Volvo 2010 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2010 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

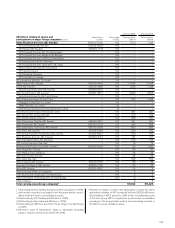

NOTES AND COMMENTS

GENERAL INFORMATION

Amounts in SEK M unless otherwise specified. The amounts within parentheses refer to the preceding year, 2009.

NOTE 1 ACCOUNTING PRINCIPLES

NOTE 2 INTRA-GROUP TRANSACTIONS

The accounting principles applied by Volvo are described in note 1 to

the consolidated financial statements.

The Parent Company also applies RFR 2 including the exception in

the application of IAS 39 which concerns accounting and valuation

of financial contracts of guarantee in favour of subsidiaries and associ-

ated companies. The Parent Company decided to early adopt the pres-

entation of comprehensive income applied as of 2010, from January 1,

2009.

The share-based incentive programs adopted at the Annual Gen-

eral Meeting from 2004–2009 are covered by IFRS 2 Share-based

payments.

The Volvo Group has adopted IAS 19 Employee Benefits in its

financial reporting. The Parent Company is still applying the principles

Of the Parent Company’s net sales, 499 (578) pertained to Group companies while purchases from Group companies amounted to 449 (357).

of FAR SRS’s Recommendation No. 4 “Accounting of pension liabil-

ities and pension costs” as in previous years. Consequently there are

differences between the Volvo Group and the Parent Company in the

accounting for defined-benefit pension plans as well as in valuation of

plan assets invested in the Volvo Pension Foundation.

The difference between depreciation according to plan and tax

depreciation is reported as accumulated additional depreciation,

which is included in untaxed reserves. In the consolidated balance

sheet a split is made between deferred tax liability and equity.

Reporting of Group contributions is in accordance with UFR 2,

a statement issued by the Swedish Financial Reporting Board. Group

contributions are reported among Income from investments in Group

companies.

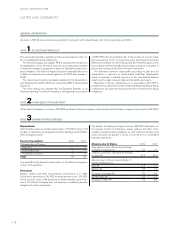

NOTE 3 ADMINISTRATIVE EXPENSES

Depreciation

Administrative expenses include depreciation of 16 (14) of which 1 (0)

pertains to machinery and equipment, 0 (0) to buildings and 15 (14) to

other intangible assets.

Fees to the auditors 2009 2010

PricewaterhouseCoopers

– Audit fees 17 17

– Audit-related fees 1 1

– Tax advisory services 1 0

Total 19 18

See note 35 for the Group for a description of the different categories

of fees to the auditiors.

Personnel

Wages, salaries and other remunerations amounted to 211 (160).

Social costs amounted to 142 (87) of which pension costs, 104 (55).

Of the pension costs, 9 (8) pertained to Board members and Presi-

dents. The Parent Company does not have any outstanding pension

obligations to these individuals.

The number of employees at year-end was 198 (190). Information on

the average number of employees, wages, salaries and other remu-

nerations including option programs as well as Board members and

senior executives by gender is shown in note 34 to the consolidated

financial statements.

Absence due to illness 2009 2010

Total absence due to illness in percentage

of regular working hours 1.2 1.1

of which, continuous sick leave for 60 days

or more, % 21.4 41.4

Absence due to illness in percentage of

regular working hours

Men, % 0.7 1.1

Women, % 1.8 1.1

29 years or younger, % 0.2 3.0

30–49 years, % 1.2 1.1

50 years or older, % 1.3 0.9

FINANCIAL INFORMATION 2010

118