US Airways 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

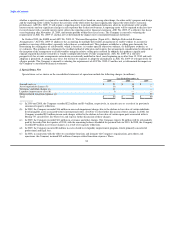

Indefinite lived assets are not amortized but instead are reviewed for impairment annually and more frequently if events or

circumstances indicate that the asset may be impaired. The Company had $39 million and $55 million of international route authorities as

of December 31, 2009 and 2008, respectively. As of December 31, 2009 and 2008, the Company had $30 million of trademarks on its

balance sheets.

The Company performed the annual impairment test on its international route authorities and trademarks during the fourth quarter of

2009. The fair values of international route authorities were assessed using the market approach. The market approach took into

consideration relevant supply and demand factors at the related airport locations as well as available market sale and lease data. For

trademarks, the Company utilized a form of the income approach known as the relief-from-royalty method. As a result of the Company's

annual impairment test on its international route authorities, the Company recorded a $16 million impairment charge related to the

decline in fair value of certain international routes. The Company will perform its next annual impairment test on October 1, 2010.

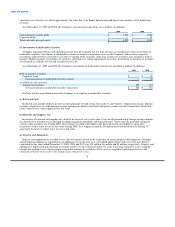

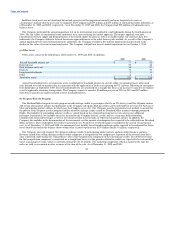

(j) Other Assets

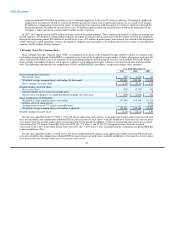

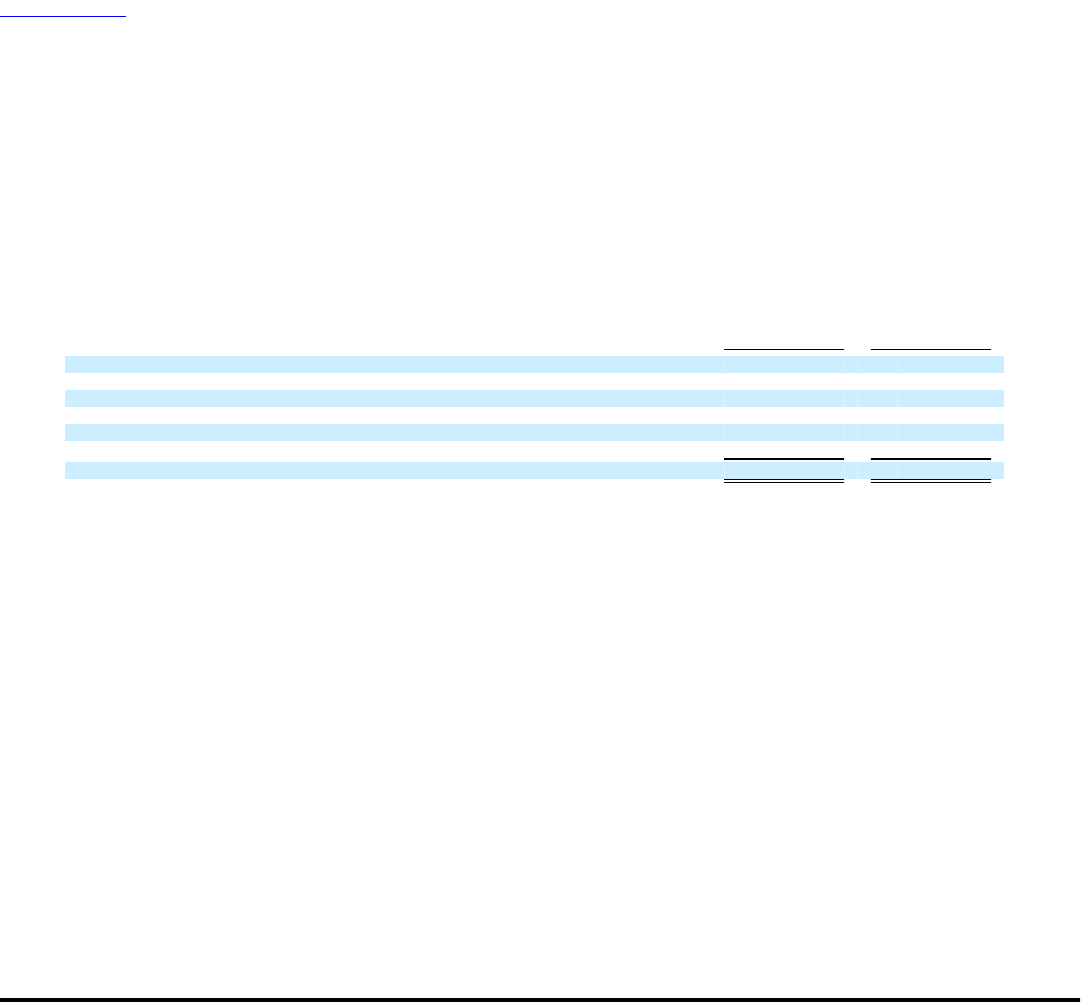

Other assets consist of the following as of December 31, 2009 and 2008 (in millions):

2009 2008

Aircraft leasehold interest, net $ 77 $ 83

Deferred rent 59 46

Debt issuance costs, net 58 57

Deposits 36 40

Long-term investments 9 11

Other 2 1

Total other assets $ 241 $ 238

Aircraft leasehold interest, net represents assets established for leasehold interests in aircraft subject to operating leases with rental

rates deemed to be below-market rates in connection with the application of fresh-start reporting for US Airways following its emergence

from bankruptcy in September 2005. These leasehold interests are amortized on a straight-line basis as an increase to aircraft rent expense

over the applicable remaining lease periods. The Company expects to amortize $6 million per year in 2010 to 2014 and $47 million

thereafter to aircraft rent expense related to these leasehold interests.

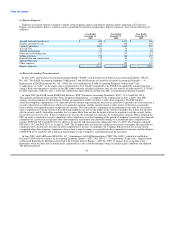

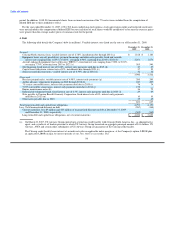

(k) Frequent Traveler Program

The Dividend Miles frequent traveler program awards mileage credits to passengers who fly on US Airways and Star Alliance carriers

and certain other partner airlines that participate in the Company's program. Mileage credits can be redeemed for travel on US Airways or

other participating partner airlines, in which case the Company pays a fee. The Company uses the incremental cost method to account for

the portion of the frequent traveler program liability related to mileage credits earned by Dividend Miles members through purchased

flights. The liability for outstanding mileage credits is valued based on the estimated incremental cost of carrying one additional

passenger. Incremental cost includes unit costs incurred by the Company for fuel, credit card fees, insurance, denied boarding

compensation, food and beverages as well as fees incurred when travel awards are redeemed on partner airlines. In addition, the

Company also includes in the determination of its incremental cost the amount of redemption fees expected to be collected from Dividend

Miles members. These redemption fees reduce incremental cost. No profit or overhead margin is included in the accrual of incremental

cost. As of December 31, 2009 and 2008, the incremental cost liability for outstanding mileage credits expected to be redeemed for future

travel awards accrued on the balance sheets within other accrued expenses was $130 million and $151 million, respectively.

The Company also sells frequent flyer program mileage credits to participating airline partners and non-airline business partners.

Revenue earned from selling mileage credits to other companies is recognized in two components. A portion of the revenue from these

sales is deferred, representing the estimated fair value of the transportation component of the sold mileage credits. The deferred revenue

for the transportation component is amortized on a straight-line basis over the period in which the credits are expected to be redeemed for

travel as passenger revenue, which is currently estimated to be 28 months. The marketing component, which is earned at the time the

miles are sold, is recognized in other revenues at the time of the sale. As of December 31, 2009 and 2008,

80