Volvo 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

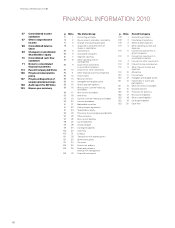

BOARD OF DIRECTORS’ REPORT 2010

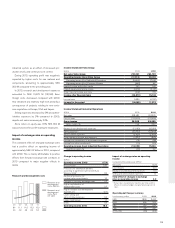

Net sales by business area

SEK M 2009 2010 %

Trucks 138,940 167,305 20

Construction

Equipment 35,658 53,810 51

Buses 18,465 20,516 11

Volvo Penta 8,159 8,716 7

Volvo Aero 7,803 7,708 (1)

Eliminations and

other (538) (680) –

Industrial

Operations1208,487 257,375 23

Customer Finance 11,712 9,031 (23)

Reclassifications

and eliminations (1,838) (1,658) –

Volvo Group 218,361 264,749 21

1 Adjusted for acquired and divested units and changes in

currency rates, net sales for Industrial operations

increased by 29%.

Operating income (loss) by business area

SEK M 2009 2010

Trucks (10,805) 10,112

Construction Equipment (4,005) 6,180

Buses (350) 780

Volvo Penta (230) 578

Volvo Aero 50 286

Eliminations and other (994) (102)

Industrial Operations (16,333) 17,834

Customer Finance (680) 167

Volvo Group (17,013) 18,000

Net sales by market area

SEK M 2009 2010 %

Western Europe 84,452 87,241 3

Eastern Europe 9,632 12,570 31

North America 37,291 45,409 22

South America 16,610 27,876 68

Asia 44,842 65,072 45

Other markets 15,660 19,207 23

Total Industrial

Operations 208,487 257,375 23

The Volvo Group

Net sales

Net sales for the Volvo Group increased by

21% to SEK 264,749 M in 2010, compared

with SEK 218,361 M in 2009.

Operating income

Volvo Group operating income amounted to

SEK 18,000 M (loss: 17,013).

Operating income for the Industrial Ope-

rations increased to SEK 17,834 M compared

with an operating loss of SEK 16,333 M in

the preceding year. The Customer Finance

operations’ operating income rose to SEK

167 M (loss: 680).

Net financial items

Net interest expense was SEK 2,700 M, com-

pared with SEK 3,169 M in 2009. The improve-

ment is mainly attributable to lower expense

for post-employment benefits.

During the year, market valuation of deriva-

tives, mainly used for the customer financing

portfolio, had a positive effect on Other finan-

cial income and expenses in an amount of

SEK 871 M (neg: 90).

The currency in Venezuela was devalued

twice during 2010, which negatively impacted

Other financial income and expenses by SEK

116 M during the first quarter and an add-

itional SEK 158 M during the fourth quarter.

Income taxes

The tax expense for the year amounted to

SEK 4,302 M corresponding to a tax rate of

28%. In 2009 the tax income amounted to SEK

5,889 M and a tax rate of 29%.

Income for the period and earnings

per share

The income for the period amounted to SEK

11,212 M (loss: 14,685), corresponding to basic

and diluted earnings per share of SEK 5.36 (neg:

7.26). The return on shareholders’ equity was

16.0% (neg: 19.7).

Industrial Operations

In 2010, net sales for the Volvo Group’s Industrial

Operations increased by 23% to SEK 257,375 M

(208,487). Hard products accounted for SEK

166,945 M and soft products (services and

aftermarket products) for SEK 90,430 M of net

sales.

Compared with 2009, sales increased in all of

the Group’s market areas. Demand in Europe and

North America recovered gradually during the

year at the same time as the emerging econo-

mies in South America and Asia continued to

have strong growth. However, development in

Japan continued to be weak.

Considerable earnings improvement

In 2010, the operating income for the Volvo

Group’s Industrial Operations amounted to SEK

17,834 M, compared with an operating loss of

SEK 16,333 M in 2009. The operating margin for

the Industrial Operations amounted to 6.9%

(neg: 7.8).

The earnings improvement is the result of

increased sales, improved cost coverage in the

FINANCIAL PERFORMANCE

Operating margin

% 2009 2010

Trucks (7.8) 6.0

Construction Equipment (11.2) 11.5

Buses (1.9) 3.8

Volvo Penta (2.8) 6.6

Volvo Aero 0.6 3.7

Industrial Operations (7.8) 6.9

Volvo Group (7.8) 6.8

Strong earnings improvement

The Volvo Group made a turnaround in profitability and recorded operating

income of SEK 18 billion thanks to higher sales volumes, strict cost control,

increased capacity utilization and a good productivity trend in the industrial system.

58