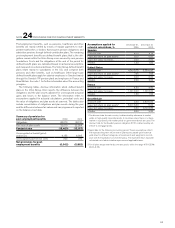

Volvo 2010 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2010 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

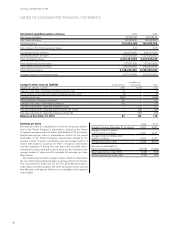

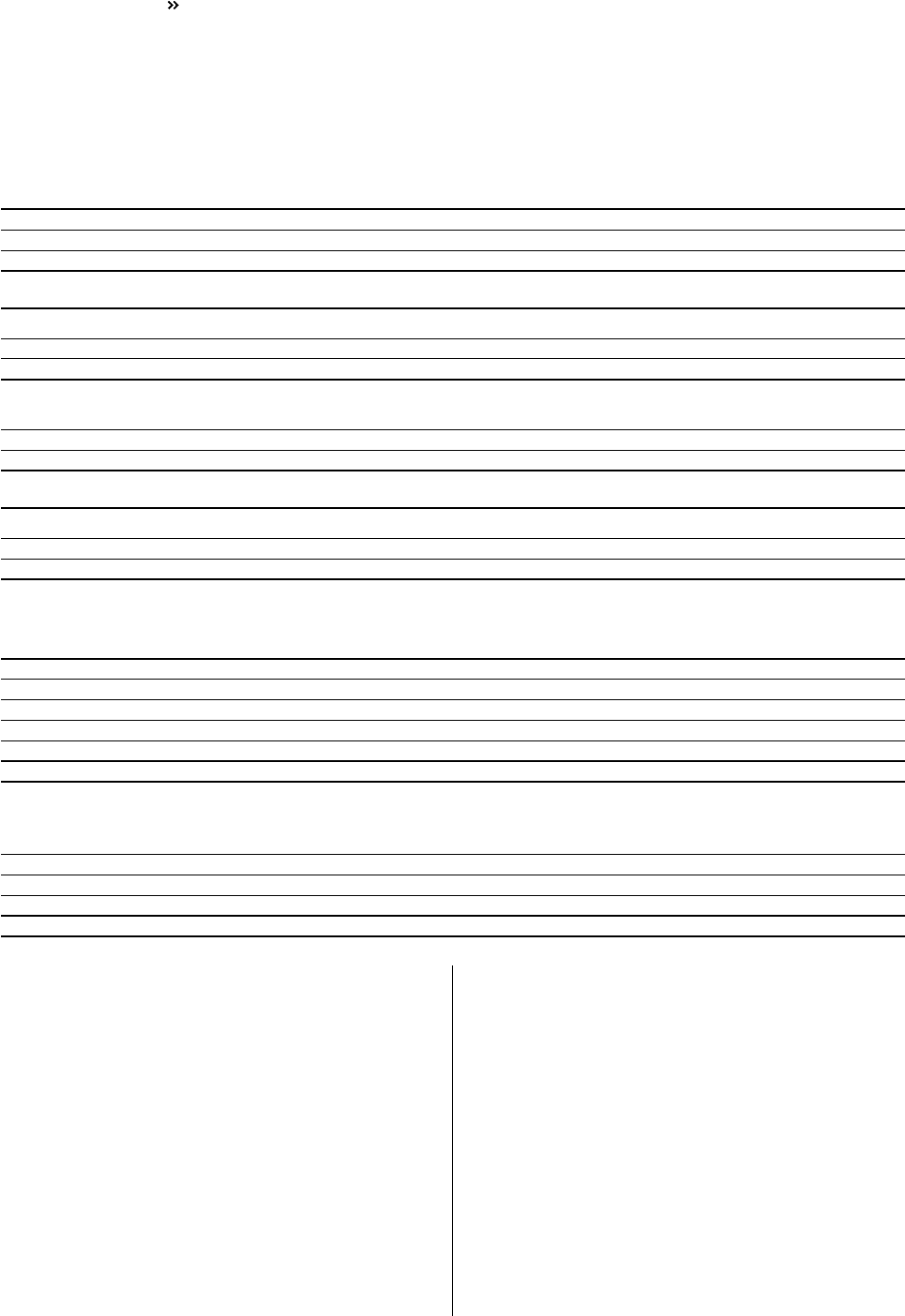

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Net provision for

post-employment benefits Sweden

Pensions

United

States

Pensions

France

Pensions

Great

Britain

Pensions

US

Other

benefits

Other

plans Total

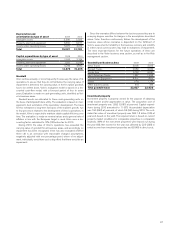

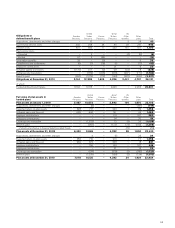

Funded status at December 31, 2009 (3,451) (3,492) (1,897) (46) (3,669) (2,905) (15,460)

Unrecognized actuarial (gains) and losses 3,030 4,373 232 635 3841501 9,155

Unrecognized past service costs – (81) 405 – (6) (15) 303

Net provisions for post-employment

benefits at December 31, 2009 (421) 800 (1,260) 589 (3,291) (2,419) (6,002)

of which reported as

Prepaid pensions and other assets – 1,254 – 588 120 87 2,049

Provisions for post-employment benefits (421) (454) (1,260) 1 (3,411) (2,506) (8,051)

Funded status at December 31, 2010 (2,066) (3,463) (1,605) 167 (3,417) (2,783) (13,167)

Unrecognized actuarial (gains) and losses 1,475 4,054 113 388 322 643 6,995

Unrecognized past service costs – (65) 380 – (5) – 310

Net provisions for post-employment

benefits at December 31, 2010 (591) 526 (1,112) 555 (3,100) (2,140) (5,862)

of which reported as

Prepaid pensions and other assets – 900 – 555 110 83 1,648

Provisions for post-employment benefits (591) (374) (1,112) – (3,210) (2,223) (7,510)

1 A decrease by 194 from reclassification to financial liability in Mack Trucks.

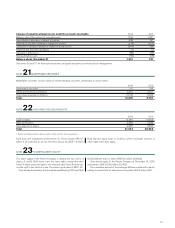

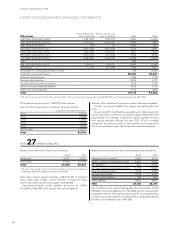

Plan assets by category 2009 % 2010 %

Shares and participation, Volvo 195 1 403 2

Shares and participations, other 10,893 48 11,494 50

Bonds and interest-bearing securities. 10,167 45 9,100 40

Property 319 1 440 2

Other 1,036 5 1,517 6

Total 22,610 100 22,954 100

Actual return on plan assets amounted to 2,259 (2,821).

Actuarial gains and losses 2009 2010

Experience-based adjustments in obligations (110) 293

Experience-based adjustments in plan assets 1,463 861

Effects of changes in actuarial assumptions (1,696) 235

Actuarial gains and (losses), net (343) 1,389

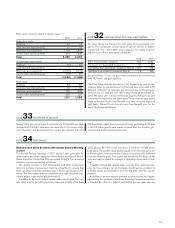

Volvo’s pension foundation in Sweden was formed in 1996 to secure

obligations relating to retirement pensions for salaried employees in

Sweden in accordance with the ITP plan (a Swedish individual pension

plan). Plan assets amounting to 2,456 were contributed to the foun-

dation at its formation, corresponding to the value of the pension obli-

gations at that time. Since its formation, net contributions of 1,472

have been made to the foundation. The plan assets in Volvo’s Swedish

pension foundation are invested in Swedish and foreign stocks and

mutual funds, and in interest-bearing securities, in accordance with a

distribution that is determined by the foundation’s Board of Directors.

At December 31, 2010, the fair value of the foundation's plan assets

amounted to 7,059 (6,408), of which 57% (46) was invested in shares

or mutual funds. At the same date, retirement pension obligations

attributable to the ITP plan amounted to 8,794 (9,465).

Swedish companies can secure new pension obligations through

balance sheet provisions or pension fund contributions. Furthermore,

a credit insurance must be taken for the value of the obligations. In

addition to benefits relating to retirement pensions, the ITP plan also

includes, for example, a collective family pension, which Volvo finances

through insurance with the Alecta insurance company. According to

an interpretation from the Swedish Financial Reporting Board, this is

a multi-employer defined-benefit plan. For fiscal year 2009, Volvo did

not have access to information from Alecta that would have enabled

this plan to be reported as a defined-benefit plan. Accordingly, the

plan has been reported as a defined-contribution plan. Alecta's fund-

ing ratio is 143% (141).

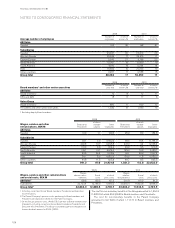

Volvo’s subsidiaries in the United States mainly secure their pen-

sion obligations through transfer of funds to pension plans. At the end

of 2010, the total value of pension obligations secured by pension

plans of this type amounted to 11,378 (12,923). At the same point in

time, the total value of the plan assets in these plans amounted to

9,535 (9,866), of which 59% (59) was invested in shares or mutual

funds. The regulations for securing pension obligations stipulate cer-

tain minimum levels concerning the ratio between the value of the

plan assets and the value of the obligations. As a consequence of the

Master Agreement 2009 between Mack Trucks and United Auto

Workers (UAW) an independent trust has been established that will

completely eliminate Mack's commitments for providing healthcare to

FINANCIAL INFORMATION 2010

96