US Airways 2009 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

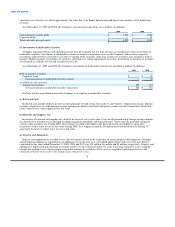

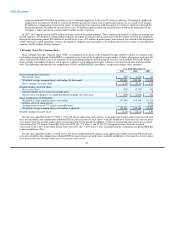

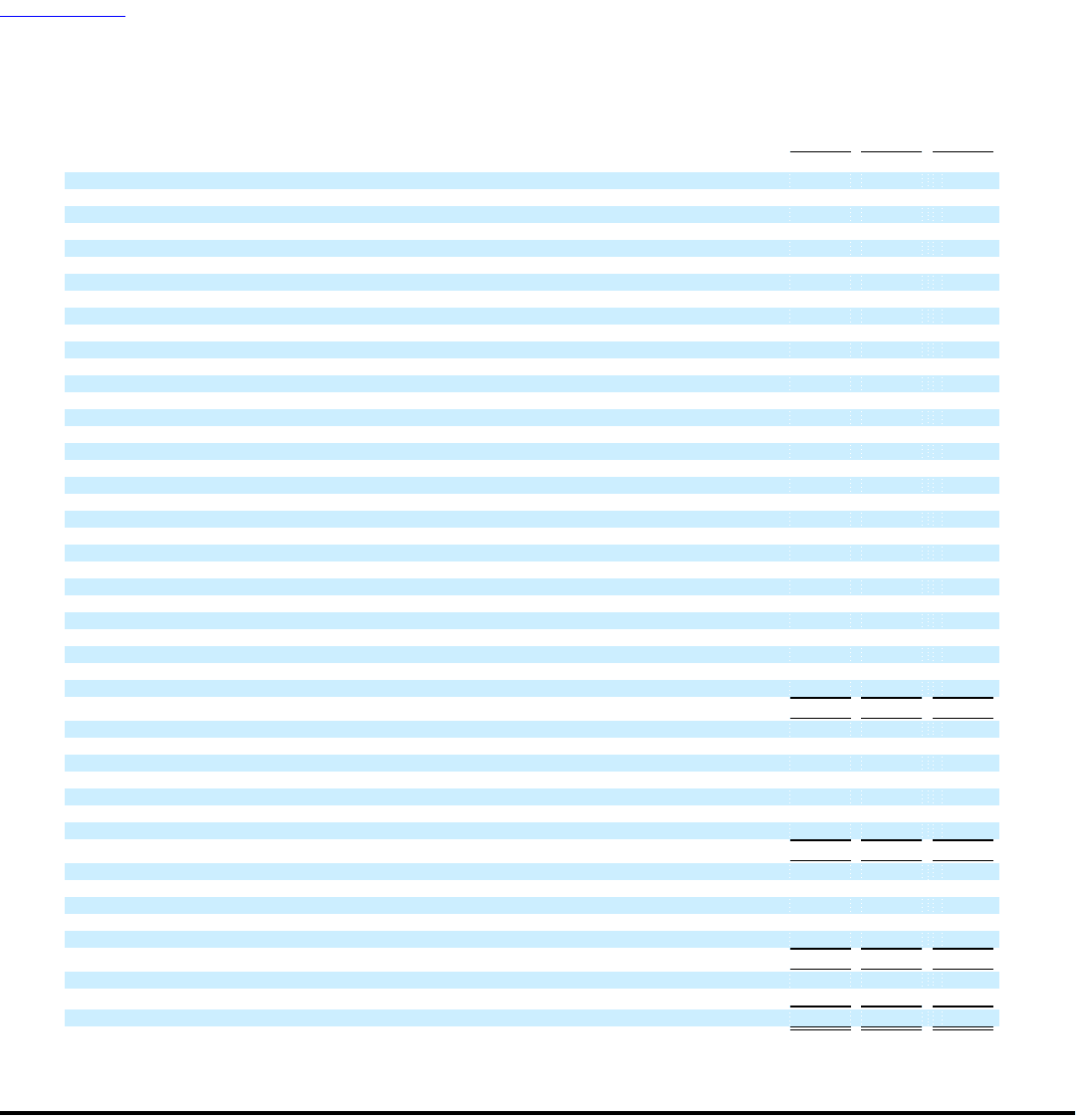

US Airways Group, Inc.

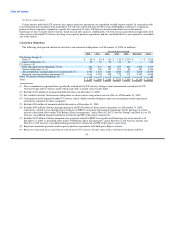

Consolidated Statements of Cash Flows

For the Years Ended December 31, 2009, 2008 and 2007

2009 2008 2007

(In millions)

Cash flows from operating activities:

Net income (loss) $ (205) $ (2,215) $ 423

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities:

Depreciation and amortization 267 240 212

Gain on curtailment of pension benefit — — (5)

Loss on dispositions of property and equipment 61 7 1

Gain on forgiveness of debt — (8) —

Gain on sale of investments — (1) (17)

Goodwill impairment — 622 —

Auction rate security impairment 10 214 10

Asset impairment 21 13 —

Non-cash tax benefits (24) — —

Utilization of acquired net operating loss carryforwards — — 7

Change in fair value of fuel hedging instruments, net (375) 496 (187)

Amortization of deferred credits and rent (62) (41) (40)

Amortization of debt discount and issuance costs 56 25 18

Amortization of actuarial gains (6) (2) —

Stock-based compensation 20 34 32

Debt extinguishment costs 6 7 18

Other (8) — —

Changes in operating assets and liabilities:

Decrease (increase) in restricted cash 186 (184) (1)

Decrease in accounts receivable, net 8 74 14

Decrease (increase) in materials and supplies, net (29) 49 (18)

Decrease (increase) in prepaid expenses and other 162 (259) (52)

Decrease (increase) in other assets, net (14) 4 (5)

Increase (decrease) in accounts payable (78) 96 (11)

Increase (decrease) in air traffic liability 80 (134) (22)

Increase (decrease) in accrued compensation and vacation 20 (67) (37)

Decrease in accrued taxes (1) (10) (29)

Increase (decrease) in other liabilities (36) 60 140

Net cash provided by (used in) operating activities 59 (980) 451

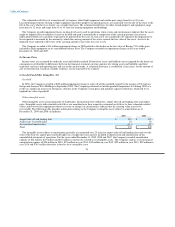

Cash flows from investing activities:

Purchases of property and equipment (683) (1,068) (603)

Purchases of marketable securities — (299) (2,591)

Sales of marketable securities 52 505 3,203

Proceeds from sale of other investments — 4 56

Decrease (increase) in long-term restricted cash 60 (74) 200

Proceeds from sale-leaseback transactions and dispositions of property and equipment 76 17 4

Net cash provided by (used in) investing activities (495) (915) 269

Cash flows from financing activities:

Repayments of debt and capital lease obligations (407) (734) (1,680)

Proceeds from issuance of debt 919 1,586 1,798

Deferred financing costs (14) (50) (9)

Proceeds from issuance of common stock, net 203 179 3

Net cash provided by financing activities 701 981 112

Net increase (decrease) in cash and cash equivalents 265 (914) 832

Cash and cash equivalents at beginning of year 1,034 1,948 1,116

Cash and cash equivalents at end of year $ 1,299 $ 1,034 $ 1,948

See accompanying notes to consolidated financial statements.

75