US Airways 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

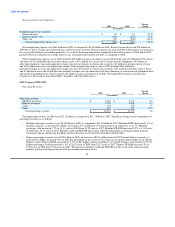

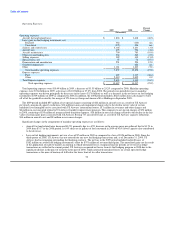

• Aircraft maintenance expense decreased 10.6% due principally to decreases in the number of engine overhauls performed in 2009

as compared to 2008 as a result of the timing of maintenance cycles.

• Selling expenses decreased 13% due to lower credit card fees, booking fees and commissions paid as a result of a decline in the

number and value of tickets sold resulting from the weakened demand and pricing environment caused by the economic recession.

• Depreciation and amortization expense increased 12% due to a net increase in owned aircraft, primarily driven by the acquisition

of 19 Airbus A320 family aircraft and two Airbus A330 aircraft in 2009, which increased depreciation expense on owned aircraft.

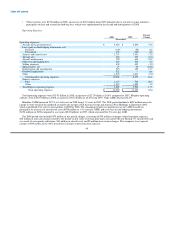

Total Express expenses decreased $511 million or 16.3% in 2009 to $2.63 billion from $3.14 billion in 2008. The year-over-year

decrease was primarily driven by decreases in fuel costs. Express fuel costs decreased $528 million as the average fuel price per gallon

decreased 44.3% from $3.23 in 2008 to $1.80 in 2009. In addition, gallons of fuel consumed in 2009 decreased 3.8% on 3.9% lower

capacity. Other Express expenses increased $17 million or 0.9% despite a 3.9% decrease in Express ASMs due to certain fixed costs

associated with our capacity purchase agreements as well as certain contractual rate increases with these carriers.

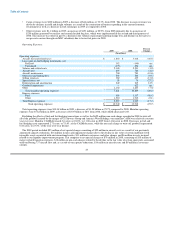

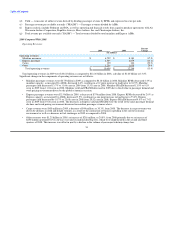

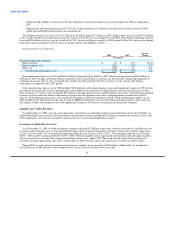

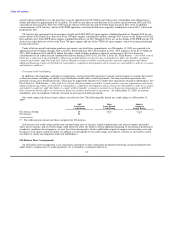

Nonoperating Income (Expense):

Percent

2009 2008 Change

(In millions)

Nonoperating income (expense):

Interest income $ 24 $ 83 (71.5)

Interest expense, net (241) (218) 10.7

Other, net (83) (240) (65.8)

Total nonoperating expense, net $ (300) $ (375) (20.1)

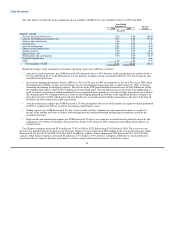

Net nonoperating expense was $300 million in 2009 as compared to $375 million in 2008. Interest income decreased $59 million in

2009 due to lower average investment balances and lower rates of return. Interest expense, net increased $23 million due to an increase in

the average debt balance outstanding primarily as a result of financing transactions completed in the fourth quarter of 2008 and in 2009,

partially offset by reductions in average interest rates associated with variable rate debt as compared to 2008.

Other nonoperating expense, net in 2009 included $49 million in non-cash charges associated with the sale of 10 Embraer 190 aircraft

and write off of related debt discount and issuance costs, a $14 million loss on the sale of certain aircraft equipment, $10 million in

other-than-temporary non-cash impairment charges for US Airways' investments in auction rate securities, $3 million in foreign currency

losses and a $2 million non-cash asset impairment charge. Other nonoperating expense, net in 2008 included $214 million in

other-than-temporary non-cash impairment charges for US Airways' investments in auction rate securities, $25 million in foreign

currency losses and $6 million in write offs of debt discount and debt issuance costs in connection with the refinancing of certain aircraft

equipment notes and a loan prepayment, offset in part by $8 million in gains on forgiveness of debt. The impairment charges on auction

rate securities are discussed in more detail under "Liquidity and Capital Resources."

53