Volvo 2010 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2010 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

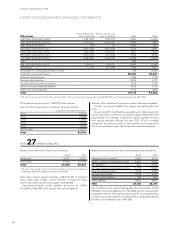

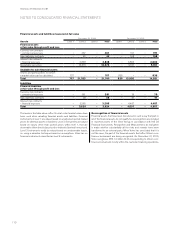

Change of valuation allowances for doubtful

customer financing receivables 2010

Balance sheet, December 31, preceding year 1,513

New valuation allowance charged to income 1,586

Reversal of valuation allowance charged to income (207)

Utilization of valuation allowance related to actual losses (1,451)

Translation differences (116)

Balance sheet, December 31 1,325

For details regarding the long-term customer-financing receivables

and the short-term customer receivables, refer to note 16 and 19.

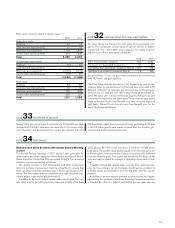

Age analysis of portfolio value – Accounts receivable and Customer financing receivables (days/SEK M)

2009 2010

Accounts receivable not due 1–30 31–90 >90 Total not due 1–30 31–90 >90 Total

Accounts receivable gross 19,705 1,032 616 1,285 22,638 23,324 799 391 640 25,154

Valuation allowance for doubtful

accounts receivable (493) (37) (46) (725) (1,301) (205) (26) (26) (464) (721)

Accounts receivable not

recognized as impairment losses 19,212 995 570 560 21,337 23,119 773 365 176 24,433

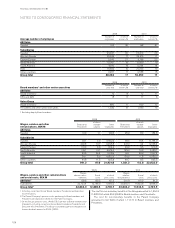

2009 2010

Customer financing receivables

payments due not due 1–30 31–90 >90 Total not due 1–30 31–90 >90 Total

Overdue amount – 655 560 740 1,955 – 490 405 805 1,700

Valuation allowance for doubtful

customer financing receivables (99) (111) (159) (313) (682) (91) (56) (74) (308) (530)

Customer financing receiv ables

not recognized as impairment

losses (99) 544 401 427 1,273 (91) 434 331 497 1,170

The table above presents overdue payments within the customer

financing operations in relation to specific reserves. The total contrac-

tual amount that the overdue payments are pertaining to are pre-

sented in the table below. In order to provide for occured but not yet

identified customer financing receivables overdue, there are addi-

tional reserves of 795 (831). The remaining exposure is secured by

liens on the purchased equipment, and, in certain circumstances,

other credit enhancements such as personal guarantees, credit insur-

ance, liens on other property owned by the borrower etc.

Collaterals taken in possession that meet the recognition criteria

amounted to 594 (1,391) at December 31, 2010.

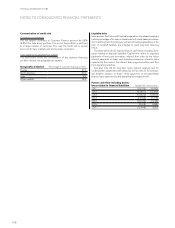

Customer financing

receivables total contractual

amount

2009 2010

not due 1–30 31–90 >90 Total not due 1–30 31–90 >90 Total

Customer financing receiv ables 67,692 7,886 4,511 3,401 83,490 63,153 6,425 2,369 2,066 74,013

Renegotiated financial assets

Financial assets that would otherwise have been overdue whose

terms have been renegotiated amount to 6,578 (8,948) and are

mainly related to renegotiated customer contracts within the cus-

tomer finance operations.

107