US Airways 2009 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

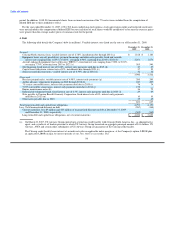

considering such assumptions, this accounting guidance establishes a three-tier fair value hierarchy, which prioritizes the inputs used in

measuring fair value as follows:

Level 1. Observable inputs such as quoted prices in active markets;

Level 2. Inputs, other than the quoted prices in active markets, that are observable either directly or indirectly; and

Level 3. Unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own

assumptions.

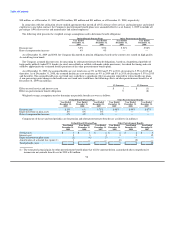

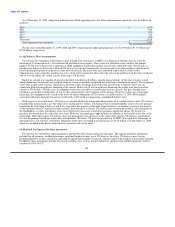

Assets measured at fair value on a recurring basis are as follows (in millions):

Quoted Prices in Significant Other Significant

Active Markets for Observable Unobservable

Identical Assets Inputs Inputs Valuation

Fair Value (Level 1) (Level 2) (Level 3) Technique

At December 31, 2009

Investments in marketable securities (noncurrent) $ 203 $ — $ — $ 203 (1)

At December 31, 2008

Investments in marketable securities (noncurrent) $ 187 $ — $ — $ 187 (1)

Fuel hedging derivatives (375) — (375) — (2)

(1) The Company estimated the fair value of its auction rate securities based on the following: (i) the underlying structure of each

security; (ii) the present value of future principal and interest payments discounted at rates considered to reflect current market

conditions; (iii) consideration of the probabilities of default, passing a future auction, or repurchase at par for each period; and

(iv) estimates of the recovery rates in the event of default for each security. These estimated fair values could change significantly

based on future market conditions. Refer to Note 6(b) for further discussion of the Company's investments in marketable securities.

(2) As the Company's fuel hedging derivative instruments were not traded on a market exchange, the fair values were determined using

valuation models which included assumptions about commodity prices based on those observed in the underlying markets. The fair

value of fuel hedging derivatives is recorded in accounts payable on the consolidated balance sheets. Refer to Note 6(a) for further

discussion of the Company's fuel hedging derivatives.

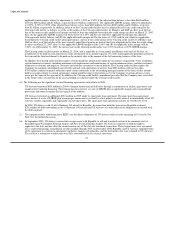

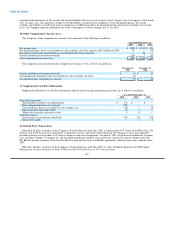

Assets measured at fair value on a recurring basis using significant unobservable inputs (Level 3) are as follows (in millions):

Investments in

Marketable

Securities

(Noncurrent)

Balance at December 31, 2007 $ 353

Losses deemed to be other than temporary reclassified from other comprehensive income to other nonoperating expense,

net 48

Impairment losses included in other nonoperating expense, net (214)

Balance at December 31, 2008 187

Net unrealized gains recorded to other comprehensive income 58

Impairment losses included in other nonoperating expense, net (10)

Sales of marketable securities (32)

Balance at December 31, 2009 $ 203

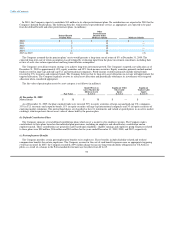

Assets measured at fair value on a nonrecurring basis are as follows (in millions):

Quoted Prices in Significant Other Significant

Active Markets for Observable Unobservable

Identical Assets Inputs Inputs Total

Fair Value (Level 1) (Level 2) (Level 3) Losses

At December 31, 2009

International route authorities $ 39 $ — $ — $ 39 $ (16)

96