US Airways 2009 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DOT's proposed order to determine next steps. However, we expect that if this order is implemented as proposed the transaction will not

go forward.

Operational Realignment

In October 2009, we announced the realignment of our operations to focus on our core network strengths, which include our hubs in

Charlotte, Philadelphia and Phoenix and our focus city at Washington National Airport. These four cities, as well as our popular hourly

Shuttle service between LaGuardia, Boston and Washington National airports, will serve as the cornerstone of our network and by the

end of 2010 are expected to represent 99% of our ASMs versus approximately 93% in 2009. Changes to facilitate this strategy include

reducing daily departures from Las Vegas, closing stations in Colorado Springs and Wichita, redeploying our E190 fleet to routes

between Boston and Philadelphia and the Boston-LaGuardia leg of the Shuttle, suspending five European destinations, returning our

Philadelphia-Beijing route authority, rightsizing our crew bases at our hubs and focus city and closing crew bases in Boston, LaGuardia

and Las Vegas. In connection with the realignment of our operations, we will reduce staffing by approximately 1,000 positions across our

system during the first half of 2010. These reductions include approximately 600 airport passenger and ramp service positions,

approximately 200 pilot positions and approximately 150 flight attendant positions. We believe that by concentrating on our strengths and

eliminating unprofitable flying we will be better positioned to return US Airways to profitability.

2010 Outlook

As we begin 2010, it is difficult to predict the ongoing effects of the global economic recession. We have taken numerous actions to

strengthen our current and future liquidity position. We have significantly reduced our required capital expenditures for 2010 through

2012 and eliminated our need to access aircraft finance markets in 2010. We believe that these actions coupled with our operational

realignment have well positioned us as the economy recovers.

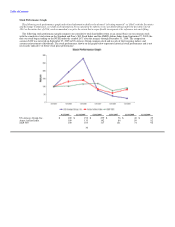

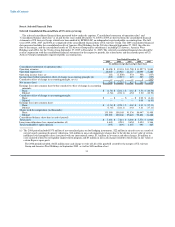

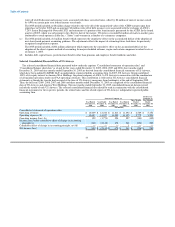

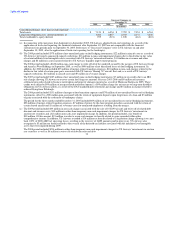

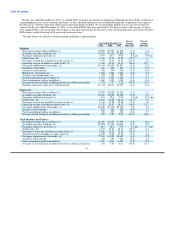

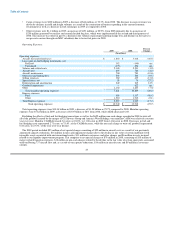

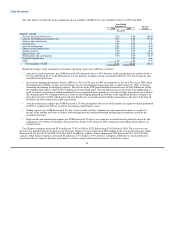

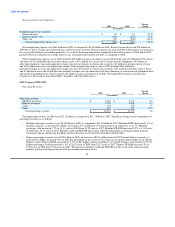

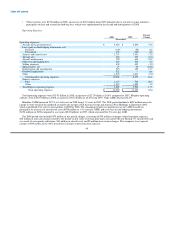

US Airways Group's Results of Operations

In 2009, we realized operating income of $118 million and a loss before income taxes of $243 million. We experienced significant

declines in revenues as a result of the global economic recession, which more than offset the benefits of reduced fuel costs during 2009.

Our 2009 results were also impacted by recognition of the following items:

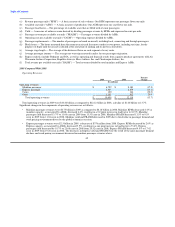

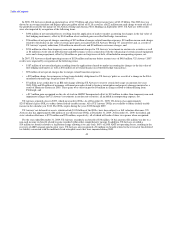

• $382 million of net realized losses on settled fuel hedging instruments, offset by $375 million of net unrealized gains resulting

from the application of mark-to-market accounting for changes in the fair value of fuel hedging instruments. In mark-to-market

accounting, the unrealized losses recognized in prior periods are reversed as hedge transactions are settled in the current period.

We were required to use mark-to-market accounting as our fuel hedging instruments did not meet the requirements for hedge

accounting. If these instruments had qualified for hedge accounting treatment, any unrealized gains or losses would have been

recorded in other comprehensive income, a component of stockholders' equity;

• $55 million of net special charges consisting of $22 million in aircraft costs as a result of our previously announced capacity

reductions, $16 million in non-cash impairment charges due to the decline in fair value of certain indefinite lived intangible assets

associated with our international routes, $11 million in severance and other charges and $6 million in costs incurred related to our

liquidity improvement program;

• $3 million in non-cash charges related to the decline in fair value of certain Express spare parts; and

• $49 million in non-cash charges associated with the sale of 10 Embraer 190 aircraft and write off of related debt discount and

issuance costs, $10 million in other-than-temporary non-cash impairment charges for our investments in auction rate securities and

a $2 million non-cash asset impairment charge, all included in nonoperating expense, net.

In 2008, we realized an operating loss of $1.8 billion and a loss before income taxes of $2.22 billion. The 2008 loss was driven by an

average mainline and Express price per gallon of fuel of $3.18 as well as a $622 million non-

39