Volvo 2010 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2010 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BOARD OF DIRECTORS’ REPORT 2010

The strong cash flow was generated through the

operating income and a reduction of working

capital.

Financial items and paid income taxes had a

SEK 5.1 billion negative effect on cash flow

within Industrial Operations, mainly through pay-

ments of interests and income tax.

Operating cash flow within Customer Finance

was a positive SEK 1.4 billion in 2010 (15.1).

Investments

The Industrial Operations’ investments in fixed

assets and capitalized R&D during 2010

amounted to SEK 10.3 billion (10.3).

Capital expenditures in Trucks amounted to

SEK 7.2 billion (7.4). The capital expenditures

within Trucks consist to a large extent of invest-

ments related to product renewals in our product

program, within product development and adap-

tations in the plants. Examples of product renew-

als are the new Volvo FMX construction truck

and UD Trucks’ launches of a new version of the

Quon heavy truck and a new Condor medium

duty truck equipped with a new medium-duty

engine. The ongoing investments aiming for

increased capacity and flexibility have more or

less been finalized during the year. Those relate

to the cab plant in Umeå, Sweden, and the engine

plants with the new foundry but also investments

in machining and assembly processes in Skövde,

Sweden, and the assembly line in Ageo, Japan.

During 2010, Trucks invested in the dealer net-

work and workshops, mainly in Europe, however

on a lower level than previous year.

Capital investments for Construction Equip-

ment increased to SEK 1.4 billion from SEK 1.0

billion previous year. A majority of the invest-

ments refer to expansion of the excavator busi-

ness in the BRIC countries, during 2010 espe-

cially in China. It includes product offerings as the

new EC200B Volvo excavator for the Chinese

market, and increased manufacturing capacity in

China, Lingong with SDLG, and also in Korea,

Changwon, for components and assembly. Prod-

uct related investments during the year also refer

to the emission regulations with Tier4i and Stage

IIIB engines.

The investments within Volvo Aero during

2010 were SEK 0.8 billion (0.6). The majority of

the investments refer to the involvement in the

new engine programs, PW1000G with Pratt &

Whitney, and Trent XWB with Rolls-Royce. The

investments also refer to finalization of a number

of investments in Aero’s production facilities in

order to secure the capacity required for the

GEnx program, carried out in cooperation with

General Electrics, and capacity investments in

the Low Pressure Turbine shop.

The investments in Buses were SEK 0.2 billion

(0.4). They were mainly related to maintenance

and efficiency-enhancing investments in the fac-

tories. Product related investments during the

year relate mainly to emission standards and

product renewals.

The level of investments in Volvo Penta were

SEK 0.2 billion (0.3) and consist mainly of prod-

uct-related investments in the new D13 engine

and IPS3, the finalization phase of investments in

the new logistics system as well as tooling and

other development activities.

Investments in leasing assets amounted to

SEK 0.3 billion (0.2).

For 2011, the Volvo Group estimates that

investments in property, plant and equipment will

be around SEK 10 billion. This is higher than in

2010 as investments in future product programs

will increase, as well as the expansion of the busi-

ness in the BRIC countries. The process in which

ongoing and future investments are continuously

reviewed and prioritized is still in focus.

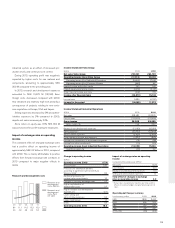

Capital expenditures, Industrial Operations

Capitalized development

costs, SEK bn

Capital expenditures,

% of net sales

10090807

2.62.12.12.9

5.04.33.63.9

7.710.58.06.8

Property, plant and

equipment, SEK bn

06

3.2

4.0

7.1

Self-financing ratio, Industrial operations %

Cash-flow from

operating activities

divided by net

investments in fixed

assets and leasing

assets.

1009080706

294(16)78265235

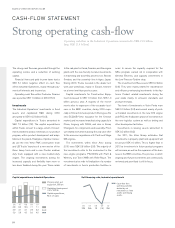

CASH-FLOW STATEMENT

Strong operating cash-flow

Operating cash flow in the Industrial Operations amounted to SEK 19.0 billion

(neg: SEK 11.4 billion).

64