US Airways 2009 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

the amendments, US Airways has agreed to maintain a level of unrestricted cash in the same amount required by the US Airways

Group Citicorp credit facility. This transaction was treated as a financing transaction for accounting purposes using an effective

interest rate commensurate with US Airways' credit rating. There are no stated interest payments.

(g) In December 2004, deferred charges under US Airways' maintenance agreements with GE Engine Services, Inc. were converted

into an unsecured term note. Interest on the note accrues at LIBOR plus 4%, and became payable beginning in January 2008, with

principal and interest payments due in 48 monthly installments through 2011. The outstanding balance on the note at December 31,

2009 was $26 million at an interest rate of 4.5%.

In October 2008, US Airways entered into a promissory note with GE Engine Services, Inc. pursuant to which maintenance

payments of up to $40 million due from October 2008 through March 2009 under US Airways' Engine Service Agreement were

deferred. Interest on the note accrues at 14%, and the first of 12 monthly principal and interest payments commenced in April 2009.

The outstanding balance on the note at December 31, 2009 was $10 million.

(h) The industrial development revenue bonds are due April 2023. Interest at 6.3% is payable semiannually on April 1 and October 1.

The bonds are subject to optional redemption prior to the maturity date on or after April 1, 2008, in whole or in part, on any interest

payment date at the following redemption prices: 102% on April 1 or October 1, 2008; 101% on April 1 or October 1, 2009; and

100% on April 1, 2010 and thereafter.

(i) In connection with US Airways' emergence from bankruptcy in September 2005, it reached a settlement with the Pension Benefit

Guaranty Corporation ("PBGC") related to the termination of three of its defined benefit pension plans. The settlement included the

issuance of a $10 million note which matures in 2012 and bears interest at 6% payable annually in arrears.

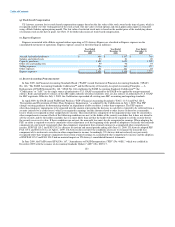

Secured financings are collateralized by assets, primarily aircraft, engines, simulators, rotable aircraft parts and hangar and

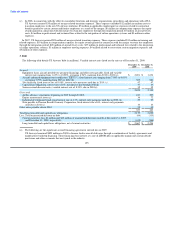

maintenance facilities. At December 31, 2009, the estimated maturities of long-term debt and capital leases are as follows (in millions):

2010 $ 421

2011 334

2012 305

2013 255

2014 265

Thereafter 1,599

$ 3,179

Certain of US Airways' long-term debt agreements contain significant minimum cash balance requirements and other covenants with

which US Airways was in compliance at December 31, 2009. Certain of US Airways' long-term debt agreements contain cross-default

provisions, which may be triggered by defaults by US Airways under other agreements relating to indebtedness.

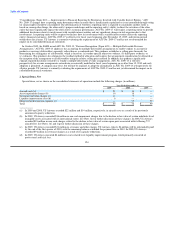

4. Income Taxes

US Airways accounts for income taxes using the asset and liability method. US Airways and its wholly owned subsidiaries are part of

the US Airways Group consolidated income tax return. US Airways Group allocates tax and tax items, such as net operating losses

("NOLs") and net tax credits, between members of the group based on their proportion of taxable income and other items. Accordingly,

US Airways' tax expense is based on taxable income, taking into consideration allocated tax loss carryforwards/carrybacks and tax credit

carryforwards.

US Airways reported a loss in 2009, which increased its NOLs. As of December 31, 2009, US Airways has approximately

$2.05 billion of gross NOLs to reduce future federal taxable income. All of US Airways' NOLs are available to reduce federal taxable

income in the calendar year 2010. The NOLs expire during the years 2022 through 2029.

US Airways' net deferred tax assets, which include $1.98 billion of the NOLs, have been subject to a full valuation allowance. US

Airways also has approximately $86 million of tax-effected state NOLs at December 31,

127