US Airways 2009 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

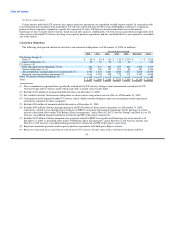

(a) vendor-specific objective evidence; (b) third-party evidence; or (c) estimates. This guidance also eliminates the residual method of

allocation and requires that arrangement consideration be allocated at the inception of the arrangement to all deliverables using the

relative selling price method. In addition, this guidance significantly expands required disclosures related to a vendor's multiple-

deliverable revenue arrangements. ASU No. 2009-13 is effective prospectively for revenue arrangements entered into or materially

modified in fiscal years beginning on or after June 15, 2010 and early adoption is permitted. A company may elect, but will not be

required, to adopt the amendments in ASU No. 2009-13 retrospectively for all prior periods. We are currently evaluating the requirements

of ASU No. 2009-13 and have not yet determined the impact on our consolidated financial statements.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Market Risk Sensitive Instruments

Our primary market risk exposures include commodity price risk (i.e., the price paid to obtain aviation fuel) and interest rate risk. The

potential impact of adverse increases in these risks is discussed below. The following sensitivity analyses do not consider the effects that

an adverse change may have on the overall economy nor do they consider additional actions we may take to mitigate our exposure to

these changes. Actual results of changes in prices or rates may differ materially from the following hypothetical results.

Commodity Price Risk

Prices and availability of all petroleum products are subject to political, economic and market factors that are generally outside of our

control. Accordingly, the price and availability of aviation fuel, as well as other petroleum products, can be unpredictable. Prices and

availability may be affected by many factors, including:

• the impact of global political instability on crude production;

• unexpected changes to the availability of petroleum products due to disruptions in distribution systems or refineries as evidenced

in the third quarter of 2005 when Hurricane Katrina and Hurricane Rita caused widespread disruption to oil production, refinery

operations and pipeline capacity along certain portions of the U.S. Gulf Coast;

• unpredicted increases to oil demand due to weather or the pace of economic growth;

• inventory levels of crude, refined products and natural gas; and

• other factors, such as the relative fluctuation in value between the U.S. dollar and other major currencies and influence of

speculative positions on the futures exchanges.

Our 2010 forecasted mainline and Express fuel consumption is approximately 1.42 billion gallons, and a one cent per gallon increase

in aviation fuel price results in a $14 million annual increase in expense. Since the third quarter of 2008, we have not entered into any

new fuel hedging transactions and, as of December 31, 2009, we had no remaining outstanding fuel hedging contracts.

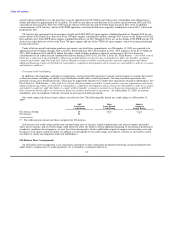

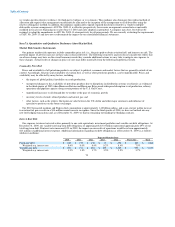

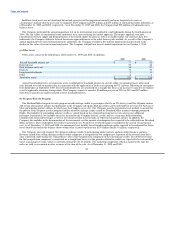

Interest Rate Risk

Our exposure to interest rate risk relates primarily to our cash equivalents, investment portfolios and variable rate debt obligations. At

December 31, 2009, our variable-rate long-term debt obligations of approximately $3.33 billion represented approximately 69% of our

total long-term debt. If interest rates increased 10% in 2009, the impact on our results of operations would have been approximately

$13 million of additional interest expense. Additional information regarding our debt obligations as of December 31, 2009 is as follows

(dollars in millions):

Expected Maturity Date

2010 2011 2012 2013 2014 Thereafter Total

Fixed-rate debt $ 240 $ 159 $ 138 $ 76 $ 252 $ 601 $ 1,466

Weighted avg. interest rate 9.4% 9.0% 8.4% 8.2% 8.4% 7.5%

Variable-rate debt $ 271 $ 191 $ 283 $ 295 $ 1,289 $ 998 $ 3,327

Weighted avg. interest rate 3.9% 3.8% 3.7% 3.5% 3.5% 3.7%

70