US Airways 2009 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

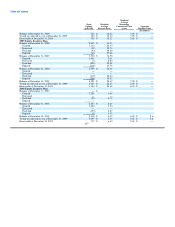

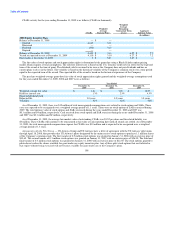

20. Selected Quarterly Financial Information (unaudited)

Summarized quarterly financial information for 2009 and 2008 is as follows (in millions, except share and per share amounts):

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

2009

Operating revenues $ 2,455 $ 2,658 $ 2,719 $ 2,626

Operating expenses 2,480 2,536 2,713 2,612

Operating income (loss) (25) 122 6 14

Nonoperating expenses, net (78) (64) (86) (131)

Income tax benefit — — — (38)

Net income (loss) (103) 58 (80) (79)

Earnings (loss) per common share:

Basic: $ (0.90) $ 0.47 $ (0.60) $ (0.49)

Diluted: $ (0.90) $ 0.42 $ (0.60) $ (0.49)

Shares used for computation (in thousands):

Basic 114,121 123,790 132,985 161,103

Diluted 114,121 144,125 132,985 161,103

2008

Operating revenues $ 2,840 $ 3,257 $ 3,261 $ 2,761

Operating expenses 3,036 3,793 3,950 3,139

Operating loss (196) (536) (689) (378)

Nonoperating expenses, net (41) (32) (174) (168)

Income tax provision (benefit) — — 3 (3)

Net loss (237) (568) (866) (543)

Loss per common share:

Basic: $ (2.58) $ (6.17) $ (8.46) $ (4.76)

Diluted: $ (2.58) $ (6.17) $ (8.46) $ (4.76)

Shares used for computation (in thousands):

Basic 92,023 92,137 102,406 114,106

Diluted 92,023 92,137 102,406 114,106

The Company's 2009 and 2008 fourth quarter results were impacted by recognition of the following items:

Fourth quarter 2009 operating expenses included $33 million of net special charges consisting of $16 million in non-cash impairment

charges due to the decline in fair value of certain indefinite lived intangible assets associated with international routes, $5 million in

aircraft costs as a result of the Company's previously announced capacity reductions, $6 million in severance charges and $6 million in

costs related to the Company's liquidity improvement program. Operating expenses also included $3 million in non-cash charges related

to the decline in fair value of certain Express spare parts. Nonoperating expenses, net included $49 million in non-cash charges associated

with the sale of 10 Embraer 190 aircraft and write off of related debt discount and issuance costs. Income tax benefit includes $21 million

of a non-cash income tax benefit related to gains recorded within other comprehensive income, a $14 million tax benefit related to a

legislation change allowing the Company to carry back 100% of 2008 AMT net operating losses, resulting in the recovery of AMT

amounts paid in prior years and a $3 million tax benefit related to the reversal of the deferred tax liability associated with the indefinite

lived intangible assets that were impaired during 2009.

Fourth quarter 2008 operating expenses included $234 million of net unrealized losses on fuel hedging instruments and $8 million of

net special charges consisting of $7 million in aircraft costs and $1 million in severance charges, both as a result of the Company's

capacity reductions. Non-operating expenses, net included $74 million in other-than-temporary non-cash impairment charges for the

Company's investments in auction rate securities as well as $5 million in write offs of debt issuance costs resulting from certain loan

prepayments.

111