gross 83,490 74,013

Valuation allowance for doubtful customer

financing receivables (1,513) (1,325)

Customer financing receivables net 81,977 72,688

FINANCIAL INFORMATION 2010

106