Volvo 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

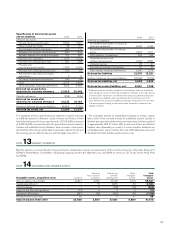

Acquisitions after the end of the period

Volvo has not made any acquisitions after the end of the period that

have had a significant impact on the Volvo Group.

Divestments

The divestment of Volvo Aero’s US subsidiary, Volvo Aero Services,

was completed in the beginning of October. A total of SEK 515 M has

negatively affected Volvo Group’s operating result, of which SEK

368 M was reported in 2009. As a consequence of the Group’s

accounting principles described in note 1 the same transaction

affected Volvo Aero’s operating result negatively by SEK 538 M. The

sale of VAS is due to Volvo Aero’s strategy of focusing on its core

operations of developing and manufacturing components for aircraft

engines, combined with the goal of reducing the company’s tied-up

capital.

In May Volvo CE sold its Russian distribution network with assets

amounting to SEK 200 M, the transaction had a minor effect on Volvo’s

result. In July Volvo CE sold its Turkish distribution network with assets

and liabilities of SEK 232 M and SEK 36 M, respectively, classified as

assets held for sale. The transaction had a positive impact on the

Group’s operating income of SEK 107 M.

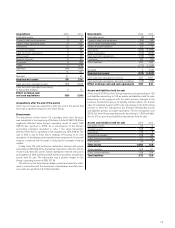

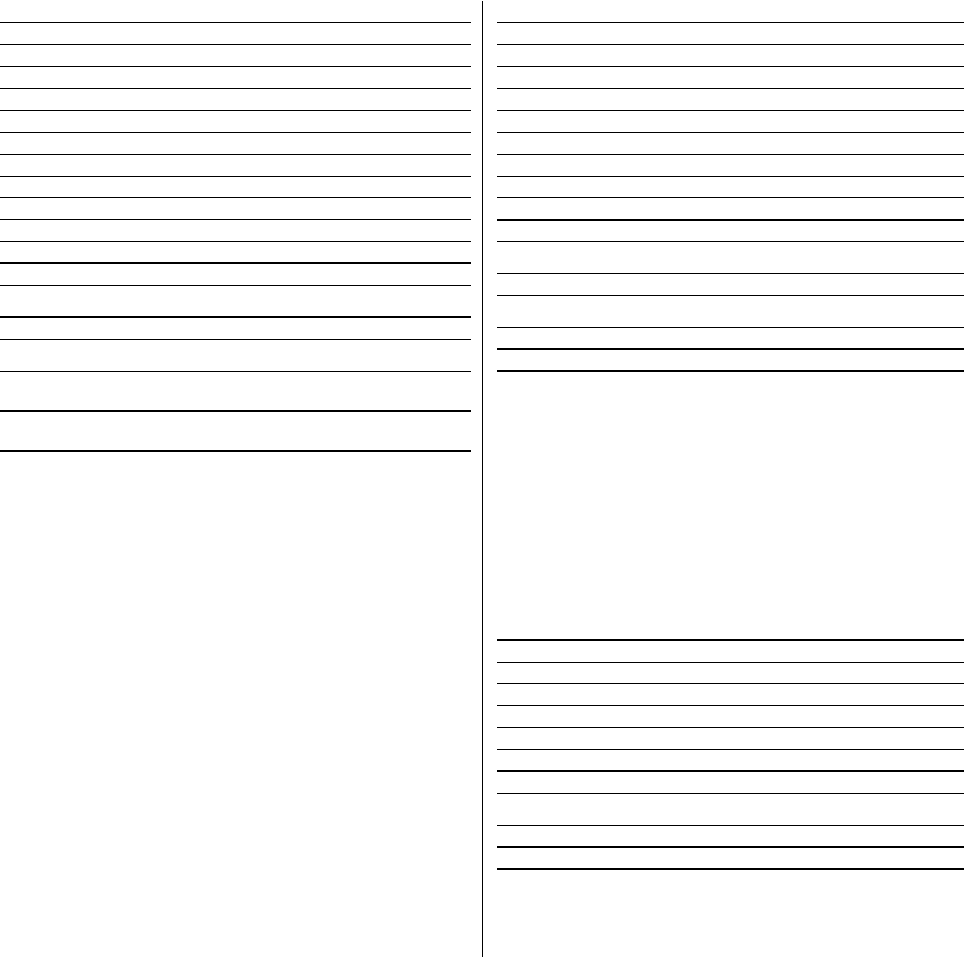

The effects on the Volvo Group’s balance sheet and cash-flow state-

ment in connection with the divestment of subsidiaries and other busi-

ness units are specified in the following table:

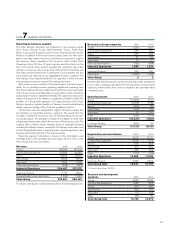

Acquisitions 2009 2010

Intangible assets 3 0

Property, plant and equipment 4 32

Assets under operating lease 19 468

Inventories 20 56

Current receivables 2 99

Cash and cash equivalents 0 15

Other assets 9 12

Minority interests 0 20

Provisions 6 (22)

Loans 0 (374)

Liabilities (48) (143)

15 163

Goodwill 41 52

Acquired net assets 56 215

Cash and cash equivalents paid (56) (229)

Cash and cash equivalents according

to acquisition analysis 0 15

Effect on Group cash

and cash equivalents (56) (214)

Divestments 2009 2010

Intangible assets (3) 0

Property, plant and equipment (59) (32)

Assets under operating lease (42) (190)

Shares and participations 65 0

Inventories (280) (1,096)

Other receivables (112) (334)

Cash and cash equivalents (116) (176)

Provisions 80 (10)

Other liabilities 254 540

(213) (1,298)

Goodwill 0 (122)

Divested net assets (213) (1,420)

Cash and cash equivalents received 321 1,007

Cash and cash equivalents, divested companies (116) (176)

Effect on Group cash and cash equivalents 205 831

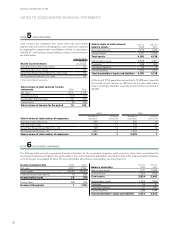

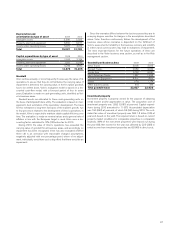

Assets and liabilities held for sale

At the end of 2010 the Volvo Group reports assets amounting to 136

and liabilities amounting to 135 as assets and liabilities held for sale.

Depending on the progress with the sales process, changes in the

business environment, access to liquidity, market outlook, etc. the fair

value of remaining assets held for sale may change in the forthcoming

periods or when the transactions are finalized. Reclassified assets

and liabilities pertain to smaller operations. For the comparison year

2009, the Volvo Group reported assets amounting to 1,692 and liabil-

ities to 272 as assets and liabilities classified as held for sale.

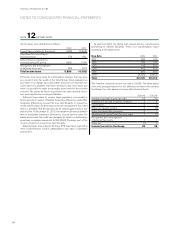

Assets and liabilities held for sale 2009 2010

Intangible assets 54 0

Tangible assets 618 43

Inventories 776 8

Accounts receivable 109 56

Other current receivables 111 24

Other assets 24 5

Total assets 1,692 136

Trade payables 108 31

Other current liabilities 164 104

Total liabilities 272 135

79