US Airways 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

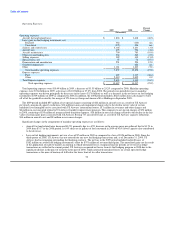

Other 2009 Financing Transactions

US Airways borrowed $825 million in 2009 to finance Airbus aircraft deliveries through a combination of facility agreements and

manufacturer backstop financing. These financings bear interest at a rate of LIBOR plus an applicable margin and contain default

provisions and other covenants that are typical in the industry.

US Airways borrowed an additional $120 million in 2009 under its spare parts loan agreement. The spare parts loan agreement bears

interest at a rate of LIBOR plus a margin per annum and is secured by a first priority security interest in substantially all of US Airways'

rotable, repairable and expendable aircraft spare parts. The spare parts loan agreement matures on October 20, 2014.

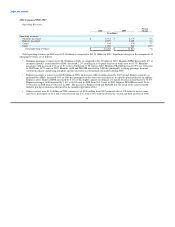

In 2009, US Airways sold 10 of its Embraer 190 aircraft to Republic. In connection with this transaction, Republic assumed

$216 million of debt outstanding on the 10 Embraer 190 aircraft and US Airways was released from its obligations associated with the

principal due under the debt. Additionally, at the time of sale, US Airways had $35 million outstanding under a loan from Republic (the

"Republic loan"). The Republic loan was scheduled to be repaid starting in January 2010 and fully repaid in October 2011. The full

amount outstanding under the Republic loan was applied to the purchase price of the 10 aircraft.

US Airways Group is party to a co-branded credit card agreement with Barclays Bank Delaware. The co-branded credit card

agreement provides for, among other things, the pre-purchase of frequent flyer miles in an amount totaling $200 million. Barclays has

agreed that it will pre-purchase additional miles on a monthly basis in an amount equal to the difference between $200 million and the

amount of unused miles then outstanding. In November 2009, US Airways Group entered into an amendment to its co-branded credit

card agreement with Barclays. Commencing in January 2012, the $200 million will be reduced over a period of up to approximately two

years. Among the conditions to this monthly purchase of miles is a requirement that US Airways Group maintain an unrestricted cash

balance, as defined in the agreement, of at least $1.35 billion for the months of March through November and $1.25 billion for the

months of January, February and December.

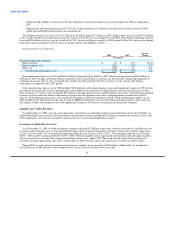

Credit Card Processing Agreements

We have agreements with companies that process customer credit card transactions for the sale of air travel and other services. Credit

card processors have financial risk associated with tickets purchased for travel because, although the processor generally forwards the

cash related to the purchase to us soon after the purchase is completed, the air travel generally occurs after that time, and the processor

may have liability if we do not ultimately provide the air travel. Our agreements allow these processing companies, under certain

conditions, to hold an amount of our cash (referred to as a "holdback") equal to a portion of advance ticket sales that have been processed

by that company, but for which we have not yet provided the air transportation. These holdback requirements can be modified at the

discretion of the processing companies, up to the estimated liability for future air travel purchased with the respective credit cards, upon

the occurrence of specified events, including material adverse changes in our financial condition. The amount that the processing

companies may withhold also varies as a result of changes in financial risk due to seasonal fluctuations in ticket volume. Additional

holdback requirements will reduce our liquidity in the form of unrestricted cash and short-term investments by the amount of the

holdbacks.

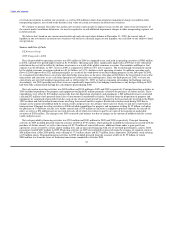

Aircraft and Engine Purchase Commitments

US Airways has definitive purchase agreements with Airbus for the acquisition of 134 aircraft, including 97 single-aisle A320 family

aircraft and 37 widebody aircraft (comprised of 22 A350 XWB aircraft and 15 A330-200 aircraft), of which 30 aircraft have been

delivered through December 31, 2009. Deliveries of the A320 family aircraft commenced during 2008 with the delivery of five A321

aircraft. During 2009, US Airways took delivery of 18 Airbus A321 aircraft, five A330-200 aircraft and two Airbus A320 aircraft. Of the

20 A320 family aircraft, 11 were financed using manufacturer backstop financing, eight were financed through existing financing

facilities and one was financed through a leasing transaction. Of the five A330-200 aircraft, three were financed through leasing

transactions and two were financed through new loan agreements.

In November 2009, US Airways amended its purchase agreements with Airbus to defer 54 aircraft originally scheduled for delivery

between 2010 and 2012 to 2013 and beyond. These deferral arrangements will reduce our

62