US Airways 2009 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

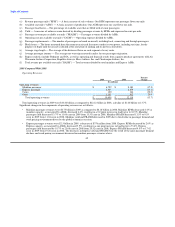

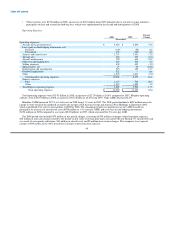

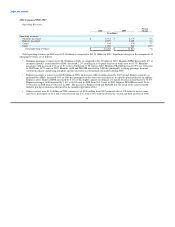

Net nonoperating expense was $415 million in 2008 as compared to $103 million in 2007. Interest income decreased $89 million in

2008 due to lower average investment balances and lower rates of return. Interest expense, net decreased $19 million due primarily to

reductions in average interest rates associated with variable rate debt, partially offset by an increase in the average debt balance

outstanding as compared to the 2007 period.

Other nonoperating expense, net in 2008 included $214 million in other-than-temporary non-cash impairment charges for our

investments in auction rate securities primarily due to the length of time and extent to which the fair value has been less than cost for

these securities. We also recognized $25 million in foreign currency losses and $7 million in write offs of debt discount and debt issuance

costs in connection with the refinancing of certain aircraft equipment notes and certain loan prepayments in connection with our 2008

financing transactions, offset in part by $8 million in gains on forgiveness of debt. Other nonoperating expense, net in 2007 included an

$18 million write off of debt issuance costs in connection with the refinancing of the GE loan in March 2007 as well as $10 million in

other-than-temporary non-cash impairment charges for our investments in auction rate securities, offset by a $17 million gain on the sale

of stock in ARINC Incorporated and $7 million in foreign currency gains.

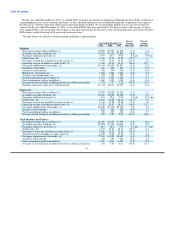

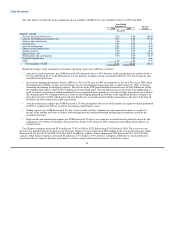

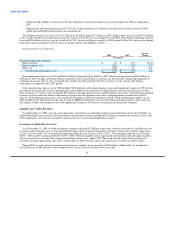

US Airways' Results of Operations

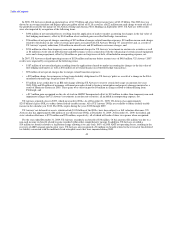

On September 26, 2007, as part of the integration efforts following the merger, AWA surrendered its FAA operating certificate. As a

result, all mainline airline operations are now being conducted under US Airways' FAA operating certificate. In connection with the

combination of all mainline airline operations under one FAA operating certificate, US Airways Group contributed 100% of its equity

interest in America West Holdings, the parent company of AWA, to US Airways. As a result, America West Holdings and AWA became

wholly owned subsidiaries of US Airways. In addition, AWA transferred substantially all of its assets and liabilities to US Airways. All

off-balance sheet commitments of AWA were also transferred to US Airways.

Transfers of assets between entities under common control are accounted for similar to the pooling of interests method of accounting.

Under this method, the carrying amount of net assets recognized in the balance sheets of each combining entity are carried forward to the

balance sheet of the combined entity, and no other assets or liabilities are recognized as a result of the contribution of shares. This

management's discussion and analysis of financial condition and results of operations is presented as though the transfer had occurred at

the time of US Airways' emergence from bankruptcy in September 2005.

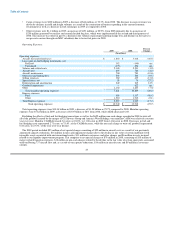

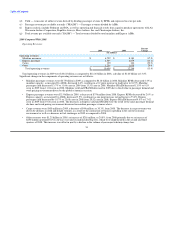

In 2009, US Airways realized operating income of $122 million and a loss before income taxes of $178 million. US Airways

experienced significant declines in revenues as a result of the global economic recession, which more than offset the benefits of reduced

fuel costs during 2009. US Airways' 2009 results were also impacted by recognition of the following items:

• $382 million of net realized losses on settled fuel hedging instruments, offset by $375 million of net unrealized gains resulting

from the application of mark-to-market accounting for changes in the fair value of fuel hedging instruments. In mark-to-market

accounting, the unrealized losses recognized in prior periods are reversed as hedge transactions are settled in the current period.

US Airways was required to use mark-to-market accounting as its fuel hedging instruments did not meet the requirements for

hedge accounting. If these instruments had qualified for hedge accounting treatment, any unrealized gains or losses would have

been recorded in other comprehensive income, a component of stockholder's equity;

• $55 million of net special charges consisting of $22 million in aircraft costs as a result of US Airways' previously announced

capacity reductions, $16 million in non-cash impairment charges due to the decline in fair value of certain indefinite lived

intangible assets associated with US Airways' international routes, $11 million in severance and other charges and $6 million in

costs incurred related to US Airways' liquidity improvement program; and

• $49 million in non-cash charges associated with the sale of 10 Embraer 190 aircraft and write off of related debt discount and

issuance costs, $10 million in other-than-temporary non-cash impairment charges for US Airways' investments in auction rate

securities and a $2 million non-cash asset impairment charge, all included in nonoperating expense, net.

48