US Airways 2009 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

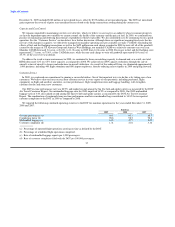

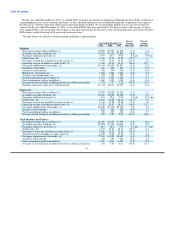

Liquidity Position

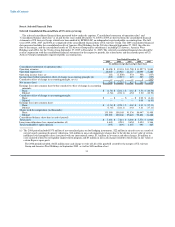

As of December 31, 2009, our cash, cash equivalents, investments in marketable securities and restricted cash were $1.98 billion, of

which $480 million was restricted. Our investments in marketable securities included $203 million of auction rate securities that are

classified as noncurrent assets on our consolidated balance sheets.

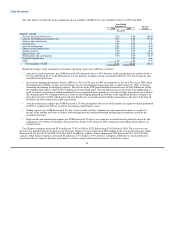

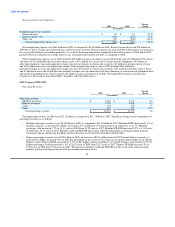

December 31, December 31,

2009 2008

(In millions)

Cash, cash equivalents and short-term investments in marketable securities $ 1,299 $ 1,054

Short and long-term restricted cash 480 726

Long-term investments in marketable securities 203 187

Total cash, cash equivalents, investments in marketable securities and restricted cash $ 1,982 $ 1,967

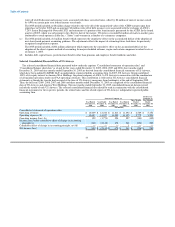

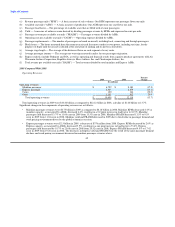

In addition to our capacity and cost control initiatives described above, we took further action in 2009 to strengthen and preserve our

liquidity position. In the first nine months of 2009, we completed financing transactions generating $486 million. These transactions

included net proceeds from public offerings of common stock and convertible notes of $66 million and $168 million, respectively, in

May, and $137 million from an additional public offering of common stock in September. The remaining $115 million included proceeds

from additional loans under a spare parts loan agreement, a loan secured by certain airport landing slots and an unsecured financing with

one of our third-party Express carriers.

In November 2009, we completed a series of transactions with key business partners designed to improve our near-term and future

liquidity. Our actions included the deferral of 54 Airbus aircraft previously scheduled for delivery between 2010 and 2012 that are now to

be delivered in 2013 and beyond. These deferral arrangements will reduce our aircraft capital expenditures over the next three years by

approximately $2.5 billion and reduce near- and medium-term obligations to Airbus and others by approximately $132 million. In

addition to the aircraft deferral, we arranged credit facilities in the amount of $95 million and $180 million of aircraft financing

commitments for the 2010 deliveries. Also, we agreed with Barclays Bank Delaware, our co-branded credit card provider, to permanently

lower the monthly unrestricted cash condition precedent for the advance purchase of frequent flyer miles and defer for 14 months the

amortization of $200 million advanced in connection with the previous purchase of miles. In the aggregate, these transactions improved

year-end 2009 liquidity by approximately $150 million and will generate approximately $450 million of projected liquidity

improvements by the end of 2010.

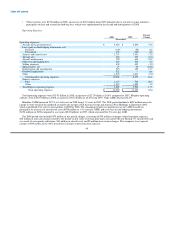

Strategic Initiatives

In 2009, we took the following actions which we believe will position us for success and help return us to profitability as the economy

improves:

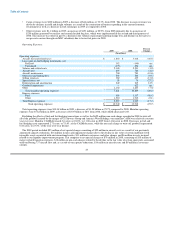

Delta Slot Transaction

In August 2009, US Airways Group and US Airways entered into a mutual asset purchase and sale agreement with Delta. Pursuant to

the agreement, US Airways would transfer to Delta certain assets related to flight operations at LaGuardia Airport in New York,

including 125 pairs of slots currently used to provide US Airways Express service at LaGuardia. Delta would transfer to US Airways

certain assets related to flight operations at Washington National Airport, including 42 pairs of slots, and the authority to serve Sao Paulo,

Brazil and Tokyo, Japan. One slot equals one take-off or landing, and each pair of slots equals one roundtrip flight. The agreement is

structured as two simultaneous asset sales and is expected to be cash neutral to US Airways. The closing of the transactions under the

agreement is subject to certain closing conditions, including approvals from a number of government agencies, including the

U.S. Department of Justice, the DOT, the FAA and The Port Authority of New York and New Jersey. If approved, this transaction will

significantly increase our capacity in the Washington, D.C. market and improve profitability.

On February 9, 2010, the DOT issued a proposed order conditionally approving the transaction. The proposed order, which is subject

to a 30-day comment period, would require the airlines to divest 20 of the 125 slot pairs involved at LaGuardia and 14 of the 42 slot pairs

at Washington National. Delta and we are currently reviewing the

38